Iranian steel market has recently faced many challenges stemming from changes in customs policies, exchange rate fluctuations, energy supply constraints, and supply and demand dynamics in both domestic and export markets.

Impact of Customs Regulations on Steel Exports

One of the most important developments in Iran was the customs directive banning the export of steel and petroleum products by border traders and their cooperative companies, aimed at controlling the outflow of undeclared goods and managing foreign exchange. This has had a number of consequences. These are;

Reduction in the volume of exports; although most exports were made by large factories and organizations with external links, the elimination of border traders and border residents temporarily reduced the volume of exports.

Increased pressure on domestic producers; The cessation of exports by these groups puts additional pressure on domestic producers, as it takes time and new mechanisms to channel these exports through official channels.

Impact on exchange rates; Reduced exports means less foreign exchange entering the market, which could lead to more volatility in exchange rates in the short term.

The upward trend in exchange rates in recent months has made exports more attractive for steel producers. Many producers have taken advantage of free market exchange rates to intensify competition in export markets. One of the biggest challenges faced in steel exports has been the repatriation of foreign exchange earnings, which are usually realized through foreign exchange networks and pose various financial risks. Since Iranian steel exports are based on free market exchange rates, they may be offered at lower prices than similar products in target markets, making competition more difficult for other exporters.

Supply and Demand Conditions in the Domestic Market

Exports played an important role in sustaining steel production as domestic demand declined. However, the sector was also significantly affected by energy supply constraints. The most important factors affecting this were;

Gas supply restrictions for the steel sector led to reduced production and availability of sponge iron, increasing raw material costs and putting additional pressure on the supply chain.

Stagnation in the steel sheet market

Last week, the supply of steel sheet on the commodity exchange attracted less interest than expected, indicating that domestic demand is declining and the market recession may continue.

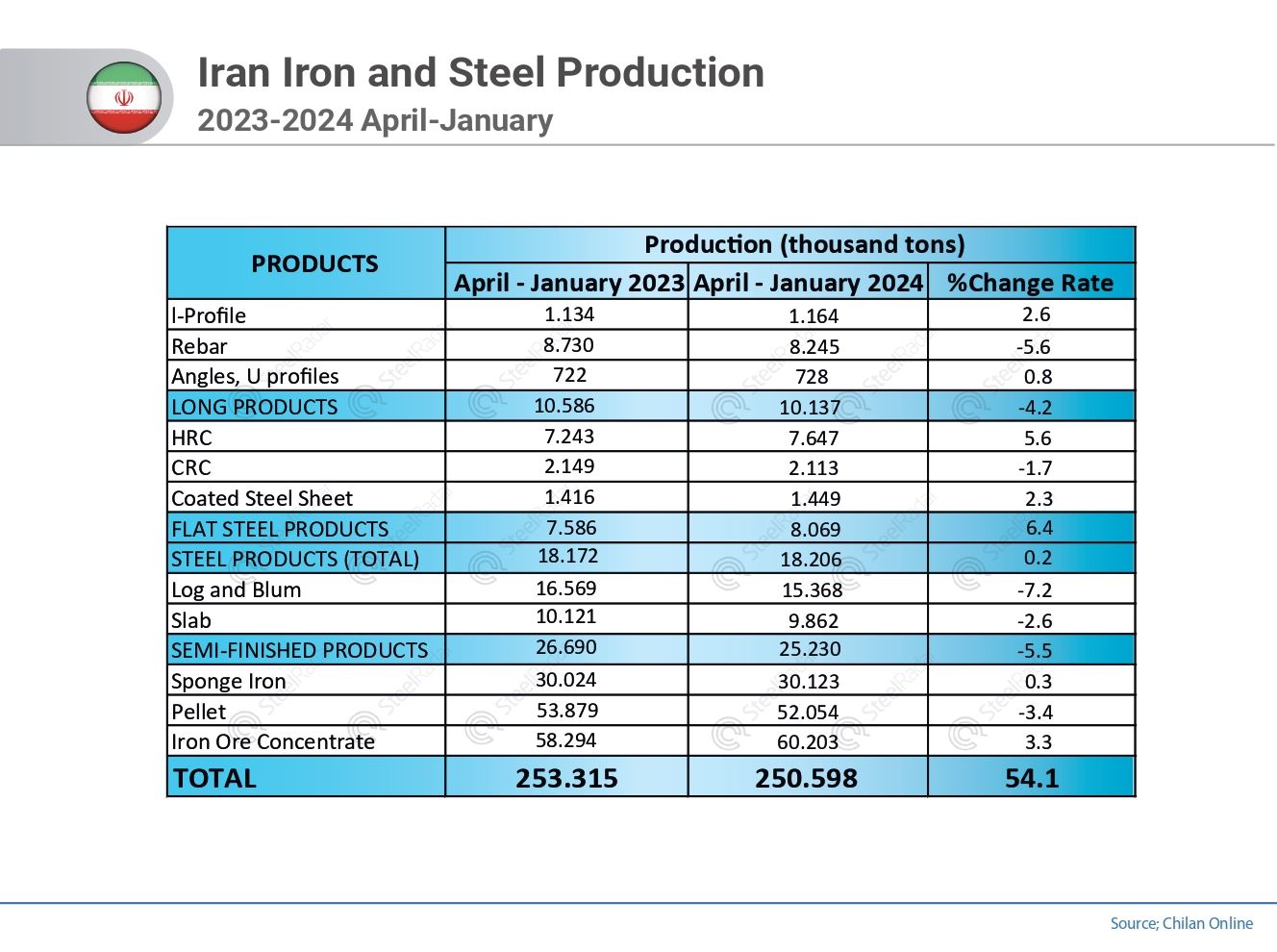

The decline in crude steel production intensified due to electricity and gas restrictions. Iran's crude steel production fell by 4.8% in the first nine months of this year, but rose to 5.5% in the ten-month period as energy restrictions intensified.

Production loss of 1.5 million tons

Electricity and gas outages led to a drop in crude steel production of around 1.5 million tons, valued at over $650 million. 90% of this decline occurred in billet and bloom production, indicating a more significant impact on small and medium-sized private sector units.

Growth in sponge iron production was nullified

Sponge iron production increased by 11.2% in the first eight months of the year, but tighter gas restrictions in the last two months have almost wiped out this growth.

Contrasting trends in iron ore processing

Over 60 million tons of concentrate were produced in the past ten months (up 3.3% y-o-y), while pellet production decreased by 3.4% over the same period.

Gradual improvement in long product production

The pace of decline in long product output slowed in the ten-month period, partly due to renewed export incentives stemming from revised FX repatriation arrangements.

Steel market outlook for the year ahead

One of the main challenges facing the steel industry in the coming year is the structural duality among producers. Large-scale producers, companies that control the entire supply chain, such as Mobarakeh Steel, have more flexibility to cope with market fluctuations due to their large operations. Small and medium-sized enterprises (SMEs), which mainly produce rebar and steel sheet, face significant bankruptcy risks if the government does not support them.

Conclusion and Recommendations

Given the current circumstances, the following measures are recommended to optimize steel market management:

•Creating sustainable mechanisms for foreign currency repatriation

•Supporting small and medium-sized enterprises to prevent financial crises

•Effective management of raw material prices and gas supply for the steel industry

•Leveraging long-term contracts to expand new export markets and reduce trade risks

•Ensuring stable energy supply to reduce production losses

Ultimately, the future of the steel market will depend on macroeconomic decisions and government policies that support producers. Adoption of appropriate policies can prevent market stagnation and lay a foundation for sustainable growth of the Iranian steel industry.

Comments

No comment yet.