Australian mining company Mineral Resources (MinRes) delivered a strong performance in the October-December period, increasing iron ore shipments. Despite Cyclone Sean disrupting operations in December, the company said it maintained its shipment target for the financial year to 30 June 2025.

MinRes shipped a total of 5.2 million wet metric tons (wmt) from its three iron ore mines in Western Australia in the quarter, up 8% on the same period last year. The company expects to achieve its annual shipment target of 21.5-24.7 million wmt with the acceleration it has achieved.

With the addition of a new transhipper to the fleet in February, MinRes plans to increase its capacity to transport iron ore directly to major export centres. This strategic move will improve the company's logistics efficiency and support its competitiveness in the global market.

On the other hand, according to Simon Nicholas, IEEFA's Chief Analyst for the global steel industry and an expert on Asian seaborne coal markets, China's steel demand has passed its peak and has entered a downtrend. This is leading China to reduce its iron ore imports. At the same time, the country will recycle more scrap steel, further reducing iron ore demand.

This could have a direct impact on Australia, where iron ore is the largest export item. Prices are falling as new mining capacities come on stream, reducing royalty and tax revenues for the Australian government. In addition, when the Simandou mine in Guinea starts production, the country will become the world's third largest iron ore exporter, increasing pressure on Australia's market share.

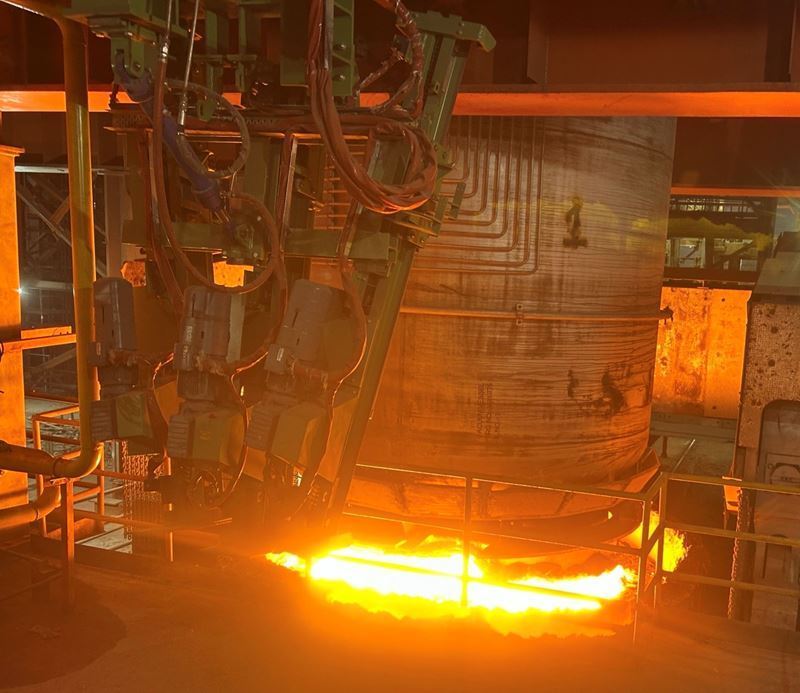

To counter these challenges, Nicholas believes Australia should direct its iron ore directly into the production of low-carbon iron and steel. To do this, it will need to assess its high-grade iron ore reserves and find solutions on how to utilise low-grade ore in low-carbon production processes.

Comments

No comment yet.