In the realm of steel production, Iran has witnessed a substantial surge in the export of rebars, steel sheets, and various other steel products to Afghanistan over the past several years. Exports of steel products in 2022 were comparatively modest, but in the eight months of the Iranian year from April to October, the value of exports jumped to $46 million.

Iran has served as a key supplier of steel products to Afghanistan. However, a recent shift has occurred as a result of the Taliban's directive. Under their mandate, any product that can be domestically manufactured is now subject to multiple import tariffs. This has imposed a significant financial burden on companies seeking to export rebars to Afghanistan, making the process economically impractical. Consequently, the export of rebars has dwindled, with the associated costs no longer justifiable from an economic standpoint.

Billet Prices in the Middle East

The import price of billet in the UAE from Iranian suppliers stands at $495-500 CFR. This reflects a significant week-on-week decrease of 15-20. The drop in prices may be attributed to various market factors, including changes in global demand and supplier dynamics.

Major merchant billet suppliers in Saudi Arabia are offering prices at $520-525 EXW. This marks a week-on-week increase of +5. However, other local mills in Saudi Arabia are offering billet at a slightly higher price range, ranging from $540-545 CPT and an increase of +5-10 compared to the previous week.

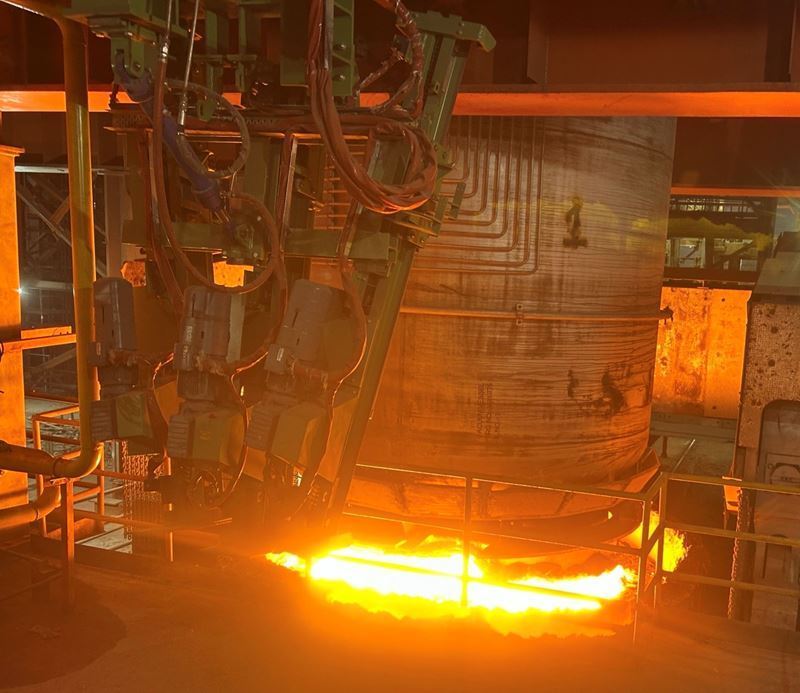

In Oman, Electric Arc Furnace (EAF)-based mills are offering billet at $520-525 FOB. Import prices from Iranian sources are in the same range at $520-525 delivered. This indicates a week-on-week increase of +10-15. The rise in prices may be influenced by factors such as production costs, global demand, and supply chain dynamics.

Impact of Red Sea Incident:

Last week, following an incident targeting a Norwegian-owned oil tanker (Strinda) in the Red Sea, there was an upswing in Yemen's Red Sea shipping insurance. In the upcoming days, steel and other products imported from Turkey to Yemen are expected to witness additional price increases. In today's Yemeni market, certain traders sold Türkiye's rebar at a rate of 2,900 Saudi Riyals (773$), marking a 100 Saudi Riyal increase (26$ increase) compared to the preceding days.

Consequently, the local construction iron production factory in Yemen found it necessary to raise the prices of its domestic products. This predicament resulted in a $26 surge in the factory's local products, and this price escalation is still ongoing. Considering the current circumstances, the uptrend is anticipated to persist into the following week. However, owing to a decline in demand, there is a substantial likelihood of prices experiencing a decrease.

Significant Price Surge for UAE HMS 80:20

The United Arab Emirates (UAE) metal scrap market has recently experienced a significant shift as HMS 80:20 prices surged by $10 to $14, reaching a current range of $340 to $346 per metric ton. This notable increase is influenced by a confluence of global factors impacting metal scrap pricing.

Economic factors, both global and local, impact the demand for raw materials, affecting the pricing structure of scrap in the market.

Disruptions or challenges in the metal scrap supply chain, including shipping and logistics, can contribute to price fluctuations.

Regional Outlook:

In addition to the UAE, regional expectations in Saudi Arabia suggest an anticipated rise in steel product prices by 50-100 Saudi Riyals. Similarly, in the UAE, a forecasted increase of $25 to $30 is expected.

Notably, pellet prices have increased by $7 this year, reaching $55. This global trend is influencing regional markets and contributing to the upward trajectory of metal scrap prices.

Comments

No comment yet.