Ritesh Maheshwari, Member of the Board of Shabro Metallic Pvt Ltd from India, began his speech by emphasizing, “We expect and want more and more Indians to involve in the BIR and be more at the front, and more and more Indians in this industry.”

Expressing that the stainless industry in Europe is currently experiencing problems due to renewed price pressure and the sharp slowdown in production, he stated that some factories are operating at only 50% capacity. Saying that stainless steel prices are currently in a downtrend, Maheshwari emphasized that high interest rates are again a huge problem for the entire industry globally.

Talking about positive projects in the industry, Maheshwari stated that South Korean Posco's stainless factory restarted all its furnaces after it entered a pause period due to flooding. He said that thanks to the projects in the Middle East worth $2.3 trillion, strong consumption growth is expected for stainless steel. Lastly, referring to super alloys, Maheshwari stated that the consumption is stable and there are orders until 2025.

The next speaker, Markus Moll, Managing Director of Steel & Metals Market Research, started his presentation with the tougher facts about the European stainless steel industry. “We had a 4% drop last year because even China was behind last year,” Moll said. "We believe that China will grow by 5% this year, but as we know from China's first quarter figures, it was extremely weak. This situation continues in the second half in terms of crude steel production.” Noting that the demand in Europe has decreased further, he also stated that there will be less stainless steel imports to Europe.

Is 2023 the anniversary of LME's death?

“Could 2023 be the year of death of the LME and the LME nickel contract?” Moll said that the LME only trades Class 1 and that it is time to explore new platforms for nickel price comparisons.

“Europe is no longer cost competitive”

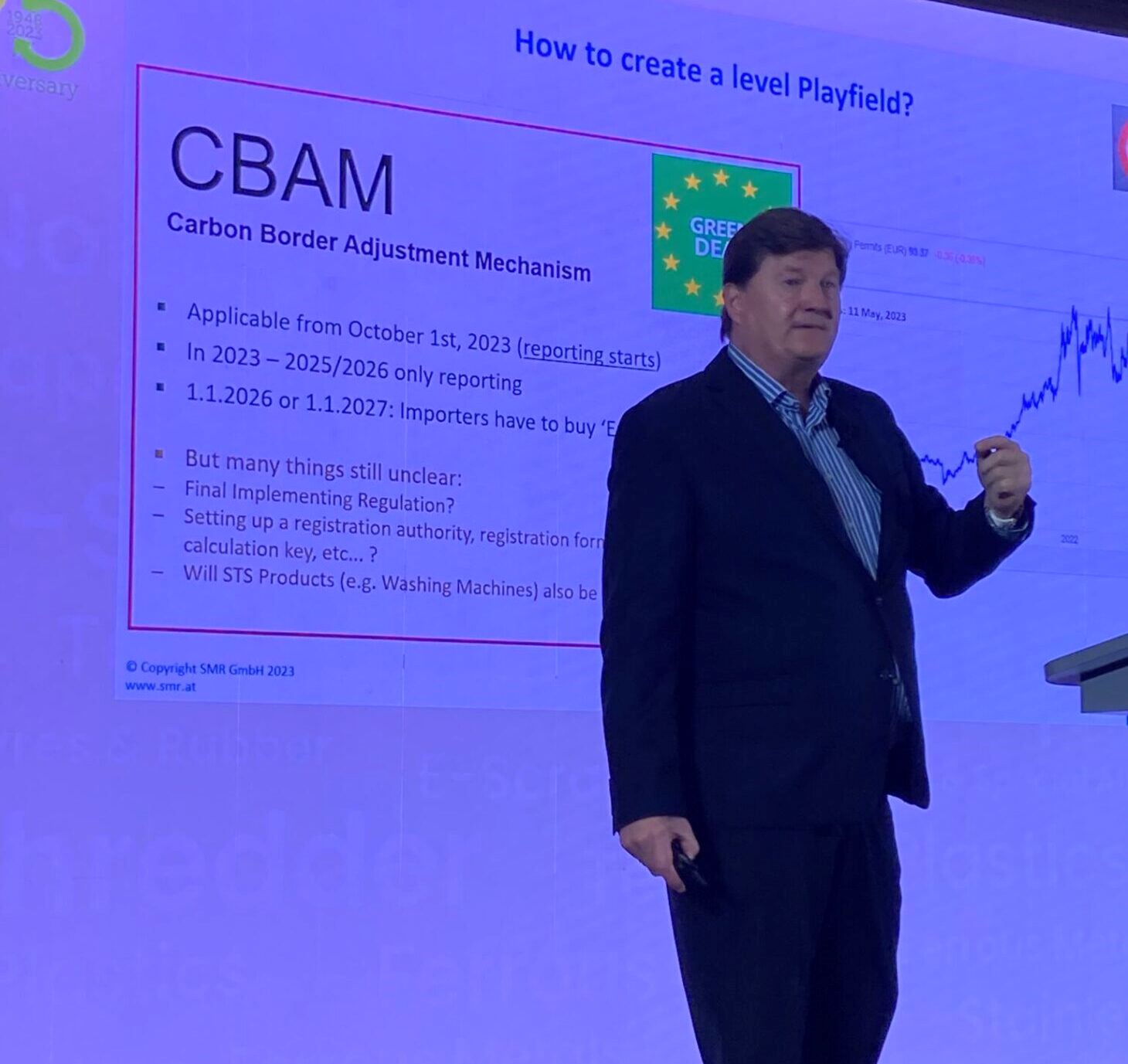

He criticized Europe's stainless steel industry by claiming that it is becoming the "ping-pong ball of politics" as the emergence of stricter climate targets coincides with competition from major producers in Asia "who benefit from a supply chain that provides them with the lowest cost base in the world," Moll added: “Europe is no longer cost competitive." He stated that without safeguards, it is not possible for them to compete with Asians, otherwise the stainless steel industry in Europe will disappear.

Markus Moll, wanting to end his speech with promising details about the sector, listed the positive aspects of the industry as follows:

- Ukraine war is about to end faster than expected

- Energy prices normalize faster than expected

- Stainless gains competition again

- New applications are coming

- The USA is still the center of nuclear

The last speaker of the session was Frank Pothen, the Professor of Economics at Germany’s ErnstAbbe-Hochschule Jena University of Applied Sciences and Senior Research Associate at the Fraunhofer Center for International Management and Knowledge Economy IMW. Emphasizing the ecological benefits of using scrap in stainless steel production in his presentation, Pothen stated that a study by Fraunhofer UMSICHT earlier this year revealed that for every tonne of stainless steel scrap used, CO2 emissions were reduced by 6.7 million tons.

“If companies are forced to use a certain amount of scrap in their production processes, which increases the demand for scrap, the scrap price will likely increase, reflecting the positive effects. The argument here is that mandatory use is much stronger than the change in the market, but much more severe than in the market, so we think the incentives for scrap use are more positive” he continued his speech.

Integration of mining into the EU emissions trading scheme; and incorporating the "scrap bonus" into pricing mechanisms of environmental cost savings, such as integrating raw materials and intermediates into the Border Carbon Regulation Mechanism, are among the policy options proposed by Fraunhofer.

Comments

No comment yet.