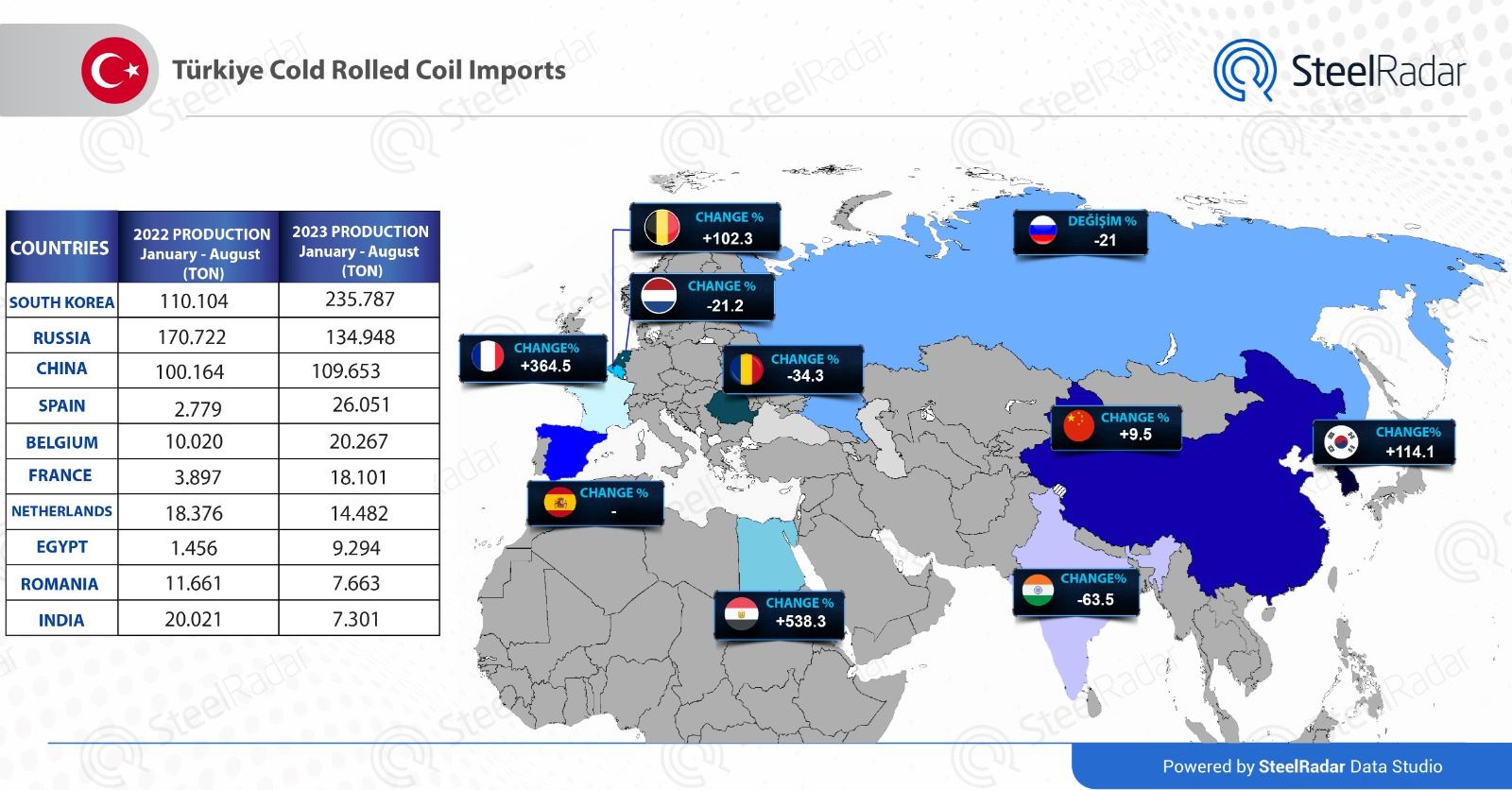

Turkey's cold rolled coil products continues to grow as the country imported 603,384 tons in the first eight months of 2023, marking a 24% increase compared to the same period last year. This surge in imports reflects Turkey's reliance on these essential steel products to support its booming manufacturing industry.

In the months spanning January to August this year, South Korea emerged as the leading supplier of cold-rolled products to Turkey, holding a significant advantage over other nations in the sector. The quality, competitiveness, and consistency of South Korean steel have made it the go-to choice for Turkey's manufacturers.

Notably, Egypt, France, and Belgium also witnessed a substantial increase in their exports of rolled products to Turkey throughout 2023, compared to the previous year. These countries have been actively expanding their market presence in Turkey, further diversifying the sources of Turkey's cold rolled product imports.

However, in a stark contrast, Iran, Turkey's western neighbor, has yet to make a notable impact on Turkey's import market for cold rolled products. According to statistics from the Iranian Steel Manufacturers Association, from April to September 2023, Iran produced over 1.2 million tons of cold sheets. Despite its geographical proximity to Turkey, Iranian steel manufacturers have not secured a significant share in Turkey's cold rolled product imports.

This disparity raises questions about Iran's ability to penetrate the Turkish market, which remains dominated by countries with advanced steel industries and well-established trade relationships with Turkey. Factors such as international sanctions, quality standards, and logistical challenges may be contributing to Iran's limited presence in Turkey's import market.

Comments

No comment yet.