Since the start of the Q3 2023 quota period in the EU, utilization has been very low. In long products, less than 5% of all products were used in the first week of July. Only Chinese commercial sections are in demand, while South Korea leads in flat steel.

(HRC) South Korea is the biggest user of EU quotas for hot rolled coil

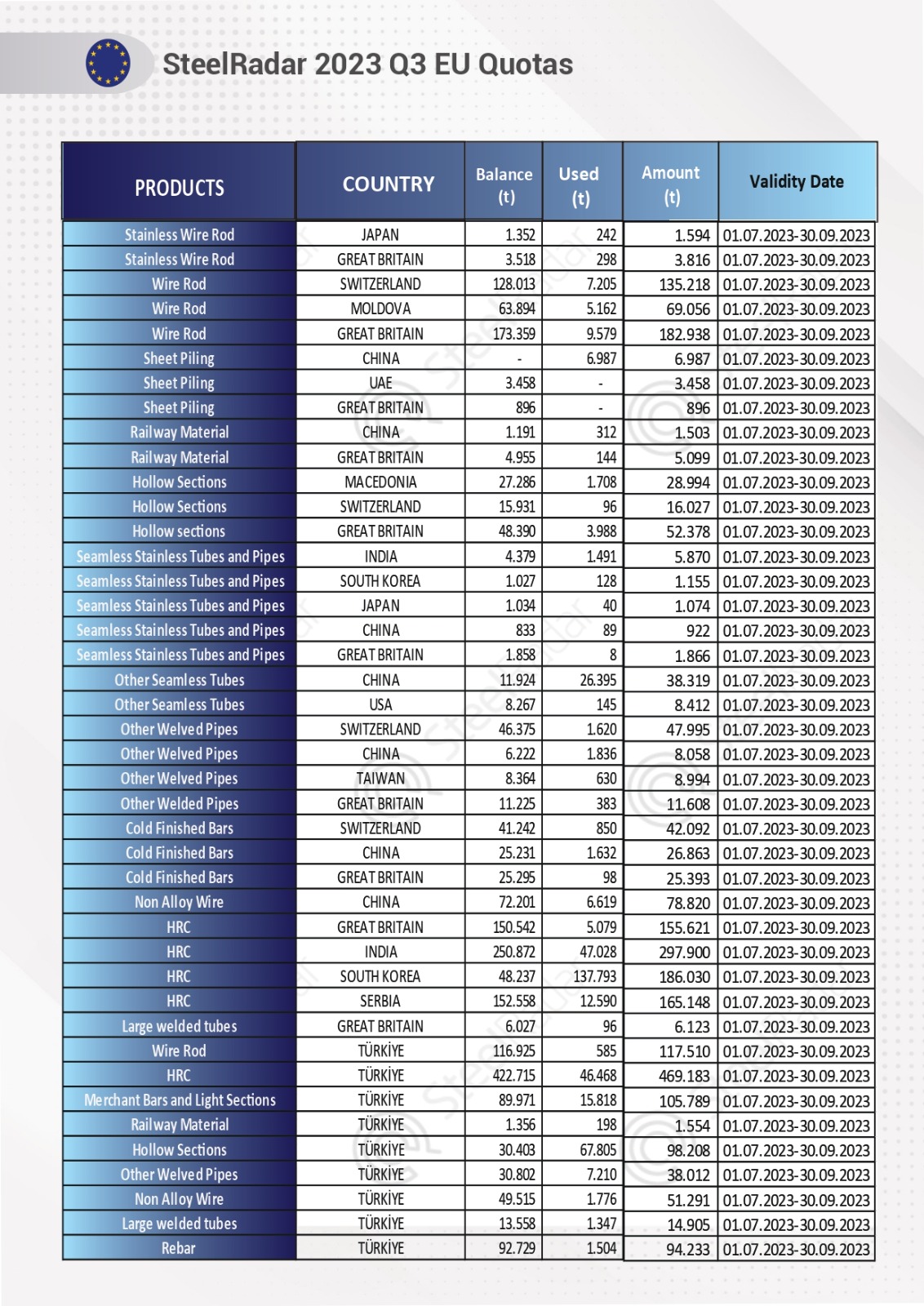

Despite the quotas allocated to five different countries, South Korea was the most successful country in terms of filling rates. South Korea used 137,793/t of the 186,030/t quota allocated for HRC, making it the country with the highest demand. South Korea's remaining quota for HRC was 48,237/t. India and Turkey followed with the highest utilization rate for HRC, but India filled around 13% of its quota. In Turkey, this figure was only 8%. India used 47,028/t of its 297,900/t quota, while Turkey consumed only 46,468/t of its 469,183/t quota.

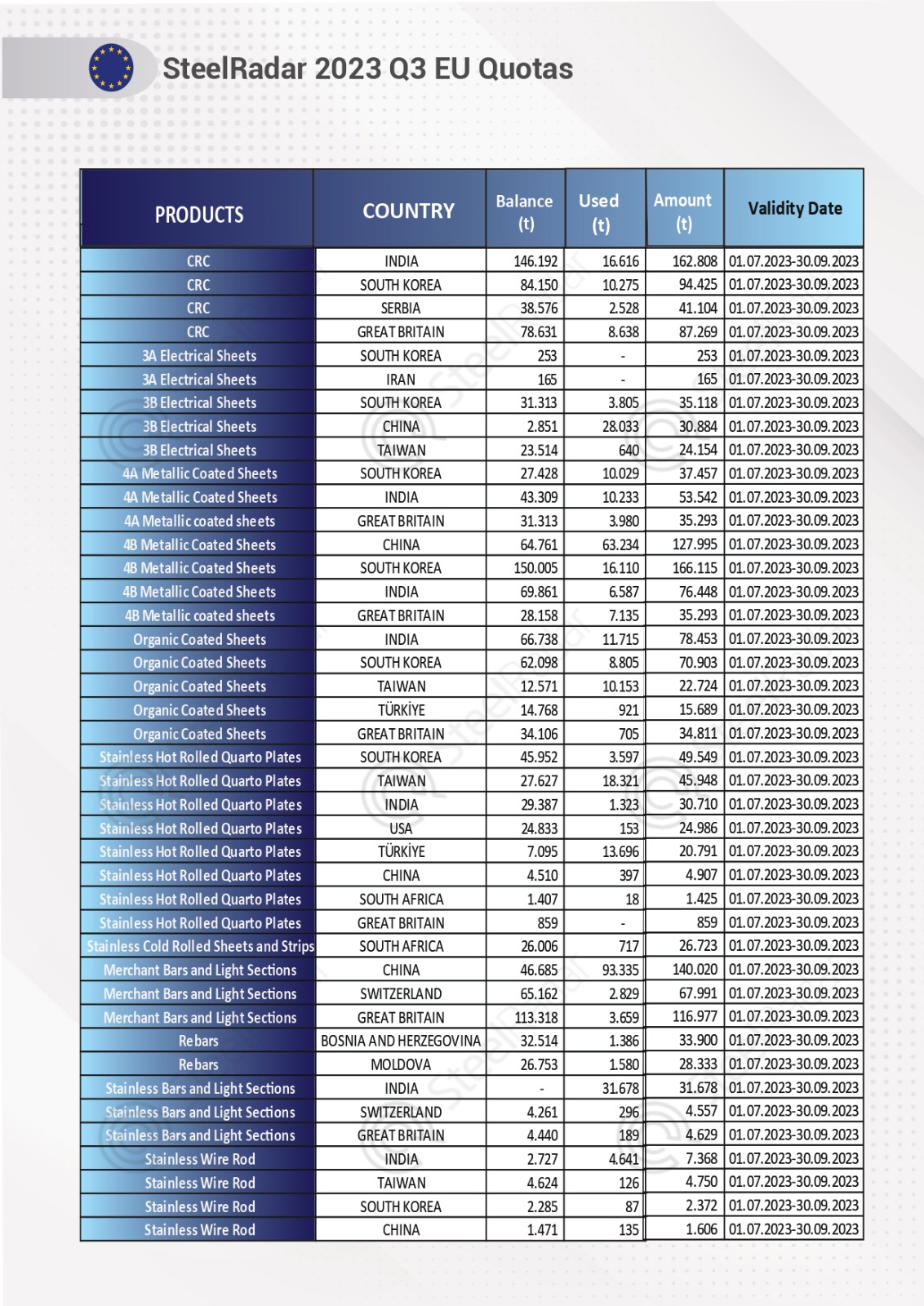

(CRC) Cold rolled coil was the least utilized product

Cold rolled coil was the least demanded product among all countries. No country was able to fulfill 10% of its quota allocations.

Profile was the most popular of Turkey's long products

EU import demand for long products also decreased. Profiles were more popular than Turkish rebar and wire rod. Only 1% of the 94,233/t rebar quota allocated to Turkey was used. The amount used was recorded as 1,504/t. Moldavia was more demanded with 5% utilization compared to the quota allocated to Turkey. Bosnia and Herzegovina used 1,386/t of its 33,900/t quota.

China used 93,335/t of its 140,020/t allocated quota for commercial bars and light profiles, filling about 66% of its quota.

Turkey followed China with 67,805/t of its 98,208/t quota for hollow sections. Turkey's remaining quota was recorded as 30,403/t.

The latest status of Q3 2023 steel quotas in the EU is as follows;

Comments

No comment yet.