The UK government wants to introduce the tax in 2027, a year after the EU introduced the tax, but the industry fears this will lead to other countries diverting their polluting steel to the UK. UK Steel, the trade association for the steel industry, has written to ministers asking the Treasury to reconsider the plans.

The government's consultation on the introduction of a "Carbon Cap Adjustment Mechanism" ends in mid-June. This is a tax mechanism for imported materials such as steel or cement, designed to protect domestic manufacturers from undercutting the prices of cheaper products from countries with lower carbon costs.

Gareth Stace, Director General of British Steel, said: "If the EU introduces this mechanism in 2026, there is a risk that emissions-intensive steel for European markets will be diverted to the UK, which would cause significant damage to the UK steel industry. "

British Steel, the UK's second largest steel producer, has drawn ministers' attention to the serious consequences that the failure to coordinate scheduling mechanisms will have on its business.

The UK Treasury announced plans for the tax last December to protect British companies from a drop in imports from countries with weaker climate change regulations than the UK. Under the plan, imports of iron, steel, ceramics, cement and other goods are subject to tariffs. However, the proposed non-alignment of implementation with the EU immediately raised concerns and industry warned of the risk of trade diversion.

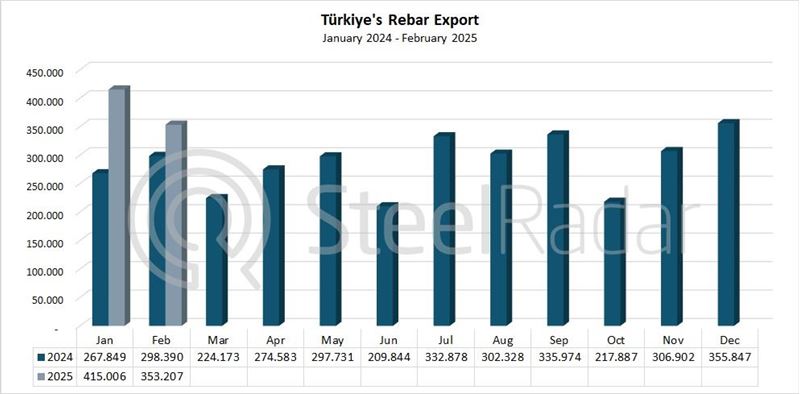

The vast majority of steel imported into the European Union comes from countries such as China, Türkiye and India, which currently do not face a significant carbon price. "We've already seen steel imports from China increase in just 12 months," Stace said. "Global steel overcapacity is huge, so even a relatively small charge from the EU on the carbon cap mechanism could divert polluting steel from the European market to other open markets such as the UK," he added.

Comments

No comment yet.