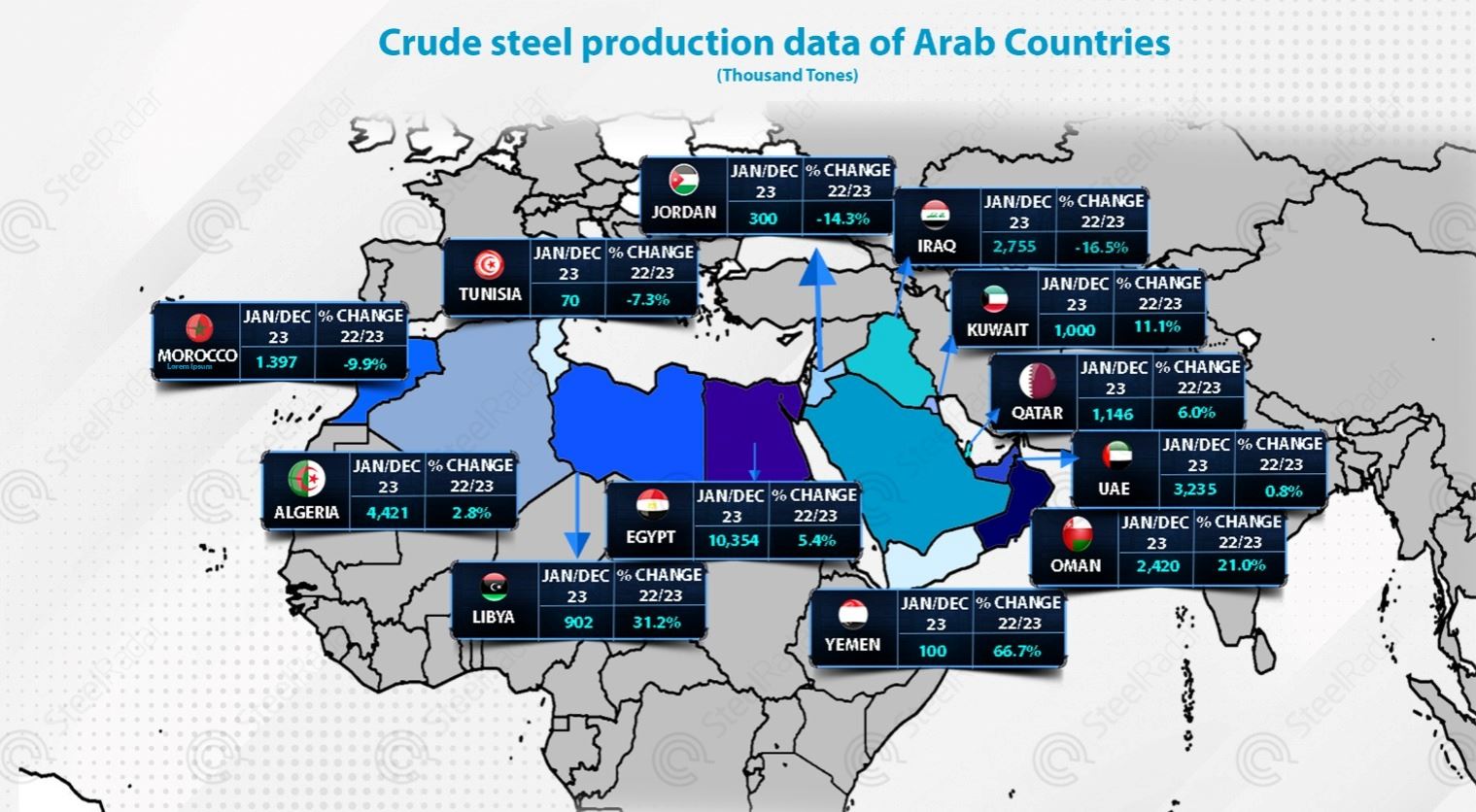

In December 2023, the Middle East experienced a notable 9.6% increase in crude steel production, marking a positive trend for the region's steel industry.

On the global scale, Egypt secured the 18th position with a total production of 10.4 million tons, showcasing its rising prominence. Saudi Arabia, contributing 9.9 million tons, earned the 20th rank globally. While it may be challenging to pinpoint the exact reasons behind this surge, several general factors contribute to such growth.

Increased demand for steel often accompanies economic growth. If the Middle East region experienced economic expansion during the specified period, it could lead to higher demand for steel in construction, infrastructure projects, and manufacturing.

The Middle East is known for undertaking large-scale construction and infrastructure projects. A surge in construction activities, such as building projects, bridges, and transportation infrastructure, drive up the demand for steel.

Growth in industrial sectors, including manufacturing and production, could contribute to higher steel consumption. Industries that rely heavily on steel, such as automotive, machinery, and appliances, boost steel production.

Government policies and initiatives that promote industrial development, construction, and infrastructure projects stimulate steel production.

Global trends in the steel industry, including fluctuations in prices, supply chain dynamics, or international demand, influence regional steel production.

In 2023, the steel industry has rebounded from the challenges of the Covid-19 pandemic, with factories across Kuwait, the United Arab Emirates, Saudi Arabia, Qatar, and Oman operating at full capacity. Notable expansions, such as a new rolling mill line by Al-Oula Steel Company in Kuwait, and initiatives like the Vision 2030 Project in Saudi Arabia, have driven increased production.

The industry is witnessing growth in Egypt, particularly due to openness to the African market and flourishing construction projects. Moreover, mega projects like NEOM and the Red Sea initiatives are shaping the market landscape. In Saudi Arabia's Ras Al Khair area, there is a focus on heavy production for vessels and plates, while steel products are being exported to the Far East, highlighting a dynamic and globally impactful steel industry in 2023.

The Egyptian steel sector experienced a positive trend in 2023, with a significant increase in production compared to 2022.

In December 2023, Egypt's steel industry saw a significant increase in crude steel production, driven by flat production. Despite a temporary drop in long steel production due to slow local sales, the industry's growth was limited due to high export levels. This dynamic interplay between flat and long steel production, coupled with a strong export market, demonstrates the industry's adaptability and global competitiveness.

Despite facing challenges in its gas and energy sectors, Iran has emerged as the tenth-largest steel producer globally in 2023, showcasing resilience and determination. The country achieved a remarkable feat by producing a total of 31 million 100 thousand tons of steel throughout the year. A pivotal moment for the steel industry occurred in December, as Iran recorded the production of an impressive 2 million 900 thousand tons of steel in that month alone.

Comments

No comment yet.