It is quite possible that the bottom will be reached at around 60 thousand rubles per ton or even lower. However, in the future the prices is expected to rise again.

Then a potential difference will arise between the regulated and unregulated market segments. The Ministry of Industry and Trade makes it clear that it will not tolerate price increases for government-funded projects.

A second attempt is being made to organize direct deliveries at “special” prices from metallurgical enterprises to specific construction sites. And what is important, prices for rebars for government buildings are set on the “cost plus” principle, and scrap metal takes up a significant part of the cost.

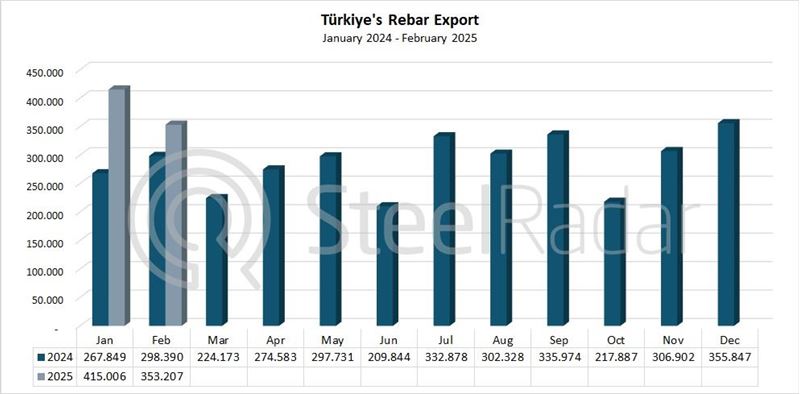

At the same time, an increase is visible in the global steel market. European, Chinese and Turkish companies announced price increases. However, the main reason for the increase was increased costs. Recently, prices for scrap and iron ore have risen. One can argue how much the cost of scrap metal will increase in winter, but most likely it will not be lower than the current one.

There is a slight growth trend in semi-finished steel products. But Russian companies have reduced their export supply due to the increase in the ruble exchange rate and export duties, supplies abroad have become unprofitable.

Central Asian countries, Israel and Latin America are main regions for Russia's rebar exports.

SteelRadar's price assessment for export rebar from Russia is at $480-500 FOB Black Sea.

Comments

No comment yet.