Türkiye's billet and bloom imports decreased by 49.8% year-on-year and 43.7% month-on-month to 155,340 tons in May this year, according to data obtained by SteelRadar from the Turkish Statistical Institute (TUIK).

In May this year, Türkiye's billet and bloom imports sharply declined, totaling 155.340 metric tons—a significant 43.7% drop from April and a striking 49.8% decrease year-on-year, according to data from the Turkish Statistical Institute (TUIK).

The accompanying financial figures reflect a similar trend, with import revenues falling by 41.9% month-on-month to $90.25 million, and plunging by 54.4% compared to last year.

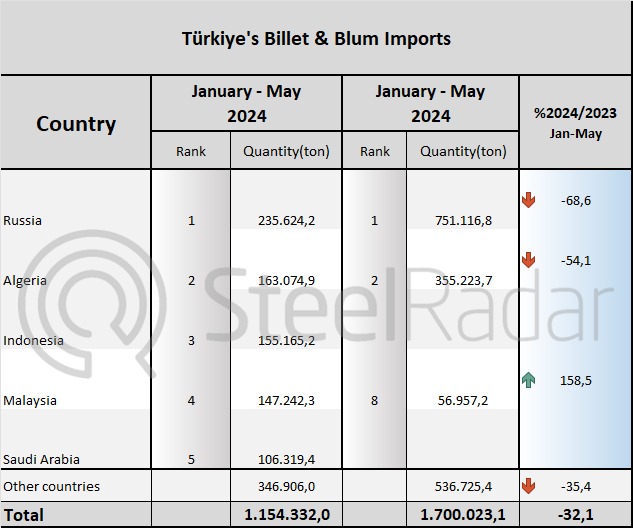

From January to May, Türkiye's cumulative imports of billet and bloom reached 1,159,343 metric tons, marking a 31.7% decline year-on-year. The import value also decreased by 34.1% to $667.63 million during this period.

Notably, Algeria emerged as a significant player in Türkiye's steel imports, ranking second behind Russia. Algeria supplied 163.074 metric tons of billet and bloom to Türkiye during this period, highlighting its growing role in the Turkish steel market. Russia remained the top supplier with 235,624 metric tons, while Indonesia followed closely with 155,165 metric tons.

Türkiye's billet imports from Iran also increased by 10.2% to 12,261 tons compared to the same month last year. Iran ranked third in the list of countries that Türkiye imported the most logs from in May.

The decline in imports and revenues underscores broader challenges facing Türkiye's steel sector, including economic uncertainties and global market fluctuations. Geopolitical dynamics and trade policies may also be influencing Türkiye's sourcing strategies and import patterns.

Looking forward, stakeholders in Türkiye's steel industry will likely focus on adapting to these changing conditions, optimizing supply chain strategies, and strengthening relationships with key suppliers like Algeria to navigate the evolving landscape effectively.

Comments

No comment yet.