Russia’s steel industry in 2024 witnessed a significant decline in production volumes, as metallurgists reduced output across nearly all major categories. Preliminary data from "Corporation CHERMET" highlights a contraction in the sector, with only a few areas demonstrating resilience.

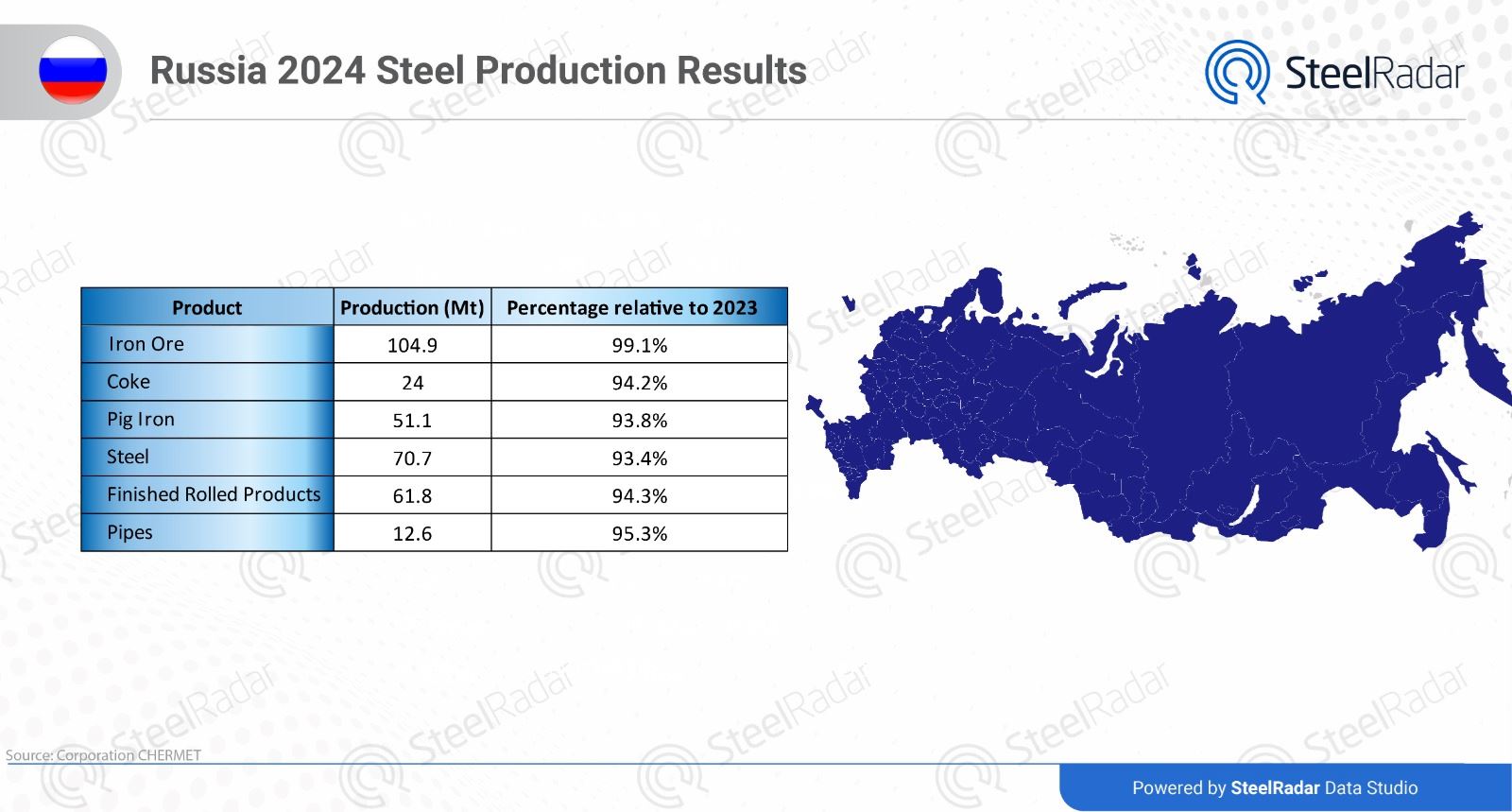

Enterprises in the ferrous metallurgy sector produced 70.7 million tons of steel, marking a 6.6% drop compared to the previous year. Iron ore output reached 104.9 million tons, which is relatively stable at 99.1% of the 2023 level. Production of coke (dry gross) amounted to 24 million tons, a decrease to 94.2% of the prior year. Manufacturers produced 51.1 million tons of pig iron, reflecting a decline to 93.8% of last year’s figures. Finished rolled products output dropped to 61.8 million tons, representing 94.3% of the 2023 level. On the other hand, pipe production demonstrated resilience, totaling 12.6 million tons, or 95.3% of last year’s production.

The preliminary data underscores a general downturn in the Russian steel industry, with declines observed across most categories. Steel production, the backbone of the sector experienced one of the sharpest reductions, driven by challenges such as lower demand, logistical hurdles, and global market pressures.

While the overall picture appears grim, iron ore and pipe production stood out as relatively stable. Iron ore production, at 99.1% of last year’s output, reflects steady demand for raw materials. Similarly, pipe production demonstrated resilience, supported by ongoing projects in key industries like oil and gas.

Thus, for the whole of last year the industry did not show positive dynamics in annual terms in any of the months. The ferrous metals sector in Russia has traditionally been export-oriented, with production volumes significantly exceeding domestic demand. One of the key external markets - the European Union - banned imports of rolled steel, rebar, welded and seamless pipes from Russia in 2022.

Comments

No comment yet.