An upward trend was followed in the commodity market last week, with supply concerns stemming from geopolitical risks.

Although there were decreases in the commodity market last week due to the strengthening of the expectations that the US Federal Reserve (Fed) will increase interest rates by 50 basis points in March, the statements regarding the escalation of tensions between Russia and Ukraine, especially on Friday, increased supply concerns and the pointer turned upward.

Stating that the concentration of Russian forces on the borders of Ukraine increased the threat of military action, Britain demanded that its citizens not travel to Ukraine and its citizens there to leave the country.

US National Security Advisor Jake Sullivan also said that Russia could begin an invasion of Ukraine before the "China Olympics" ends. The ounce price of gold, which is considered a "safe haven" by investors after increasing geopolitical risks, completed the week with an increase of 3 percent.

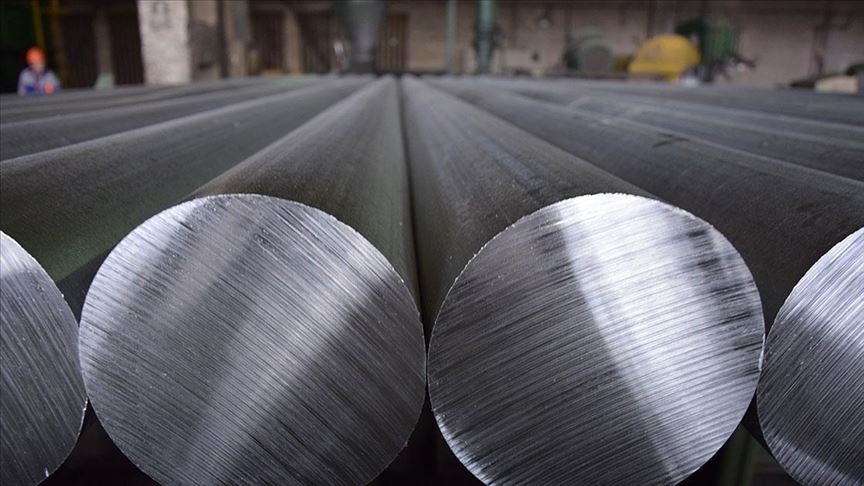

Aluminum sees historical peak

Expectations that China will concentrate on infrastructure expenditures with interest rate cuts led to sharp increases in aluminum prices. Aluminum, which saw its historical peak at $1,9902, gained 3.4 percent last week.

Analysts pointed out that Russia is one of the leading aluminum producer countries and stated that decreasing stocks were also effective in the price increase.

Silver 4.9 percent, copper 0.4 percent, palladium 1.3 percent, lead 2.9 percent, platinum 0.8 percent, nickel 0.9 percent, zinc 0.4 percent, increased last week.

Analysts said that copper is among the metals that can be most positively affected by China's monetary expansion policy.

Brent oil gained 1.6 percent last week, while natural gas lost 12.5 percent. Although the price of Brent oil was moving in search of direction during the week, it rose to its highest level since October 2014 at $ 94.5 due to the concern that the tension between Russia and Ukraine could increase further. Thus, oil prices carried their upward trend for the eighth consecutive week.

With the forecasts that the air temperatures will increase and the concerns about the decrease in the demand, the natural gas prices decreased.

Tensions between Russia and Ukraine also affected agricultural commodities

The tension between Russia and Ukraine has also caused an upward trend on the agricultural commodity side. Last week, wheat gained 4.5 percent, corn 4.8 percent, soybeans 1.9 percent and cocoa 4 percent.

With $2,6045, the highest level since September 2011, coffee finished the week with a gain of 4.2 percent.

Cotton lost 2.8 percent and sugar 1.9 percent.

Analysts said increases were seen in soybeans and cocoa amid drought concerns.

Concerns that the monetary tightening moves of the world's leading central banks would adversely affect global economic growth negatively affected cotton prices.

Futures and commodity markets expert Zafer Ergezen stated that the tension between Ukraine and Russia continues to have an impact on agricultural commodities.

Stating that Russia and Ukraine are important grain producers and exporters at the same time, Ergezen said that the increase in tension between these two countries brought along supply concerns.

Mentioning the decrease in cotton prices, Ergezen said that with the high inflation data from the USA, interest rate hike concerns have also increased. Ergezen stated that for this reason, there is sales in commodities such as cotton that are sensitive to economic data, and that economic growth is expected to slow down as a result of interest increases and a decrease in cotton demand is expected.

Regarding the rise in coffee prices, Zafer Ergezen said, "Unfavorable weather conditions in South America also negatively affect coffee production expectations. Increasing supply concerns cause coffee prices to remain strong." made its assessment.

Comments

No comment yet.