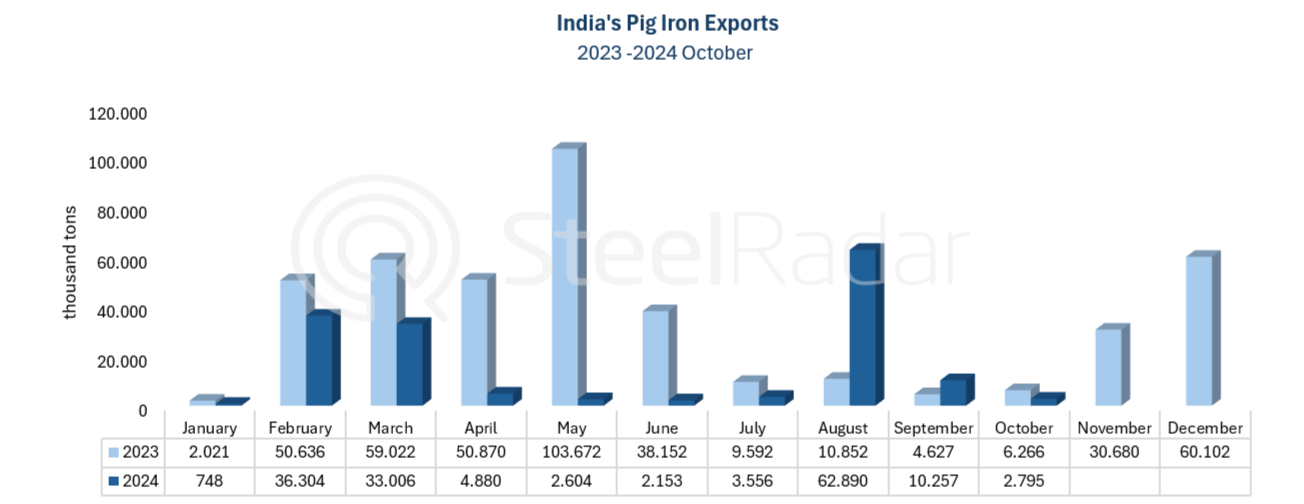

According to data obtained by SteelRadar, India's pig iron exports experienced notable fluctuations throughout the year. Starting from February 2024, exports started to decline, falling sharply by 98% to 2,604 tons in May. In May 2023, exports had reached their highest level of the year with 103,672 tons. This decline continued in June, with exports falling 94% to 2,153 tons. In July, exports fell by 63% to 3,556 tons, but recovered in August to reach 62,890 tons, up 16% year-on-year. In September, this rise accelerated and exports increased by 122% to 10,257 tons. In October, however, there was another downturn, with exports falling 55% to 2,795 tons.

India’s pig iron production stood at 682,000 tons in November. This figure reflects a decrease of approximately 11% compared to October.

In addition, the pig iron market in India was buoyed by auctions by major factories. The Steel Authority of India Limited (SAIL) and the National Mineral Development Corporation (NMDC) influenced the market dynamics with limited trading. While prices stabilized in SAIL’s Rourkela and Bhilai factories, demand remained weak in NMDC’s auctions.

The increase in Australian coke prices was effective in stabilizing pig iron prices. Rising costs have made it difficult for producers to reduce prices, while supply constraints and weather conditions have pushed up costs, supporting local prices. Experts expect a slight recovery in domestic demand and possible restrictions on metallurgical coke imports to stabilize the local market. Prices in India are expected to remain stable to slightly higher in the short term.

Comments

No comment yet.