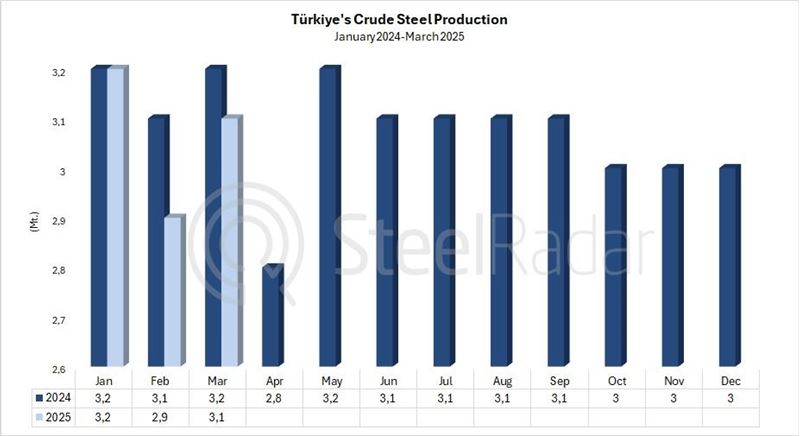

Overview of flat steel markets for the last quarter of 2023 and the first quarter of 2024:

Global flat steel markets have been flat for a long time. Prices weakened after the pandemic-era peak. Slow demand for steel in global markets, energy crises and diplomatic developments weakened export demand. In the last two weeks, the upward trend in the sheet metal market has continued, but demand has not been supporting prices. The market's lack of reaction to rising prices and weak sales have become a common problem for the whole world.

While offers from metallurgical companies continue with high prices, they do not reach the same level in actual transactions, that is, in the sales phase. Buyers can reduce the price desperately due to the weak supply-demand balance in bargaining.

SteelRadar analysts believe that prices will reach their peak in January-February deliveries, but may fall again due to insufficient demand.

Türkiye's flat steel markets have also had a tough time this year with energy costs and global price competition. Metallurgical companies, which have struggled to keep prices up as demand for all steel products in the markets has decreased, are looking more hopeful for 2024. It is thought that the effects of inflation-related developments will begin to be felt in the first quarter of 2023. In the flat steel markets, mills have been offering export offers for hot rolled coil up to $610 a ton in recent months, while domestic ex-factory prices have fallen as low as $630 a ton. However, global improvements and price hikes in recent weeks have strengthened Turkish producers. Ex-mill prices for the domestic market have risen as high as $670. Export figures are in the range of $650-665.

The latest situation in Türkiye's welded pipe trade and export growth: Analysis and prospects

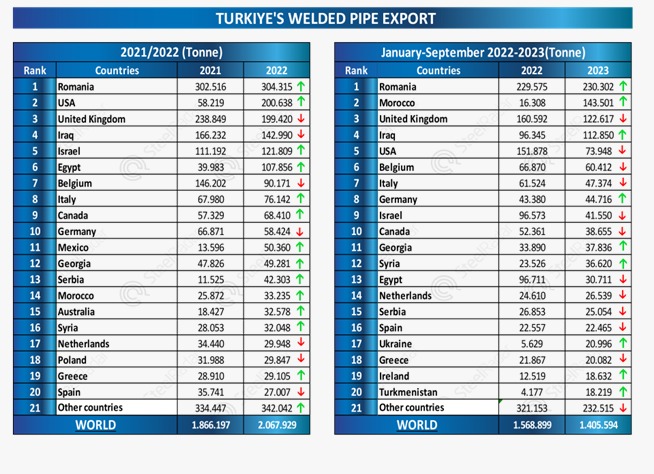

Significant changes in Türkiye's welded pipe exports in the January-September period from 2021 to 2023 stand out. Looking at the export rankings and increase rates reveals the complexity of the dynamics in the sector.

Looking at Türkiye's total export figures, welded pipe exports increased by 10.79% from 1,866,197 tons in 2021 to 2,067,929 tons in 2022. However, in the first 9 months of 2023, there was a 10.40% decrease compared to the same period last year. These fluctuations in the sector can be evaluated in connection with global economic factors and changes in trade relations.

Türkiye's welded pipe exports

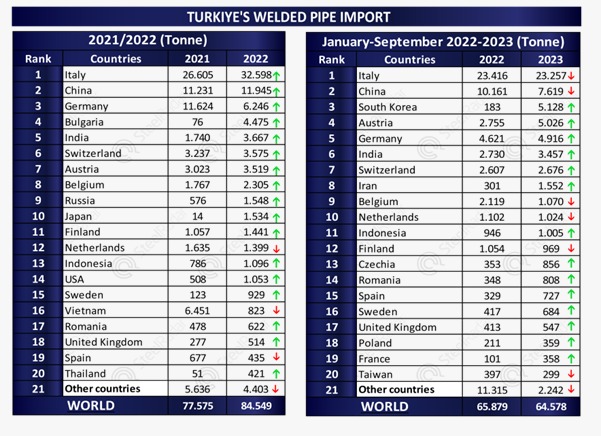

Welded pipe imports;

According to data released by TUIK (Turkish Statistical Institute), the top two countries in Türkiye's welded pipe imports have not changed for 3 years. In the first 9 months of 2021-2022 and 2023, the highest imports were from Italy, followed by China. While Germany was the 3rd country with the highest imports in 2021 and 2022, when the data for the first nine months of 2023 were taken, it gave its turn to South Korea. Between January-September 2023, South Korea ranked 3rd among the countries with the highest imports. In the first nine months of this year, Germany fell to 5th place in Türkiye's welded pipe imports.

Türkiye's welded pipe imports

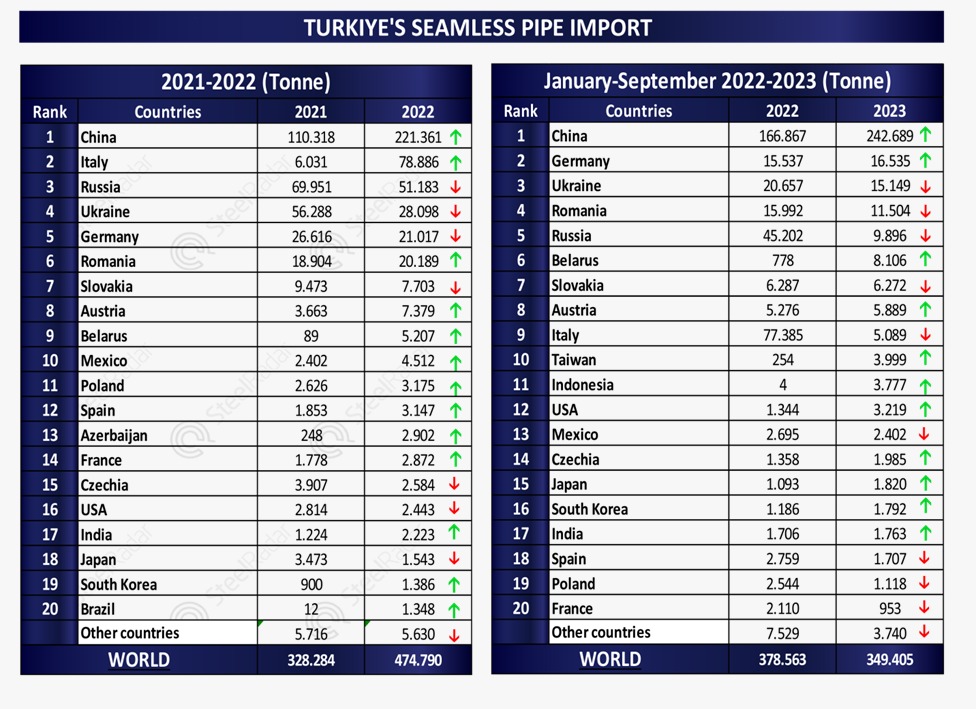

Seamless pipe imports;

Since seamless steel pipe production is low in Türkiye, most of the need is supplied through imports. A significant part of the production consists of oil and natural gas transmission lines and cold drawn pipes. According to the data announced by TUIK, the top 3 import countries in Türkiye in 2021 and 2022 were China, Italy and Russia. In the first 9 months of 2023, China continued to be the top importing country, while Germany was the second largest importer of seamless pipes in Türkiye and Ukraine was the third. In the previous years, Germany ranked fifth while Ukraine ranked fourth.

Türkiye's seamless pipe imports

Competition and quotas in the steel pipe sector

SteelRadar's EU weekly quota filling assessment reveals the performance of countries in the steel pipe sector. India's leadership in stainless bar and light sections, China's strength in seamless pipe production and Türkiye's efficiency in hollow sections determine the balance in the sector.

Türkiye's strong performance continues in pipes and profiles

Türkiye performed strongly, using its full quota of 98,208 tons of hollow sections. This achievement highlights Türkiye's efficiency in the sector and its strong capacity to respond to demand.

Türkiye also played an important role in the welded pipe category and largely supplies the demand in this area, using an impressive 88.33% of its quota of 14,905 tons. This reflects Türkiye's strong position and competitive advantage in the global steel pipe market.

More optimistic outlook for the steel pipe sector

Despite global uncertainties, the sector, which contributed 2.3 billion dollars to the Turkish economy by increasing its exports by 10.7 percent at the end of 2022 compared to the previous year, will continue to export sharply in 2023. Despite the economic difficulties in Türkiye and limited sales in domestic and foreign markets, pipe and box profile manufacturers continue their success in exports. Despite periodic uncertainties and stagnant demand, 2024 is viewed from a more hopeful perspective. Turkish producers, who have proven the strength of Turkish steel to the world, especially in project-based activities, express their hopes for the steel industry both in the domestic market and at the global level after the first quarter of next year.

Comments

No comment yet.