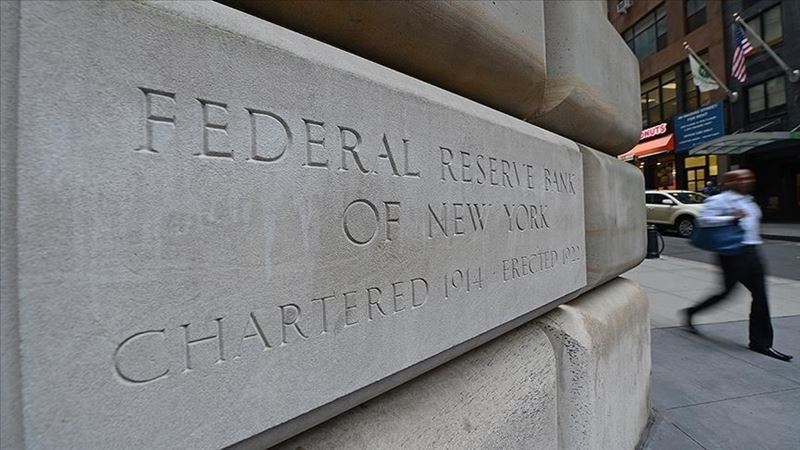

While the stock and sectoral effects of the balance sheet calendar intensified in the US last week, global markets focused on the interest rate decisions of the US and Japanese central banks. While investors will focus on the financial results of companies such as Microsoft and Meta Platforms next week, the Fed's interest rate decision and data agenda are expected to determine the direction of the markets.

While it is almost certain that the Fed will leave the policy rate unchanged next week, clues from the policy statement and Fed Chairman Jerome Powell's statements are expected to affect asset prices. US 10-year bond yield closed the week at 4.20 percent, while the dollar index remained flat at 104.3 percent.

Asian equity markets were under selling pressure last week amid concerns that Donald Trump's re-election could reignite trade wars. Bank of Japan is expected to raise interest rates by 10 basis points. In Japan, manufacturing PMI declined to 49.2, while service sector PMI and composite PMI rose to 53.9 and 52.6, respectively. Producer Price Index (PPI) for the service sector also exceeded expectations, while Consumer Price Index (CPI) increased by 2.2% yoy in July.

Dollar/yen parity fell by 2.3% on a weekly basis to 153.8. In China, the Bank of China's 10 basis points cut in 1 and 5-year borrowing rates caused the Nikkei 225 index in Japan, Hang Seng index in Hong Kong, Kospi index in South Korea and Shanghai Composite index in China to fall by 5.98%.

European stock markets saw mixed results last week but investors focused on the Bank of England's monetary policy decisions. While the Bank is expected to keep the policy rate unchanged next week, Governor Andrew Bailey's statements will give clues for future monetary policy.

Economic activity in the region slowed, reducing risk appetite. The manufacturing industry Purchasing Managers' Index (PMI) in Germany, the Eurozone and the UK exceeded expectations, the FTSE 100 index in the UK rose 1.59 percent and the DAX index in Germany rose 1.35 percent.

Comments

No comment yet.