Once a key pillar of Ukraine’s economy, the steel sector has suffered immense setbacks due to the war. Production has plummeted, exports have declined sharply, and critical infrastructure has been damaged, leaving the industry in a state of turmoil.

Decline in Production

The conflict has led to a dramatic reduction in Ukraine’s steel production. In 2022, output fell by an astonishing 70.7%, reaching only 6.3 million tons. The downward trend persisted into 2023, with production totaling 6 million tons. A modest recovery was observed in early 2025, as January steel production increased by 12% compared to December, reaching 611,000 tonnes. However, the recent suspension of operations at the Pokrovsk coal mine, Ukraine’s sole supplier of coking coal, poses a significant threat to the industry’s future. If this situation persists, steel production could plummet to as low as 2-3 million metric tons in 2025, far below the initially projected 7.5 million tons for 2024. These developments highlight the ongoing struggle of Ukraine’s steel industry amid geopolitical instability.

Shrinking Export Markets

Ukraine’s steel exports have also suffered significantly due to the war. In 2023, exports declined by 31.7%, amounting to just 2.98 million tonnes. Forecasts for 2025 suggest a further drop of 16%, reducing exports to 3.9 million tonnes. This export decline has exacerbated Ukraine’s trade deficit, which surged to a record $27.3 billion in 2023, more than doubling from $11.3 billion in 2022.

External factors have further strained the sector. The United States has imposed tariffs of at least 25% on all imported steel and aluminum, dealing another blow to Ukraine’s export potential. Meanwhile, European Union sanctions on Russian and Belarusian steel, combined with Ukraine’s reduced steelmaking capacity, have destabilized the European market, further complicating Ukraine’s ability to engage in global trade.

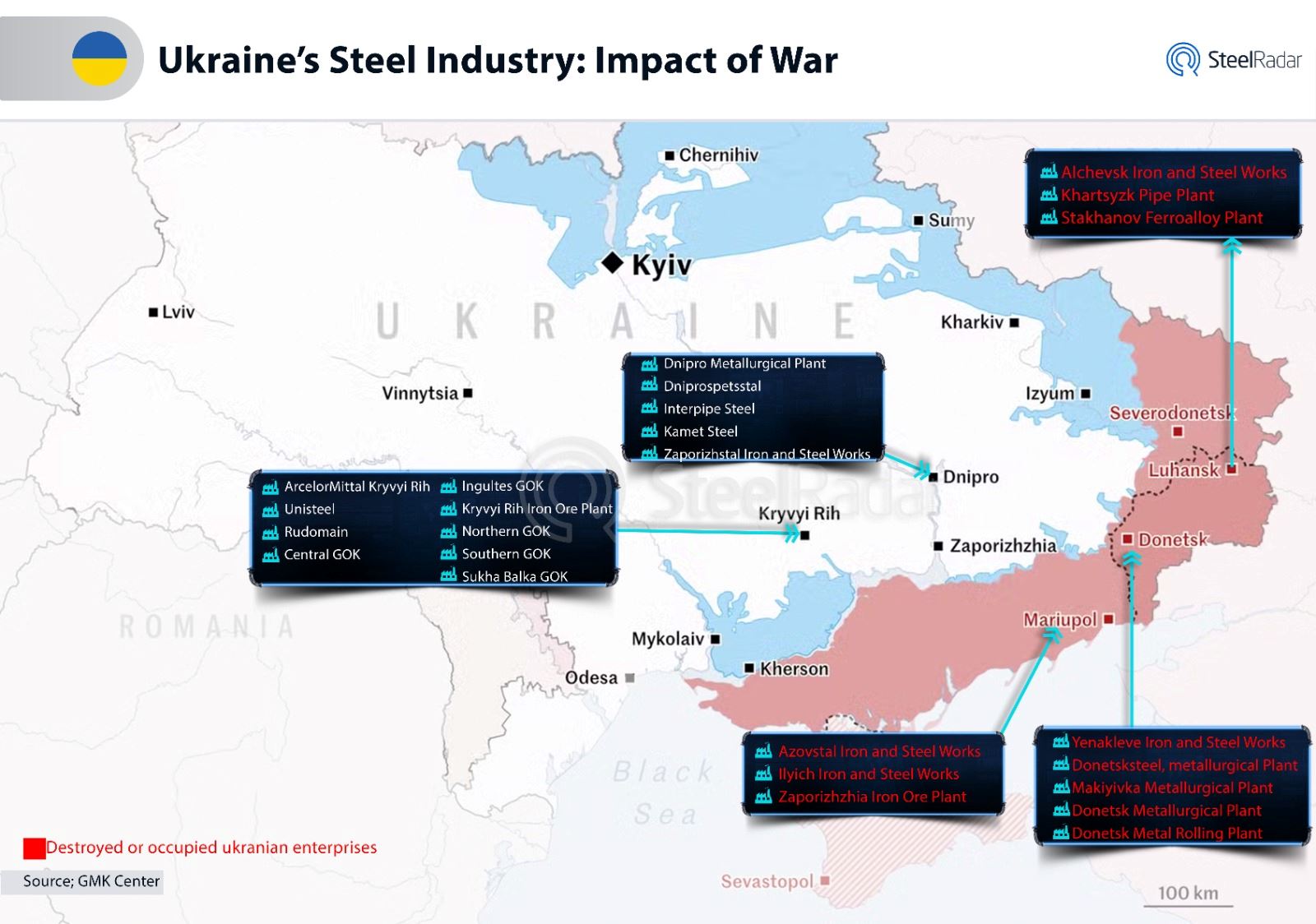

Damage to Key Facilities

The destruction and suspension of operations at major steel plants have had a profound impact on Ukraine’s industrial base. The Azovstal Iron and Steel Works and Illich Steel and Iron Works in Mariupol were heavily damaged during the Russian invasion in 2022, forcing their complete shutdown. Zaporizhstal Iron and Steel Works in Zaporizhzhia faced temporary closures due to labor shortages, power outages, and security threats, though it has since resumed limited operations. ArcelorMittal Kryvyi Rih, one of Ukraine’s largest steel plants, initially halted production due to the war but is now operating at 30% of its steelmaking capacity and 70-75% of its mining capacity. However, the closure of the Pokrovsk Coal Mine in early 2025 has created a severe raw material shortage, further hindering steel production and exports.

Russia’s Steel Industry Under Economic Pressure

While Ukraine’s steel sector has suffered due to direct war-related destruction, Russia’s industry has been severely impacted by economic sanctions, export restrictions, and shifting trade dynamics.

The Impact of Economic Sanctions

The European Union has imposed sweeping sanctions targeting Russia’s steel sector, including bans on importing finished steel products such as hot and cold rolled sheets, long products, and specific types of pipes. Additionally, the EU now prohibits the import of iron and steel products that contain Russian-origin inputs, even if processed in third countries.

Beyond trade restrictions, sanctions have extended to Russia’s financial, military, and energy sectors, limiting access to U.S. technology and the dollar-based financial system. These measures are designed to weaken Russia’s economic foundation and restrict its ability to sustain its military operations. Major Russian steel producers, such as Severstal, have been directly impacted, with the company’s majority shareholder, Alexey Mordashov, facing EU sanctions that have effectively halted steel shipments to Europe.

Export Challenges and Market Shifts

Russia’s steel industry continues to grapple with significant export challenges in 2025. Traditional markets are becoming increasingly inaccessible due to international sanctions and protective measures implemented by importing countries. Türkiye, for example, has imposed anti-dumping duties on steel imports from Russia, China, India, and Japan, with tariffs ranging from 6.1% to 43.31%. This measure affects approximately 4 million tons of steel, valued between $2 billion and $2.2 billion, as Türkiye seeks to shield its domestic steel industry from foreign competition.

The EU has further expanded its list of restricted goods to include additional minerals, chemicals, and steel products, further limiting Russia’s access to the European market. As a result, Russian steel exporters have been forced to redirect their focus towards Asia, the Middle East, and Africa. However, these alternative markets present new challenges, as lower price points and higher logistics costs have led to a staggering sevenfold decrease in export income, dropping from $7.1 billion to just $1 billion.

Global Consequences: Supply Chain Disruptions and Rising Prices

The war’s impact extends beyond Russia and Ukraine, severely disrupting global iron and steel supply chains, causing shortages, and driving up prices worldwide.

Strained Supply Chains

Ukrainian steel plants, once key suppliers to European and American markets, have experienced prolonged production stoppages, leading to a substantial decrease in pig iron shipments. The United States, which traditionally relied on Ukrainian pig iron, has faced significant supply shortages, while European manufacturers have struggled with extended delivery times and increased transportation costs.

With supplies from Russia and Ukraine becoming increasingly unreliable, European nations have turned to alternative sources for steel imports. Italian coil producers, for example, have begun sourcing slabs from China, India, Indonesia, Vietnam, and Brazil to compensate for the reduced availability of Russian and Ukrainian materials. However, this shift has led to logistical complications and increased costs, further straining the global market.

A Volatile Market

The instability in supply chains has led to a surge in global steel prices, exacerbating an already tense economic environment. The war has triggered a new supply chain crisis, impacting European industries through increased prices for both energy and raw materials, extended delivery times, and growing uncertainty. Countries like Germany and Italy, heavily reliant on steel imports, have been particularly vulnerable to these disruptions.

The Russia-Ukraine war has profoundly altered the global steel industry, with Ukraine’s sector suffering from direct destruction, Russia facing severe sanctions and trade barriers, and the global market experiencing significant supply chain disruptions. As the conflict continues, the steel industry remains in a precarious position, navigating the challenges of war, economic sanctions, and shifting trade alliances. The long-term consequences of this geopolitical turmoil will shape the future of the global steel market for years to come.

Comments

No comment yet.