The Global Steel Summit, organized for the 2nd time this year in Dubai, brought together many authorized names from the sector. SteelRadar, which attracted attention with its presentation and information about the pipe sector last year, took part as a speaker again this year. SteelRadar International Market Intelligence Specialist Berfin Çakır spoke about Turkiye's scrap market this year. Turkiye's scrap market, which is very curious by the world, was one of the topics that attracted attention at the conference. The speech titles of the presentation were as follows: Scrap in Global Markets, The Role of Scrap in Green Steel, Turkish Scrap Market in Global Markets, World Scrap Imports, Turkish Scrap Imports and Recent Scrap Transactions.

Scrap metal is the main raw material for secondary steel production. Turkiye, the USA, Iran and India are major producers of crude steel from scrap. Looking at the top 10 countries in scrap imports worldwide, Turkiye comes first with 18.8 million tons, followed by India with 11.8 million tons, Italy with 5.9 million tons and the US with 5.1 million tons. Although Turkiye imports scrap mainly from the US and Europe, it is interesting to note that these regions also have top ranks in scrap imports.

This shows that scrap is a major raw material in global steel production and continues to be strategically important for both developed and developing countries.

Energy efficiency and the use of renewable energy is another critical issue for the sustainability of the industry. Given the high energy consumption of EAFs, Turkiye's potential to transition to renewable energy sources can play an important role in reducing the industry's carbon footprint.

So what is the status of EAF use in Turkiye?

POSITION OF EAF IN TURKIYE

With Atatürk's goal of an independent and industrialized Turkiye, the Turkish steel industry developed using electric arc furnaces (EAF).

The industry's energy consumption is high, which increases its carbon footprint.

Therefore, developing alternative sources of raw materials, improving domestic scrap collection systems and increasing the use of renewable energy sources are critical to ensure the sustainability of the Turkish steel industry.

SCRAP AND BILLET IMPORTS

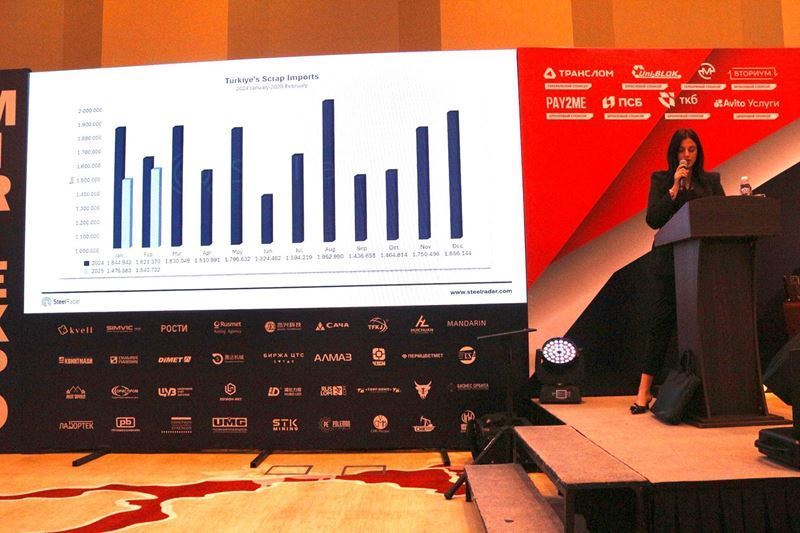

Producers usually consider billet and bloom as an alternative to scrap. However, when scrap prices increase, they revert back to importing billet and bloom. For example, as seen in this graph, scrap imports peaked in January and May this year, while billet and bloom imports remained at their lowest levels during these months.

Turkiye has 31 production facilities, including 4 blast furnace plants and 28 electric arc furnaces. In 2023, the capacity utilization rate was 58.5%. Annual steel production capacity is estimated to be around 60 million tons. The Turkish steel industry has become a major global player with EAF technology.

When it comes to steel imports, Turkiye always goes to the US and European markets.

Turkiye imports the most from the US with 4.5 million tons, followed by the Netherlands with 2.2 million tons, Belgium with 1.6 million tons and the UK with 1.3 million tons.

Turkiye also imports ferrous scrap from Romania, Denmark, Germany, Lithuania, Venezuela and France.

As the world's largest buyer of scrap imports, Turkiye plays an important role in global markets

Turkiye decreased scrap imports from 6 out of 15 countries, while increasing imports from 9 countries.

While some market experts told SteelRadar that prices are likely to fall to lower levels, others expect prices to continue at these levels, with the general comment being as follows: “This month's price is hard to read. Unfortunately, no one can guess what will happen in October or November.”

Comments

No comment yet.