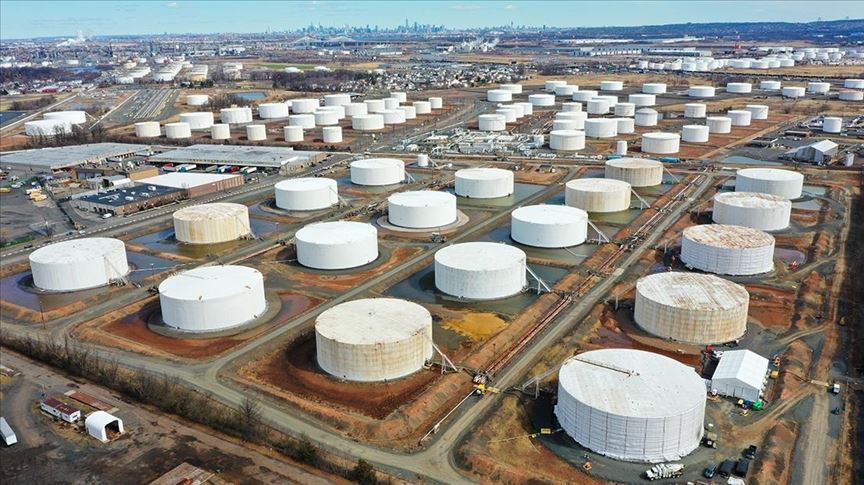

While the US and some Western countries' targeting the Russian energy sector, deepening supply concerns in global oil markets, leading to increases in oil prices, it brought up the search for resources for Washington.

Biden: We ban imports of Russian oil, gas and energy

EU has prepared a plan to get rid of dependence on Russia in energy

Britain to end imports of Russian oil by the end of 2022

Due to the recently accelerated Iran nuclear negotiations and the US's high-level talks with Venezuela after a long hiatus, it is considered that the lifting of sanctions against these countries is among the Biden administration's main options in search of resources.

According to the International Energy Agency, Iran, which is expected to increase its production rapidly when the sanctions are lifted, is expected to achieve a sustainable supply capacity of 3.8 million barrels, with an increase of 1.3 million barrels per day by the end of the year. It is also anticipated that the country's approximately 80 million barrels of oil stored in tankers will be released as quickly as possible.

It is known that Venezuela, whose daily oil production decreased to 350 thousand barrels due to sanctions, increased this figure to 800 thousand barrels in December 2021. While the uncertainties regarding the oil supply that Venezuela will provide to the market in the event of the lifting of the sanctions continue, it is considered that the production level of 1 million barrels per day is not sustainable due to the insufficient infrastructure in the country, which needs large investments in the oil sector.

"Russia is too big an oil producer to ignore"

Fereydoun Barkeshli, Founder of the Vienna Energy Research Group, told Anadolu Agency (AA) that when it comes to oil, it is not surprising that the US contacts countries that impose sanctions.

Pointing to Washington's contacts with Iran and Venezuela, Barkeshli said, "As we all know, no enmity lasts as much as friendship in international relations. The only thing that will last forever is the interests of the countries." said.

Drawing attention to the deepening supply contraction in the global oil markets, Barkeshli said, "The last time such a shortage of supply in the oil market was 30 years ago, when Saddam Hussein invaded Kuwait and about 5.4 million barrels of oil a day evaporated from the market. However, since then. "A lot has changed over time, and Russia is too big a producer to ignore. So we shouldn't be surprised if the US contacts Venezuela or Iran to add additional supply to the market." he said.

"It is not possible to completely replace Russian oil"

Referring to the reactions of the markets to the developments on the supply side, Barkeshli said, "Let's not forget that there are two sides to the coin; physical oil and market perception. The international oil market is generally perception-oriented. The market is not without oil at the moment. No buyers returned empty-handed due to supply shortages. There is plenty in the market. "There is a lot of oil, but the market is focused on the empty glass. If the perception is negative, the expectation is always that the worse will come." made its assessment.

In terms of the physical oil market, Barkeshli stated that Russian oil is 'desperately' looking for buyers in the market. said.

Barkeshli said that the substitution of Russian oil with Iranian and Venezuelan oil is not entirely possible. Barkeshli said:

"Such a situation will certainly relax the market, but it is not possible to completely replace Russian oil. Iran currently exports about 1.1 million barrels per day through the gray zone, albeit unofficially. Also, Iran is exporting around the world, in nearby consumption markets and ports in Iran. It has about 120 million barrels of oil. Iran can easily add 1 million barrels a day to its oil exports in weeks, if not days. When Iran was sanctioned by former US President Donald Trump, it did not completely close any oil fields. Production continued but in smaller volumes. So The country does not have a big problem. However, we will probably have to wait a few months for the next 1 million. I would say 5-6 months."

Stating that the situation in Venezuela is more complex, Barkeshli said, "It may take 1 to 2 years for Venezuela to approach 2017 production levels. Venezuelan oil industry is struggling with very serious and chronic technical difficulties." he said.

Barkeshli stated that Venezuelan heavy and extra-heavy crude oils, unlike Russian and Iranian oils, are generally used in oil refineries to be mixed with other types of crude oil. It has a refinery with a daily capacity of 1 million barrels. said.

"Only the US can be a ready market for Venezuelan crude"

Energy Point Research Founder Doug Sheridan also said that the positive conclusion of the US talks with oil producers Iran and Venezuela will reflect on the market as an additional oil supply.

Sheridan said, "I think the lifting of any sanctions will result in the introduction of around 1.5 million barrels of oil per day until the last quarter of this year. I predict that the main contribution will come from Iran. Venezuela will need time to increase its oil production and exports. On the other hand, Only the United States can be a ready market for Venezuelan crude." used the phrases.

Pointing out that the high-level talks between the USA and Venezuela after a long hiatus are not the result of a normalization process, Sheridan said, "The sanctions against Venezuela are lifted as a result of the imposition of sanctions on another country, which is an ally of the country, and this raises concerns that the sanctions have apparently been lifted. " he said.

Still, Sheridan stated that lifting the sanctions could improve the image of the USA in the eyes of the citizens of both countries.

Comments

No comment yet.