During the China Development Forum on Sunday, Li Qiang acknowledged the challenges facing the economy but emphasized the potential for further policy support. He noted that measures taken to mitigate risks in sectors such as real estate and local government debt had yielded positive results.

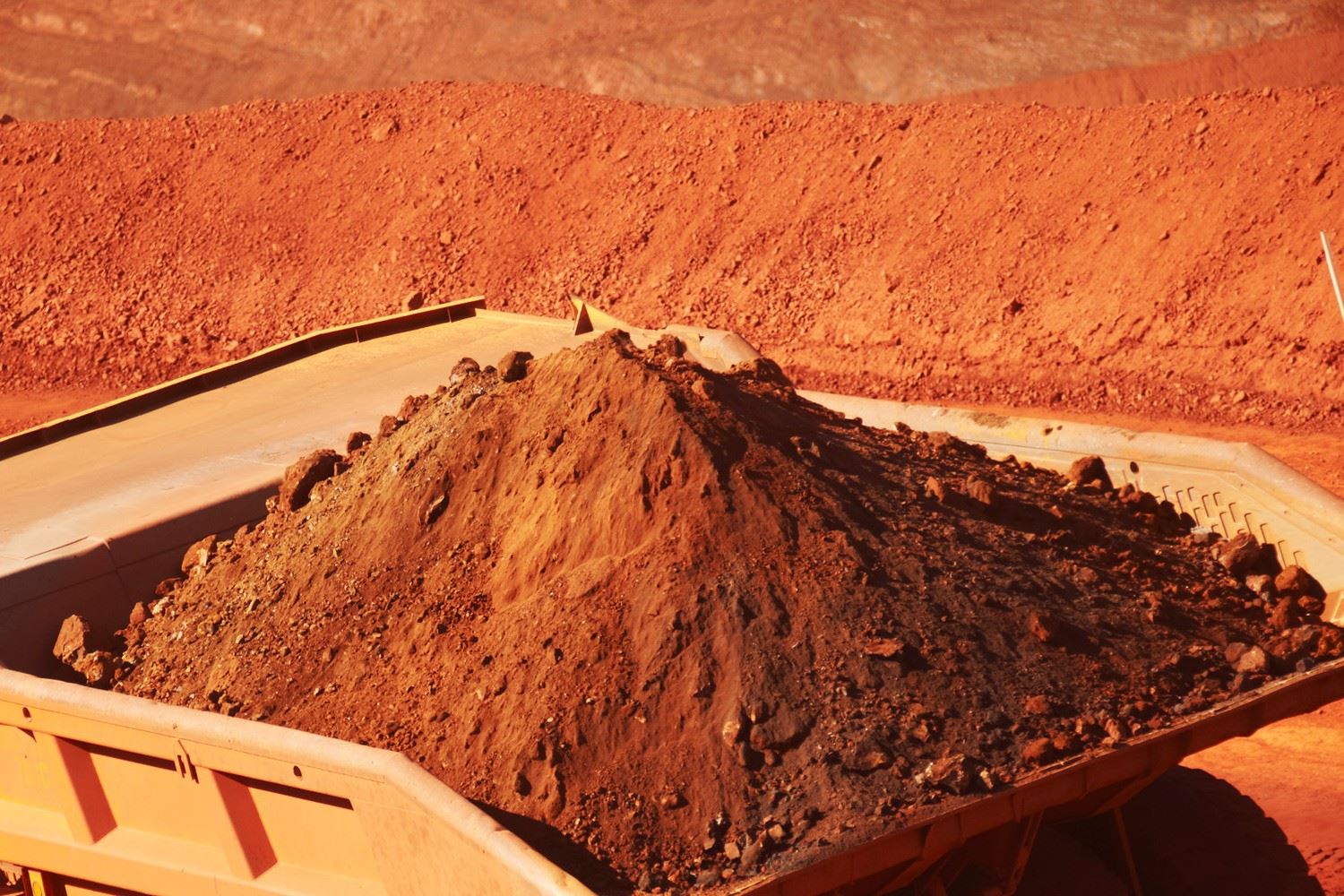

Iron ore prices had fallen below $100 per ton last week, reaching their lowest level since May. This decline was attributed to the real estate crisis in China and a slowdown in steel consumption.

However, increasing optimism about China's economic recovery in recent weeks has led to a rise in iron ore prices. Prices surged by more than 8% last week, reaching $108 per ton.

Despite this recent increase, iron ore remains one of the worst-performing commodities this year, with losses exceeding 20%. Iron ore inventories at Chinese ports continue to rise.

The recent uptick in iron ore prices is driven by growing optimism about China's economic recovery. If this optimism persists, iron ore prices are likely to continue rising in the coming months.

Comments

No comment yet.