The resumption of relations between İran and Saudi Arabia is expected to lead to a significant increase in trade, particularly in steel exports and the mining sector. For instance, last year, over 30,000 tons of steel billet valued at $14,207,000 were exported to Saudi Arabia.

Saudi Arabia boasts the Middle East's largest construction market, featuring numerous multi-billion dollar projects underway and in the planning stages by both public and private sectors. Up to 2009, it invested $80 billion in infrastructure and public construction, with a substantial planned expenditure of $385 billion from 2011 to 2015. This includes ambitious plans like constructing 600 new facilities, schools, doubling desalination capacity, and enhancing electricity generation and distribution. In response to surging demand for steel products, Saudi Arabia intends to undertake three steel production projects valued at $9.32 billion.

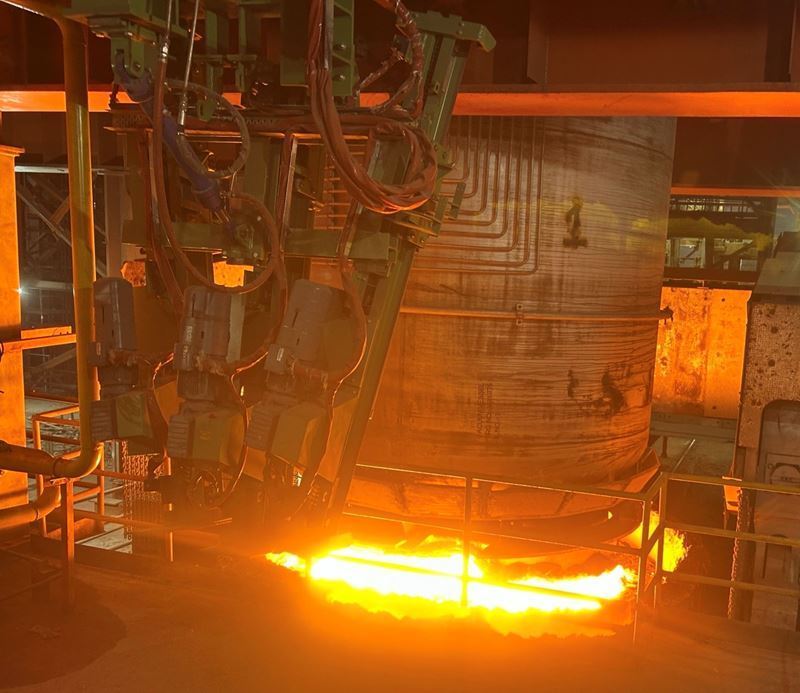

The country's robust steel industry, with reliable suppliers and a consistent stream of quality steel, is a driving force behind market growth. Increasing investments in local steel factories are expected to be a trend, leading to higher production of structural steel and overall volume growth. In Saudi Arabia's steel market, the residential sector dominates in terms of end-use, driven by rising living standards, government support, and urbanization, which has spurred investments in new residential projects. Presently, the country relies heavily on steel imports, but this is anticipated to change as domestic production grows. Major capacity expansion initiatives by manufacturers are expected to reduce the reliance on imported steel, marking a downward trend in the coming years.

Comments

No comment yet.