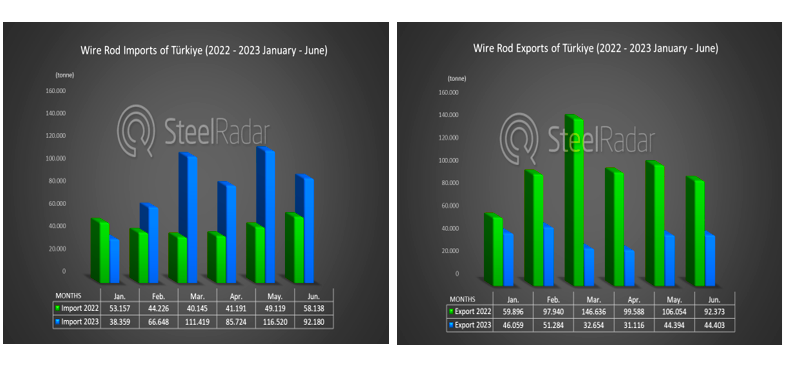

According to SteelRadar's research from TUIK (Turkish Statistical Institute), wire rod exports, which were 46,59 tons in January 2023, decreased by 3.60% to 44,403 tons in June.

Exports, which rose to 51,284 tons in February, fell by 36.33% to 32,65 tons in March. The decline continued in April. Compared to the previous month, it decreased by 14.71% to 31 thousand 116 tons.

However, it increased by 42.67% to 44 thousand 394 tons in May. In June, it was recorded as 44 thousand 403 tons. According to all these data, wire rod exports fell by half compared to previous years.

140% increase in imports while exports weakened

On the import side, wire rod imports, which were 38 thousand 359 tons in January 2023, increased by 140.31% to 92 thousand 180 tons in June. In February and March, it increased by 66,648 tons and 67.17% to 111,419 tons, respectively.

In April, it decreased by 23.06% to 85 thousand 724 tons. However, it increased by 35.92% to 116 thousand 520 tons in May. In June, it decreased by 20.89% to 92 thousand 180 tons.

In addition to these data, wire rod exports were 1 million 193 thousand 325 tons in 2022, but decreased to 249 thousand 909 tons in the first half of 2023. In the same period, the import figure, which was 511 thousand 472 tons in 2022, was recorded as 510 thousand 850 tons in the January-June period of 2023. These data reflect the changes and trends in the sector.

In a press release on August 3, the Turkish Steel Producers' Association underlined that the extraordinary increase in imports of long products, of which Türkiye is a net exporter, has strengthened concerns that the sector's foreign trade deficit may gradually increase.

Why has the foreign trade balance in wire rod changed?

Türkiye's strength in the long product group had been proven in the world economy and its export demand had steadily increased. However, there were sharp changes, especially in 2023. Some free trade agreements and high energy costs reduced the competitiveness of Turkish producers in the global market. Egyptian and Malaysian imports of steel mesh, where standard uses would have sufficed, surged. The earthquake that affected 11 provinces in Türkiye, which is described as the disaster of the century, created a high demand for steel mesh, and manufacturers wanted to make more reasonable production under market conditions. In addition, as word of mouth spread quickly in the market, some companies producing products such as wire, nails and bolts wanted to buy wire rod, believing that they could create a more competitive price with imports since they had DIR records. While all these developments reduced wire rod exports, an unbalanced supply-demand equation emerged in the domestic market. Apart from the giant producers, companies without DIR (Internal Processing Regime) started to move away from the idea of importing, fearing that importing would cost more and that they would not be able to find export customers in a short period of time. Türkiye continues its rapid recovery process with its location and success over the years. Export demand is expected to be stronger in the last quarter of 2023 and 2024.

Comments

No comment yet.