The union stated that the workers demanded a total wage increase of 77% over the 6-year contract, but the employers limited this rate to 50%. Despite the intervention of U.S. President Joe Biden's administration to resolve the dispute, no compromise was reached and the workers began a work stoppage on Tuesday. This raises concerns that the economic consequences will deepen as trade grinds to a halt.

A multi-billion dollar blow to the economy

The strike, the union's first since 1977, is affecting 36 ports along the east and south coasts from Maine to Texas. The stoppage of trade at these ports, where 57% of the U.S. container volume is handled, has caused serious disruptions in the supply chain of many products from food to automotive. Experts predict that if the strike lasts for more than a week, many consumer goods could see price hikes and even shortages in some products.

Serious threat to the iron and steel industry

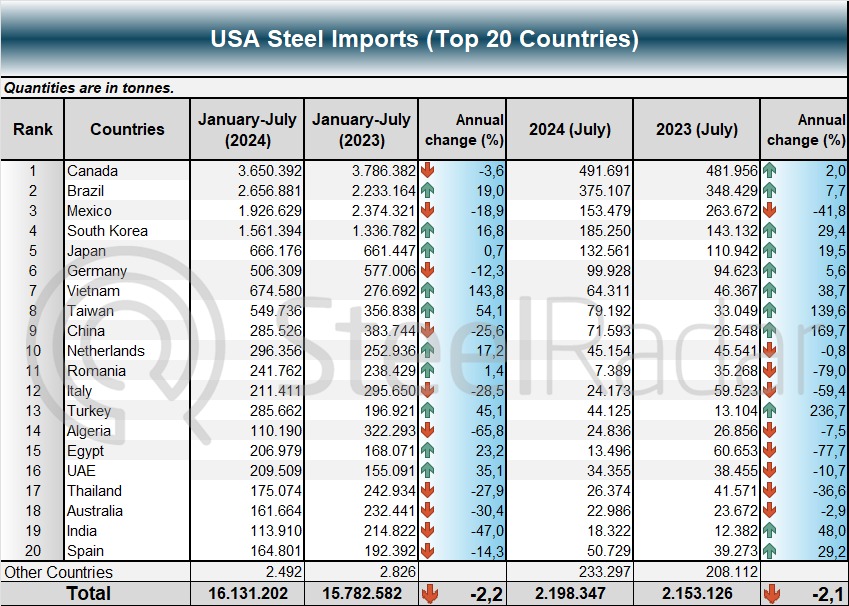

The impact of the strike on the iron and steel sector is also of great importance. While the US mostly turns to neighboring countries such as Canada, Brazil and Mexico for steel imports, Asian and European countries are also at the top of the import list. If the strike is prolonged, the U.S. is expected to turn more to border countries such as Canada and Mexico for steel supplies. This may lead to an increase in steel prices in the domestic market.

Experts in the steel industry warn that the U.S. may lose import diversification in the process and may have to turn to alternative sources of supply. Currently, a large portion of U.S. steel imports through ports could be affected by the strike. This means that steel prices will rise and the supply chain in the U.S. market will be disrupted.

European and Latin American importers are expected to be particularly hard hit. Shipments are likely to be stranded because the ports in Canada and Mexico, where container deliveries are planned to be diverted, do not have the capacity to handle U.S. products.

Seeking investment in the shadow of sanctions and banking regulations

The strike would not only result in economic losses, but could also undermine US credibility in global trade. The dockworkers' demands include not only wage increases but also greater job security against port automation projects. Experts agree that the strike could cause serious delays in the supply chain and lead to higher prices for imported goods.

Grace Zwemmer, Economist at Oxford Economics, said that the strike will affect US supply chains by increasing congestion at ports on the west coast and that it could take up to a month to process the backlogs, depending on the duration of the strike. “For now, we do not expect the strike to lead to an increase in core commodity prices, but if it causes large delays in shipments, the upside risk to inflation could increase,” Zwemmer said.

A challenging period ahead for the U.S. economy

The historic dockers' strike poses a significant risk to the U.S. economy both in the short term and in the long term. A prolonged strike could lead to a 0.1% y-o-y decline in the weekly growth rate, as well as supply chain disruptions and price hikes in critical sectors such as the steel industry. While experts emphasize that the government should take steps to mediate and resolve the issue, they agree that it will take time for trade to return to normal at ports on the east and south coasts of the U.S.

The U.S. National Retail Federation (NRF) is demanding that the administration use “every authority” to end the strike at the ports. No compromise is in sight for the time being, but if the strike continues, deeper damage to the U.S. economy seems inevitable.

Comments

No comment yet.