The consequences for recyclers as the steelmaking industry looks to decarbonise in the coming decades was the major theme during BIR’s Ferrous Division session at the Abu Dhabi convention on 23 October. Guest speaker Kedar Joshi, markets manager (Asia) for Davis Index, asserted “the revolution is here and we are all part of it”.

Mr Joshi said two important pronouncements in the previous three months showed him that scrap traders and recyclers were finally getting due recognition. In July, the World Economic Forum said 6.5 billion tonnes of materials will be needed between now and 2050 for the energy transition with steel, copper and aluminium accounting for around 95% of this. It maintained “this is not possible without increasing metals recycling”. In September, McKinsey concluded that “the metals sector will be fundamental in the effort to limit climate change”.

Such perceptions, Mr Joshi argued, meant:

· integrated mills will have to increase scrap utilisation to meet investor and community demand for lower carbon scores;

· higher demand for finished products with different environmental, social and corporate governance and carbon footprint ratings would boost scrap utilisation;

· lighter substitute materials such as aluminium were placing steel under pressure;

· increased electric vehicle (EV) penetration was changing the typical shredder feedstock mix.

Strategic resource

Acknowledging recycled steel as a ‘strategic resource’, Mr Joshi cautioned: “Growing protectionism and the political need for better domestic supply chains are causing a rise in regional markets. This changes traditional trade routes. We expect this trend to continue.”

That protectionism was already evident, he said, with more than 60 countries having banned or in the process of restricting exports to support domestic producers.

“We are at the beginning of a 30-year demand super cycle for recycled steel. If there are no major disruptions from new materials this new demand shift will last decades longer.”

Calling the market for recycled steel ‘Industry 4.0’, Mr Joshi said: “For our industry, the 4.0 era will mean having to embrace better technology to identify, sort, process and ship materials.”

He quoted his ceo Sean Davison: “BIR, it’s time we drive this message to everyone we meet. Tell them: 'You want a greener planet? Just let us continue doing the job we’ve being doing for over a hundred years’.”

The other guest speaker, Davide Braga, head of global capital equipment sales at Danieli Centro Recycling in Italy, said demand for steel would continue to grow slowly to 2050 with millowners looking to cut CO2 emissions by between 70% and 90% by then. The switch towards electric arc furnaces (EAFs), he said, would double their share of the production by 2050 and include a significant increase in direct reduced iron (DRI) production. More than an extra 300 million tonnes of scrap per year would be needed to feed the additional EAF production in the transition to green steel, he added.

Danieli says its proprietary Digimelter, which uses scrap or DRI, or a mix of scrap, DRI and hot metal as raw materials, can progressively enhance EAFs. The company calls it a “zero bucket” type delivering a continuous scrap charging and preheating system providing optimal scrap charge, lower energy consumption and smaller environmental footprint.

Presenting the update to BIR’s 14th edition of World Steel Recycling in Figures, statistics advisor Rolf Willeke said that global crude steel production in the first half of 2023 totalled 943.9 million tonnes for a decline of 1.1% over the same period in 2022.

“From our own calculations and those of worldsteel, it has been concluded that some 630 million tonnes of recycled steel are used each year in global steel production, thereby preventing almost 950 million tonnes of CO2 emissions while also saving energy and conserving natural resources,” he said.

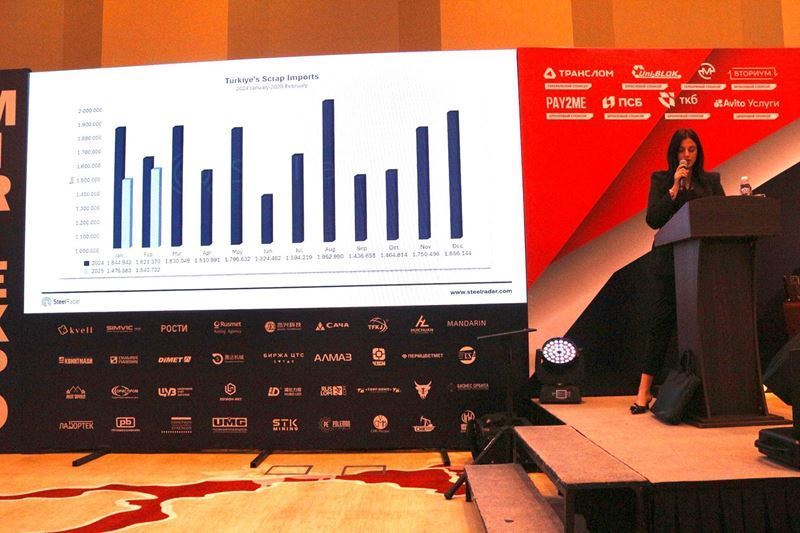

The proportion of recycled steel used in crude steel production was 21.7% in China, 60.3% in the EU-27 and 54.7% in the USA. Particularly noteworthy, said Mr Willeke, was the high figure of 87.2% for Turkey. His final graph showed both US and EU export prices following a largely parallel course. From May to June 2023, prices for HMS 1 in the USA and 80/20 in the EU increased to US$ 369 and US$ 378 per tonne respectively.

“This is a great sign that our market for recycled steel is a world market. We can [safely] say we can support the steel industry on its way to green steel.”

Ferrous Division President Denis Reuter, of TSR Recycling GmbH & Co. KG in Germany, closed the session by announcing it was his final task before handing over the presidential reins to

Shane Mellor of Mellor Metals Ltd in the UK. “I’d like to thank my colleagues from the Ferrous Board for all their support and valuable input but also want to thank the BIR secretariat, the Director General, Past President Tom Bird and [current President] Susie Burrage.”

Comments

No comment yet.