The global orientation towards a low-carbon economy and the increasing focus of ESG by investors and companies are accelerating metal recycling projects. Scrap is of great importance in responding to the increasing demand for green metals. Recent research shows that global demand for scrap metal is expected to remain strong in the coming years.

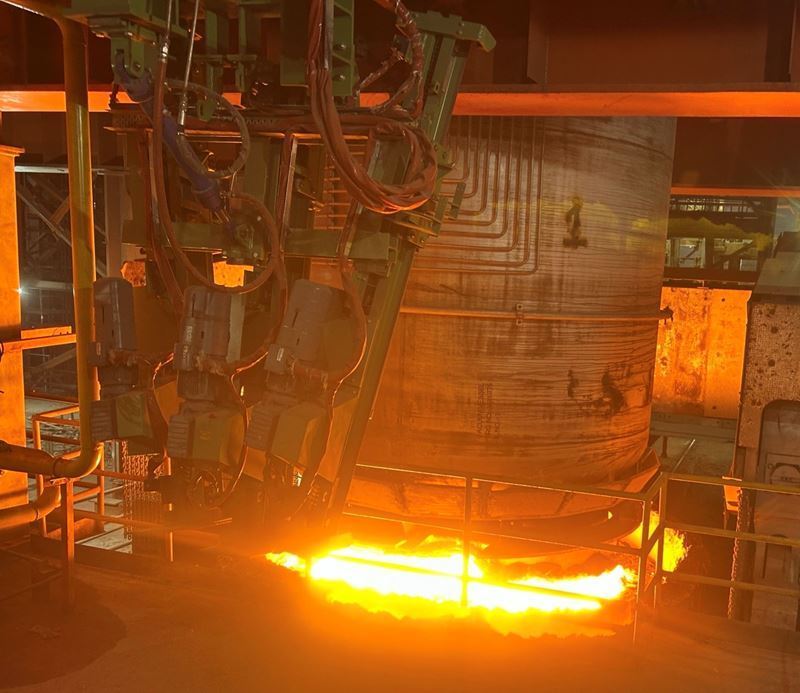

According to the report published by New York-based White & Case, the importance of recycling increases in green metal production as ESG's focus shifts to the mining and metals sector. Today, the contribution of the aluminum and steel industries to global CO2 emissions is around 2 percent and 7 percent, respectively. To reduce carbon emissions, recycled materials should be preferred. Melting scrap metal for recycling requires significantly less energy than primary metal production.

White & Case's report also points out that the disruption of global supply chains by COVID-19 and geopolitical conflicts is pushing countries to expand potential uses for scrap.

50% of aluminum in the EU will come from recycling

“The European aluminum industry has set a target in the Recycling Aluminum Action Plan to meet 50 percent of EU aluminum demand using recycled materials by 2030, well above the current 36 percent level. Strong demand for scrap metal,” the report said. "Given its importance for metal and metal production, many countries tend to reserve local scrap supplies for their metalworking industries, including by taxing or banning scrap metal exports."

Restrictions apply on the scrap trade

The research shows that about 40 percent of copper waste and scrap traded worldwide, 30 percent of aluminum and 20 percent of iron and steel scrap are subject to export restrictions.

While export restrictions on scrap metal are relatively common, fewer countries impose import restrictions on scrap metal.

The source of energy is the biggest problem

Meanwhile, in most countries, the production of metal from scrap remains dependent on fossil fuels, especially coal or natural gas, which is cited as the biggest challenge for scrap use.

Restrictions on export and import in the world

European Union: The EU is currently considering restricting scrap metal exports to some countries for environmental reasons. In November 2021, the EU Commission announced that exports of non-hazardous waste (including scrap metal) to non-OECD third countries can only be sold to countries that demonstrate their ability to treat this waste in an environmentally sustainable way. The proposed export ban will apply to waste materials that OECD members have designated as "green list" waste (i.e. those that pose a low risk to human health and the environment), including scrap iron, steel, aluminum, copper, nickel, zinc and cobalt.

China: Currently, there is a 40 percent export duty on iron and steel waste and scrap, and a 15 percent export duty on aluminum and copper waste and scrap. Given that China accounts for a relatively large share of the global production of these metals, these measures have a significant impact on the global scrap markets. China has imposed a full ban on imports of solid waste (including scrap metals) as of January 1, 2021, but exempted some key scrap metals that can be recycled provided they comply with applicable national standards. Scrap metals eligible for this exemption are scrap of iron-steel, brass, copper and cast aluminum alloys. The entry of these materials into China is subject to mandatory inspection at the port of import.

USA: It largely avoided imposing taxes or significant restrictions on scrap metal exports during WWII. But the government "Scrap for Victory!" to support the US Armed Forces. Temporarily banned the export of iron and steel scrap. However, there are currently no restrictions on US exporters.

Canada: Restricts the import and export of hazardous waste and hazardous recyclable materials.

India: It imposes a 15 percent export duty on various iron and steel waste and scrap.

Argentina: Exports of iron and steel, copper and aluminum scrap have been banned since 2016.

Vietnam: It imposes export duties ranging from 17 percent to 22 percent on many metal scraps, including iron, steel, aluminum, copper, nickel, zinc and tin.

Japan: It largely avoids imposing taxes or significant restrictions on scrap metal exports and imports.

South Korea: Voices have been rising lately for restrictions on exports and imports, but so far no taxes or significant restrictions have been placed on scrap metal exports and imports.

Comments

No comment yet.