The August results of the ISO Türkiye Manufacturing PMI survey have been released. According to the survey, where any figure above the threshold value of 50.0 indicates sector improvement, the headline PMI, which stood at 49.9 in July, dipped to 49.0 in August. This marks the second consecutive month that the PMI has remained below the 50.0 threshold, signaling a waning momentum in the Turkish manufacturing sector. The index level suggests that the slowdown is of a moderate nature.

Production witnessed growth in four out of the ten sectors, as reported by firms

They also noted challenges in securing new orders and a faster decline in new purchases compared to the previous month.

Strong price pressures remained a primary factor dissuading customers from placing new orders.

These findings are based on the Istanbul Chamber of Industry Turkey Sectoral PMI August report.

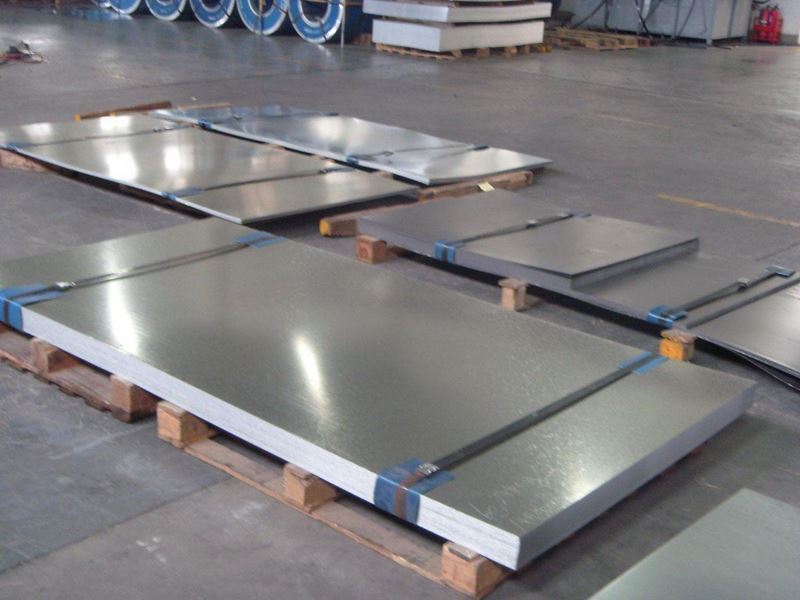

The electrical and electronic products sector experienced the most significant growth, marking its third consecutive month of expansion. Additionally, the food products, machinery, and metal products sectors returned to the growth zone. However, the clothing and leather products sector saw the most substantial production slowdown.

Most sectors experienced a decline in the momentum of new orders received from abroad. The clothing and leather products sector recorded the most substantial drop in new order volume. In contrast, three sectors, with land and sea vehicles taking the lead, reported growth in new orders. Input costs continued to rise significantly overall, with only two sectors (non-metallic mineral products and land and sea vehicles) experiencing an increase in inflation compared to July. Land and sea vehicles saw the most substantial increase, reaching its highest point in 19 months. In contrast, the basic metals sector observed a more moderate rise. Non-metallic mineral products reported the fastest increase in sales prices, with the inflation rate in this sector hitting its highest level since April 2022. In the textile sector, while the rate of increase in finished product prices showed a noticeable slowdown, it still remained at a high level.

Comments

No comment yet.