Turkish steel producers made a good start to 2024. There were significant increases on both the production and export sides. However, the growth in China's exports and the still weak outlook in Europe, one of our important export markets, raise cautious voices for the rest of the year.

At the conference held by the International Rebar Producers and Exporters Association (IREPAS) in Berlin last week, statements that Turkish rebar and scrap markets may face a 'downward outlook' attracted attention.

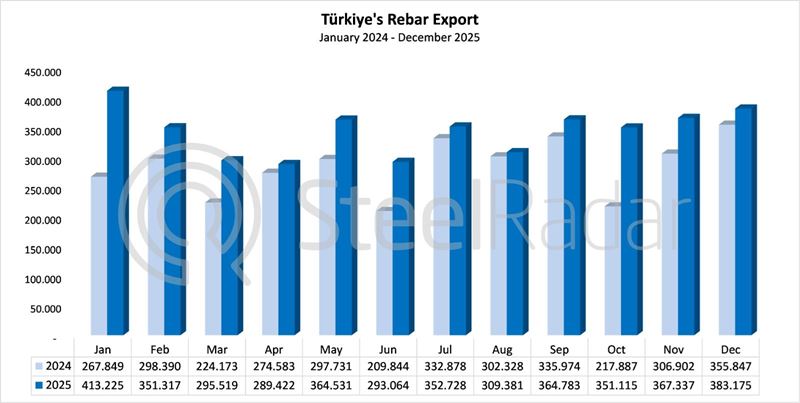

According to the data of the Turkish Steel Producers Association, Türkiye's steel production in the first quarter of the year increased by 28.4 percent and reached 9.5 million tons. According to TUIK data, Türkiye's rebar exports increased by 8.9 percent in the first quarter of the year, reaching just over 793 thousand tons.

China's exports may exceed 90 million tons

One of the main concerns of conference participants was the possibility of increased steel exports from China in 2024. China-based companies exported 25.8 million tons of steel in the first quarter, an increase of 28.47 percent compared to the same period of 2023. China's export of 90.26 million tons in 2023 caused Turkish companies to have difficulties in the export markets, and Türkiye's rebar exports decreased from 5.7 million tons in 2022 to 3.60 million tons.

While speeches at the conference showed that Chinese steel exports are expected to exceed 90 million tons once again in 2024, concerns were expressed that this could once again suppress global demand for Turkish finished steel.

Difficult to compete with China's low prices

FD Baysal, chairman of the traders committee from Seba International, said that the amount of Chinese exports is expected to continue to grow this year and said, "No one can compete with China on price."

Regarding China, Baysal said that the low steel demand created by canceled infrastructure projects led to an increase in the country's exports, and that China dominated the global market with its low prices and high steel quality. While China's steel export volume increased, the value of steel exports decreased by 20 percent annually.

There are significant opportunities in Africa and Yemen

Stating that Türkiye's export markets are limited due to the protection measures of the USA, quota restrictions of the EU and geopolitical tensions in the Middle East, Baysal stated that there are still some export opportunities for the country such as Syria, Iraq, Eastern Europe, Africa and Yemen.

Scrap flow from Europe to Turkey will decrease

Stena Metal's Jens Björkman, chairman of the raw material suppliers committee, states that scrap production in the EU has fallen due to slow economic conditions and says: “In the next 10 years, the scrap flow will change significantly and we will see more regionalization and less transportation to long distances. It is expected that European scrap exports to Türkiye, which has a significant scrap demand, will decrease with the introduction of the carbon border regulation mechanism.

Things are getting better in the Gulf and Egypt

IREPAS Committee Chairman Murat Cebecioğlu says that market conditions are more optimistic in the Gulf Cooperation Council, Saudi Arabia and Kuwait due to new major infrastructure projects that are expected to direct manufacturers to the domestic market. Market conditions are also improving in Egypt with the expectation of a decrease in inflation. Cebecioğlu also said, "I am afraid that China's exports will reach 2015 levels this year." He also expects European protection measures to continue for another two years.

Ekonomim

Comments

No comment yet.