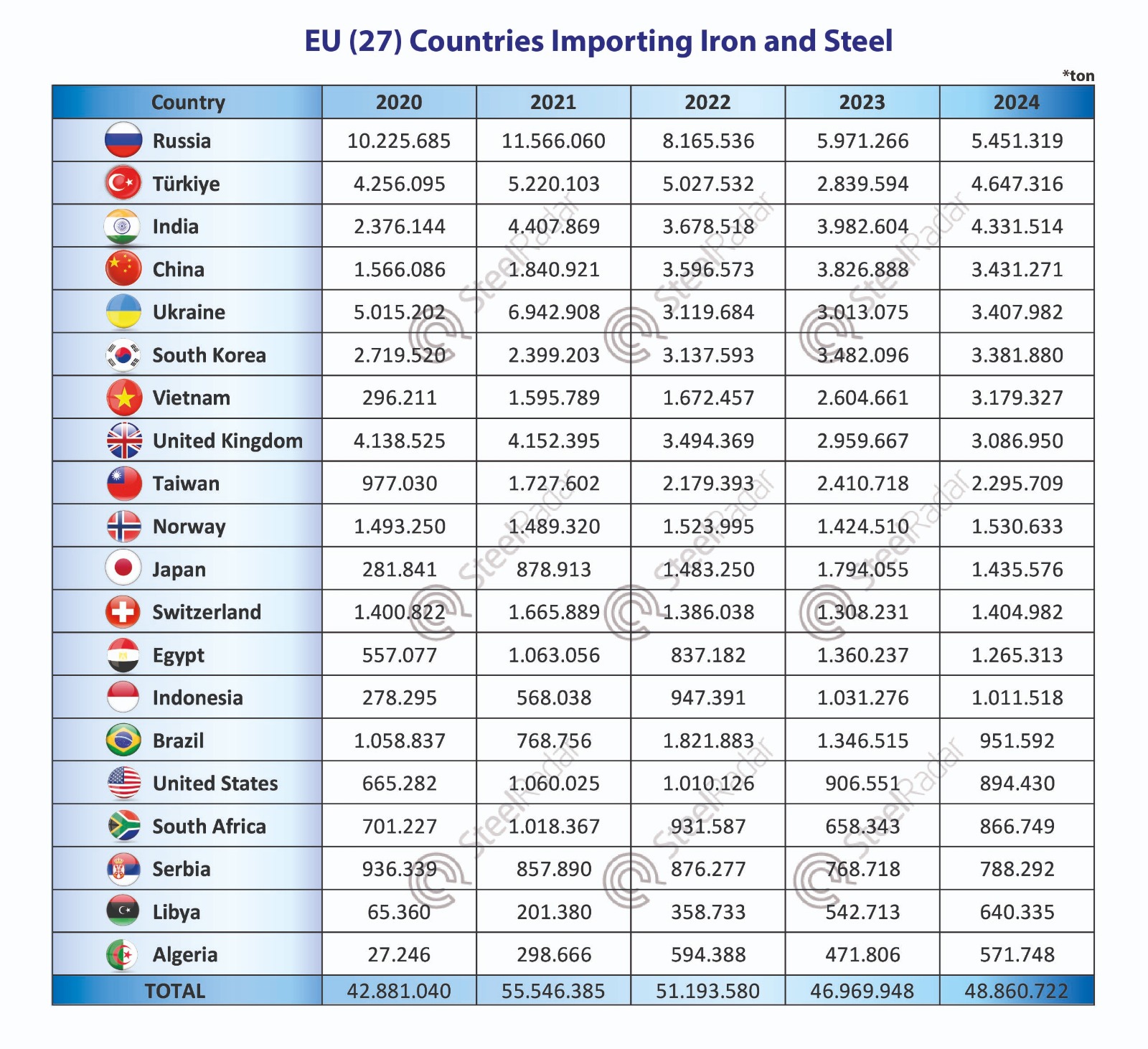

According to data compiled by SteelRadar from Eurostat, EU steel imports fluctuated between 2020 and 2024. In 2024, imports increased by 4.03% y/y from 46.96 million tons to 48.86 million tons. In this period, the highest imports were recorded in 2021 with 55.54 million tons, while the lowest imports were recorded in 2020 with 42.88 million tons. As of 2024, the EU 27 countries imported the most steel from Russia, Türkiye, India, China and Ukraine.

Russia Maintains Leadership, Türkiye Closes in

Russia was the largest steel supplier to the EU in 2024, with 5.45 million tons, while imports from Russia have decreased by half since 2020. Türkiye ranked second with shipments of 4.65 million tons. Türkiye's export volume increased significantly from 2.83 million tons in 2023 to 4.65 million tons in 2024.

Strong Inflows from Asian Countries Continue

India, China and South Korea continued to be important suppliers in the EU market. Imports from India and China reached 4.33 million tons and 3.43 million tons, respectively. Imports from South Korea increased to 3.38 million tons.

Vietnam made a big breakthrough in 2024, exporting 3.18 million tons. Shipment volume, which was 2.60 million tons in the previous year, recorded a significant growth with increasing demand and competitive prices.

Ukraine and the United Kingdom Recover in Exports

Ukraine, which felt the effects of the war heavily, increased its exports from 3.03 million tons in 2023 to 3.40 million tons in 2024. Imports from the United Kingdom also showed signs of recovery, reaching 3.08 million tons.

Decrease in Egypt and Brazil

Some countries experienced a decrease in their steel exports to the EU. Egypt's shipments decreased from 1.36 million tons in 2023 to 1.26 million tons in 2024. Brazil, on the other hand, fell behind the previous year's level of 1.34 million tons with 951 thousand tons of exports.

Overall Imports Increase Draws Attention

Increased steel flows, especially from Asia and Türkiye, have highlighted the changing dynamics in the EU's steel supply.

The competitiveness of the European steel industry and import regulations will be among the most critical agenda items for the sector in the coming period.

The ranking of the EU (27)'s top importing countries for 2020-2024 is as follows;

Comments

No comment yet.