Authorities are planning to establish a compensation mechanism to shut down old and inefficient production capacities, while developing new policies to adapt to global trade dynamics. It was emphasized that China has taken important steps to modernize the steel industry and reduce unnecessary capacity. It was reported that industry officials announced the creation of a fund to encourage the closure of old and low-efficiency steel production facilities. This initiative is designed to curb overproduction and make the industry run more efficiently. However, details on how the fund will be financed and which plants will be prioritized for closure have not yet been finalized. While there is talk of production cuts of up to 50 million tons, China's annual steel production is still above 1 billion tons, indicating that more efforts are needed to eliminate the oversupply.

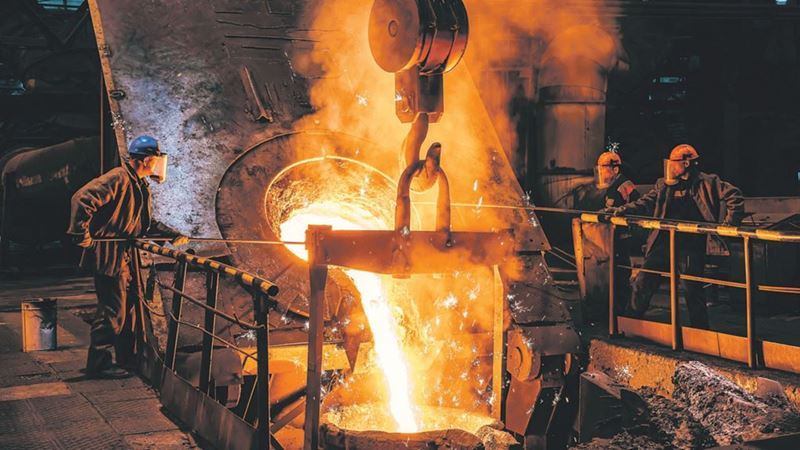

New era in China's trade policies, steel demand and price expectations

Chinese government has made new initiatives to adapt to global trade dynamics. Recent statements emphasized the need to seize opportunities in foreign trade, increase international cooperation and strengthen the integration of domestic and foreign trade. It was reported that the authorities continue to take steps in line with the country's goals of diversifying trade channels and achieving sustainable growth in exports. Experts forecast a 3% decrease in crude steel consumption. While steel exports are expected to decline by 10 million tons due to international trade tensions, the total loss of domestic and foreign demand could reach 40 million tons.

While macroeconomic policies and inventory management are expected to stabilize steel prices, it was emphasized that the future shape of the market will largely depend on the voluntary implementation of production cuts.

Movement in iron ore and construction steel markets

A recent surge in iron ore trade at China's major ports was reported. The daily trading volume increased by 4.5% compared to the previous days and reached 1,103 million tons. Similarly, construction steel sales also recorded a significant rise. Sales by 237 large trading companies increased by 34.6% to 129,500 tons. It was assessed that these developments indicate that the market is in the process of recovery and that the activity in the sector continues.

Comments

No comment yet.