Opening ports could bring Ukraine up to US$600 million in foreign currency earnings each month, not just from grain exports but also from steel exports.

100,000 bracelets made from the final batch of steel produced by Azovstal, a steel manufacturer in Mariupol, were delivered from Ukraine to customers in 44 different countries by the end of 2022.

However, Azovstal's exports had a much wider geographic reach before the full-scale Russian invasion; 90 nations received its products.

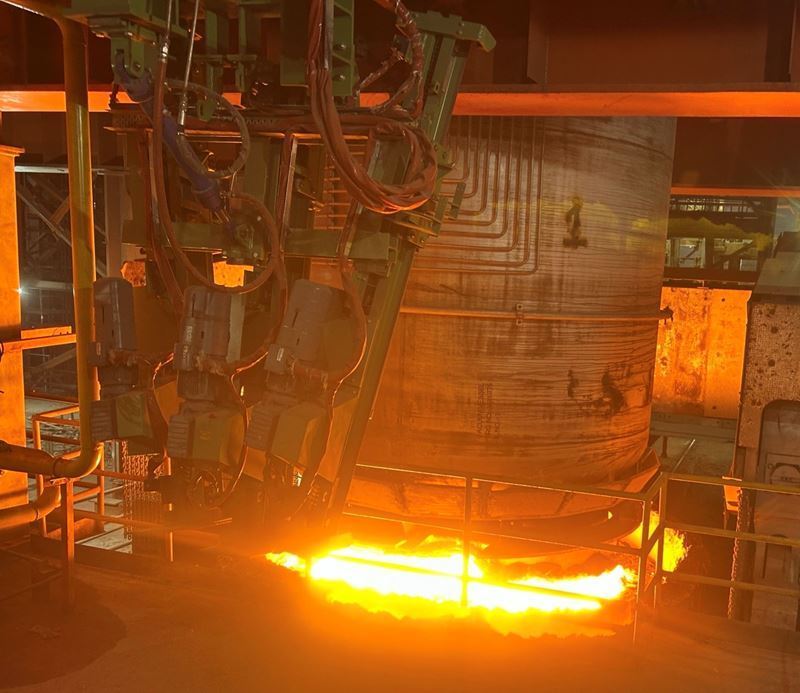

Both of Metinvest Group's Mariupol businesses, Azovstal and Ilyich Steel, which together accounted for about 40% of Ukrainian steel production, have been destroyed and have left the city's economy as a result of the Russian occupation.

The loss of control over these important businesses is not the only reason for the output decline; on Ukrainian-controlled territory, the plants are also only operating at about one-third of their full capacity. Particularly, in December 2022, production at the Kamet Steel and Zaporizhstal mills was 25% and 33%, respectively, of its pre-war levels.

In order to maintain capacity and jobs, businesses in the sector are currently operating at the very edge of profitability.

Sales issues brought on by halted seaborne exports are one of the main causes of this decrease in production. 80% of the steel produced in Ukraine was being exported before the full-scale conflict. Approximately 70% of Ukraine's steel exports used to be made through seaports, but since a full-fledged war broke out, all but a few exporters from the agricultural sector are still unable to access them.

Steelmakers are utilizing the capacity of railroads and river ports while looking for alternative means of exporting their goods. However, the cost of logistics has increased by four to six times as a result of a sharp rise in railroad tariffs and extra charges for shipping goods to EU ports.

As a result, Ukraine's revenue from the export of ferrous metals fell to $4.533 billion in 2022, a 67.5% decrease from 2021. But even this outcome represents a significant accomplishment in the circumstances at hand. It is important to note that one of the most important economic sectors is the mining and metals sector.

Comments

No comment yet.