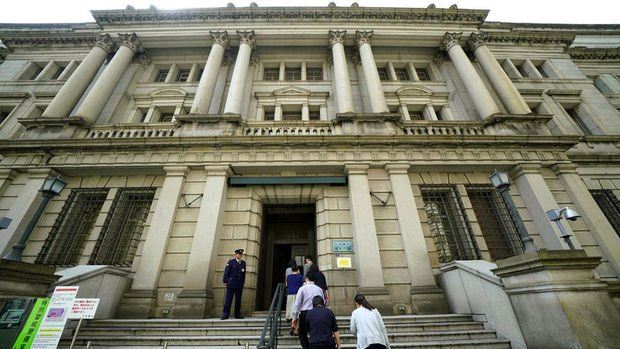

The decisions taken at the BoJ's monetary policy meeting, which started yesterday and ended today, were announced. Accordingly, the bank kept the policy rate unchanged at minus 0.1 percent. The BoJ, which passed the resolution by 8 votes to 1, announced that it will continue to purchase unlimited amounts of government bonds and 12 trillion yen annual exchange-traded funds (ETFs) and 180 billion yen annual Japanese real estate investment funds (J-REIT).

The bank also extended the deadline for loan disbursement, which is 30 June 2022, by one year, within the scope of the fundraising measure to encourage loans. We will continue to expand the monetary base until it exceeds its target and remains consistently above target.” it was said.

Emphasizing that the BOJ will continue to mainly support the financing of companies and maintain its financial stability, the text said, "For now, the bank will closely monitor the impact of the new type of coronavirus (Kovid-19) epidemic and will not hesitate to take additional expansionary measures if necessary. In addition, interest rates in the short and long term will be taken into account. rates are expected to remain at their current or lower levels." The message was retained. "The risks to the economic activity are down for now." It was stated that it is likely to recover with the reduction of the effects of the downward pressure on service consumption caused by the Kovid-19 outbreak and supply-side restrictions on service consumption.

"Although the annual rate of change in inflation has followed a volatile course due to factors such as the rise in energy prices, the dispersion of the effects of the decrease in mobile phone fees and the increase in raw material costs, it is likely to increase moderately in the positive region for now. Although the contribution of the increase in energy prices is expected to decrease in the next period, with the improvement in the output gap. In line with medium and long-term expectations, the rate of increase in the Consumer Price Index (CPI) is expected to remain around 1 percent towards the end of the projection period.In terms of economic outlook, the course of Kovid-19 and its impact on domestic and foreign economies continue to draw attention. In addition to the supply-side constraints, when the effects on commodity prices and their effects on economic activity and prices are taken into account, there are high uncertainties regarding the developments in overseas economies. "Due to the impact of Kovid-19, the risks to economic activity are on the downside for now, but it is the middle of the projection period and the risks to prices are balanced." evaluations were made.

Growth and inflation expectations The Bank kept its inflation midpoint forecast for the 2021 fiscal year, which will end in March 2022, at 0 percent, while lowering its real Gross Domestic Product (GDP) expectation for the same period from 3.4 percent to 2.8 percent. On the other hand, the bank increased its inflation expectation for the 2022 fiscal year, which will end in March 2023, from 0.9 percent to 1.1 percent, and revised its growth forecast from 2.9 percent to 3.8 percent. While the inflation is expected to be around 1.1 percent in the 2023 fiscal year, this indicates that Haruhiko Kuroda, who has been serving as the BoJ Chairman for 8 years, will not be able to meet the 2 percent inflation target in the 10-year time frame, despite the ultra-loose monetary policies.

Comments

No comment yet.