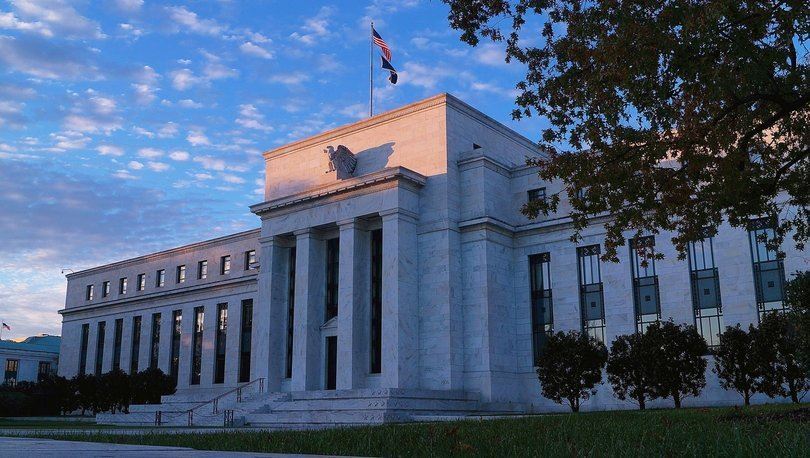

Fed officials may discuss a 100 basis point rate hike this month amid inflation rising to 9.1 percent. At the bank's meeting this month and in September, an interest rate hike of at least 75 basis points each is considered certain.

If the Fed raises interest rates by 100 basis points at its July 26-27 meeting, it will be the biggest rate hike since the early 1990s, when the bank started using the overnight rate directly in its monetary policy.

“I think they have time to change expectations,” said Michael Feroli, US Economist at JPMorgan Chase. "They have no reason to increase interest rates slowly and gradually," he said.

100 basis point estimate from Nomura

Nomura economists also announced that they expect an interest rate hike of 100 basis points at the next meeting after the inflation data. Economists “incoming data show that the inflation problem is getting worse. "We expect the Fed to raise interest rates higher for its credibility," he said.

Deutsche Bank U.S. Economist Bret Ryan said that higher-volume hike pricing makes sense, but may not do so without clear verbal communication, "but there's time if they want to deliver that message."

Citigroup US economist Andrew Hollenhorst also said a 100 basis point increase should be on the table at this month's meeting. The expert "must be cautious about the peak inflation, because it was stated that 8.3 percent would be the peak level just a few months ago." said.

Comments

No comment yet.