The Russian scrap metal market in 2024 faced significant headwinds, becoming one of the most challenging years in recent history. Demand from metallurgists sharply declined, with total deliveries struggling to reach 17 million tons. This marked a significant drop in consumption and highlighted the broader issues affecting the steel industry.

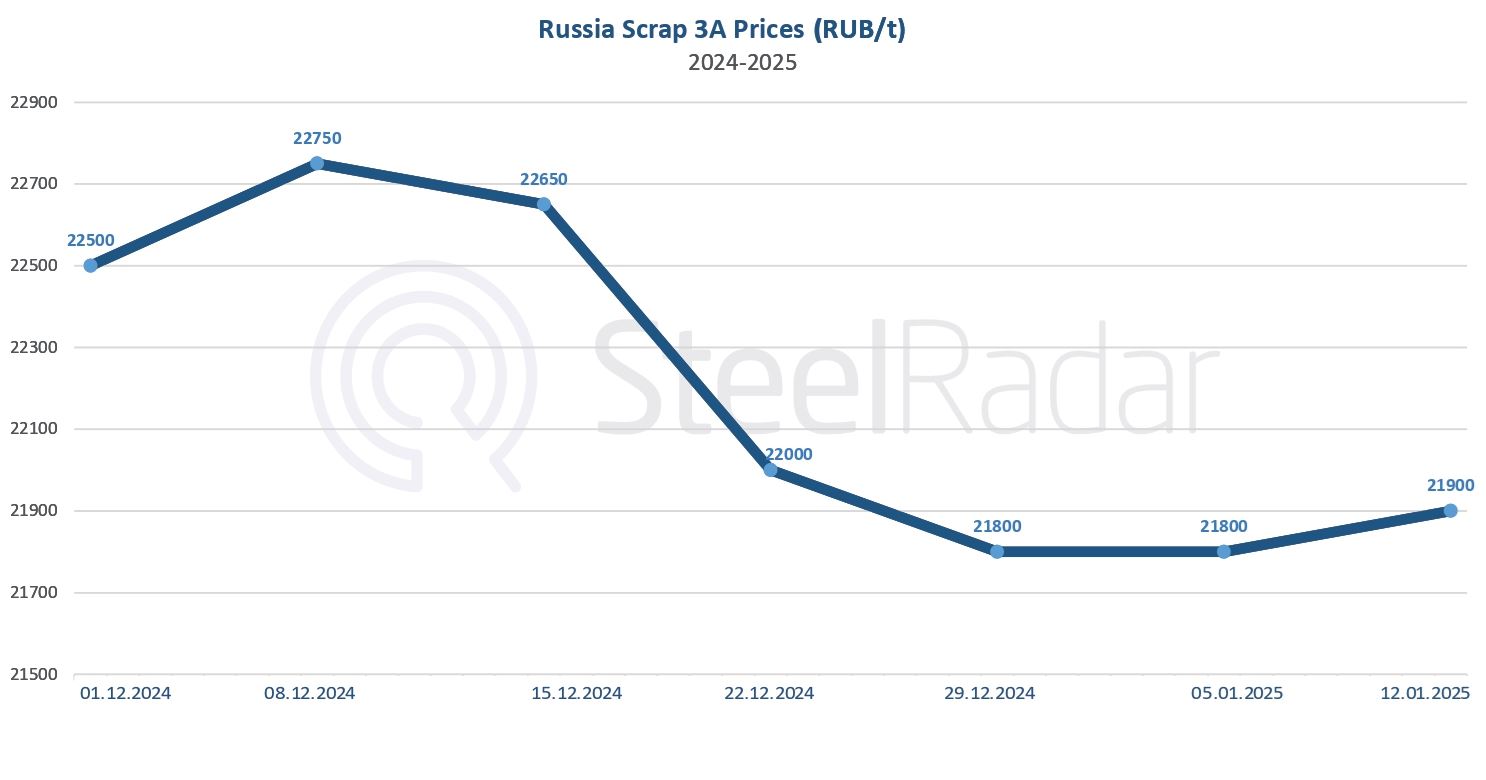

December 2024 witnessed notable price volatility, culminating in multiple price reductions. By the month's end, prices had dropped by 1500-1700 rubles. This decline reflects the oversupply in the market and the struggle to balance production costs with diminished demand.

The market's logistical landscape further complicated recovery efforts. Railway tariffs increased, and shipments experienced delays, adding to the industry's woes. This situation has pushed suppliers to shift toward truck deliveries, despite the associated rising costs. This trend underscores the growing need for adaptable logistics solutions in the face of market volatility.

As the market enters January 2025, the challenges of oversupply and logistical inefficiencies persist. Further price reductions are anticipated, dampening market sentiment. However, cautious optimism exists for a potential recovery by February, though this depends on a confluence of factors, including economic stability and improvements in transportation networks.

Comments

No comment yet.