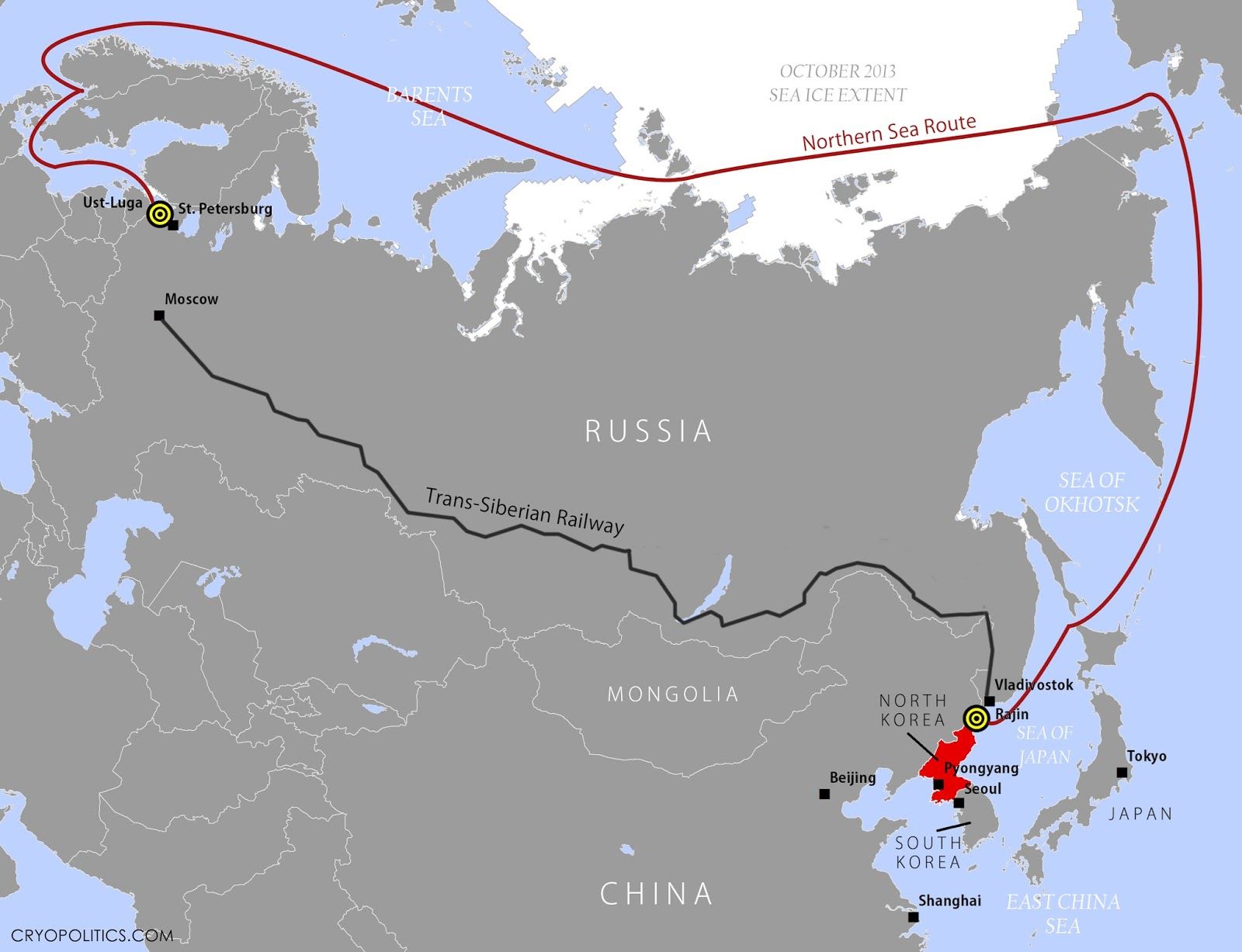

Russia and China will jointly develop the Northern Sea Route, which will allow cargo traffic between the two countries to increase more than 20 times to 50 million tons by 2030. This was announced by Rosatom CEO Alexei Likhachev during Vladimir Putin's visit to China.

The Northern Sea Route will be used to transport copper concentrate from Russia to Nornickel's new smelter in China. This could be the beginning of the Russian business community's pivot to the East.

The main reason for Russian companies to set up subsidiaries in China is Western sanctions. These sanctions make financial deals difficult even in countries not participating in the restrictions. However, the products of the joint ventures in China will be recognized as Chinese goods, thus circumventing the sanctions. Vladimir Potanin, one of Nornickel's partners, made this statement in an interview with Interfax, confirming plans to move copper production to China.

According to experts, the transfer of copper smelting capacity to China will solve several problems for the Russian economy and Nornickel. First, given that China consumes more than half of the world's copper, it will allow to overcome sanctions and ensure metal sales. Secondly, the joint project to build a new copper smelter in China will help the company save on the modernization of the old smelter, which could cost about $ 2 billion. In addition, China is interested in building such a plant, having the necessary technology and demand.

Following Nornickel, other Russian companies may also enter the Chinese market. For example, “Composite Group Chelyabinsk” plans to open joint ventures for the production of composite rebar and equipment for its production in China.

Comments

No comment yet.