It is stated that while the Russian steel industry was one of the most profitable industries in the world before the Ukraine war, nowadays manufacturers have to sell at extraordinary discounts.

Russian producers' options are beginning to dwindle as sanctions cut off access to critical European markets and customers, and customers in other regions are wary of doing business with Russia. It is noted that while Russian companies are looking for alternative buyers, companies willing to do business under current conditions want to do this with serious discounts.

According to Bloomberg sources, Severstal PJSC company faced discounts of up to 40 percent from some Asian importers for steel plates. It is among the information received that some customers from Turkey also want a discount in prices.

It is stated that some Russian steel products started to fail due to the increase in freight and transportation costs after the sector suffered from the strengthening of the ruble and rising coal prices.

Profit rates of up to 40 percent fell below 10 percent

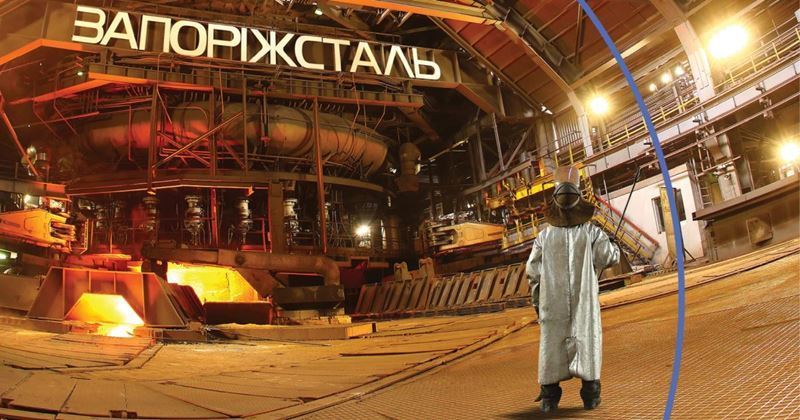

This represents a drastic change for the Russian steel industry, which is one of the world's largest steel exporters and has enjoyed very low costs for decades. It is considered that profit rates, which used to be 40 percent before, are now below 10 percent.

The downturn in the Russian steel industry is believed to be due to voluntary sanctions in the commodity markets as investors and producers are considering whether to go beyond the sanctions set by governments.

As one of the clearest examples of this, investors' avoidance of trading with palladium produced in Russia causes price differences in the European and US markets.

Among the companies affected by the sanctions imposed by Europe and the UK are giants such as Severstal, Evraz Plc and Magnitogorsk. In addition, the EU imposes sanctions on some Russian products.

The appreciation of the ruble hurts the sector's profit

However, another challenge faced by Russian producers was the rally of the ruble, which led to a decline in revenue from abroad. Ruble has reached its highest level since 2018 in the last period, as increased exports despite wide-ranging sanctions and capital controls reduced the demand for FX.

Although the latest rate hike this week has stopped the ruble's rise, the country's currency is still too high for steel exporters to profit on some products. Experts note that 16 thousand rubles ($ 239) per ton is lost in sales to China.

Alexey Sentyurin, Chairman of the Board of the Russian Steel Association, emphasized that some producers have reduced production.

Comments

No comment yet.