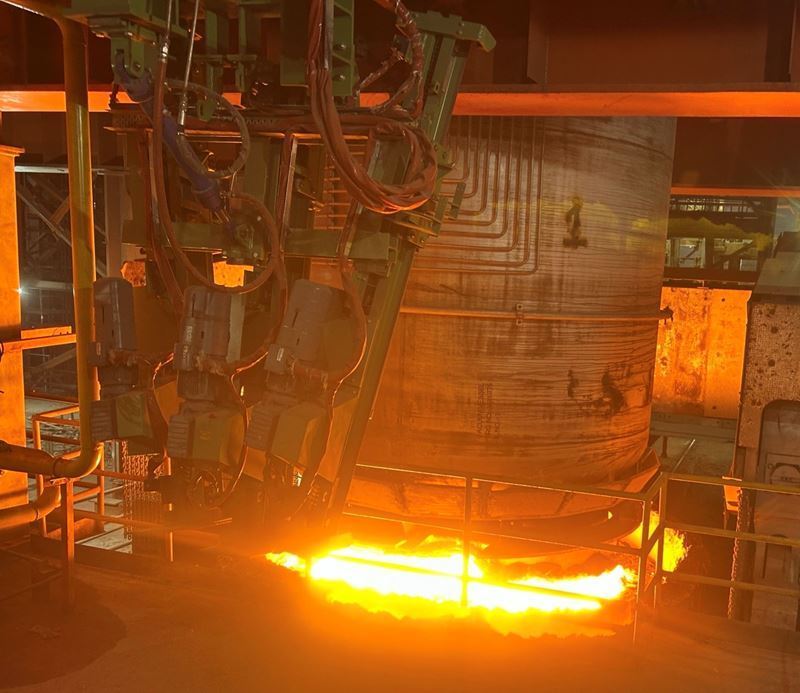

In a recent revelation, an international media outlet has brought to light the clandestine sale of Iranian slab through the intermediary of Oman. The report has sparked concerns and raised questions about the methods employed to circumvent existing sanctions.

The investigation delves into the intricate web of transactions that facilitate the transfer of Iranian slab via Oman, shedding light on a previously undisclosed aspect of international trade dynamics. As tensions surrounding Iran and its economic activities persist, this discovery adds a new layer to the ongoing debate on the effectiveness of imposed sanctions.

In the first ten months of 2023, Oman has witnessed a significant uptick in the export of slabs, totaling 1,530,000 tons. This notable increase has sparked curiosity and raised questions about the dynamics of international trade, considering Oman's role as a non-slab producing nation.

Export Trends:

Comparing the export volumes of slabs, the data reveals a clear escalation in 2023 compared to previous years. In the same period of 2022, Oman exported 1,330,000 tons, while in 2021, the figure stood at 700,000 tons. This trend emphasizes the growing role of Oman as a key player in the international slab trade.

Primary Buyers:

China, Indonesia, and Thailand have emerged as the primary buyers of Omani slabs. According to customs data, China leads the pack with 609,081 tons since the beginning of 2023. Following closely, Indonesia has purchased 410,400 tons, while Thailand secured 325,007 tons during the same period.

Implications and Questions:

The increased flow of slab exports through Oman raises questions about the effectiveness of international trade oversight and the potential implications for sanctions. As Oman acts as an intermediary for Iranian slabs, there may be increased scrutiny and discussions about ensuring the transparency and legality of such transactions.

Comments

No comment yet.