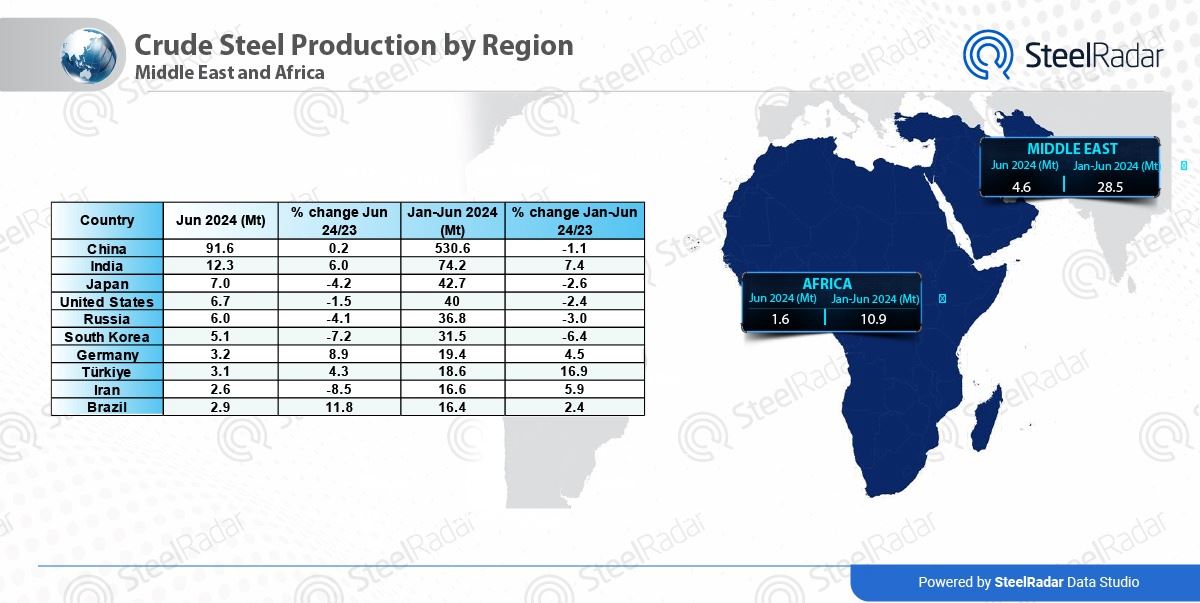

In June 2024, the African region faced challenges in its steel production sector, reporting a significant decline of 9,6% compared to the previous year. The total crude steel production amounted to 1,6 million tonnes (Mt), reflecting the impact of various economic factors on industrial output across the continent.

Economic conditions such as fluctuating raw material prices, energy shortages, and logistical constraints have contributed to the downturn in steel production in Africa. These factors have posed challenges to steelmakers in maintaining consistent output levels, impacting overall industrial growth and economic stability in the region.

Meanwhile, in the Middle East, steel production totaled 4,6 Mt during the same period, marking a decrease of 2,7% from the previous year. The decline can be attributed to regional economic conditions and market fluctuations affecting industrial activities in Middle Eastern countries.

Despite ongoing infrastructure projects and investments in the region, factors such as geopolitical tensions, regulatory changes, and shifts in global demand have influenced the Middle East's steel production landscape. These dynamics highlight the region's sensitivity to external economic factors and its efforts to navigate challenges in maintaining stable industrial output.

The World Steel Association has released its latest findings on Iran's steel production, revealing a notable fluctuation in output during June 2024. According to the report, Iran produced 2,6 million tonnes of crude steel in June, marking an 8,5% decrease compared to the same period last year. This decline is further emphasized by a significant 21,2% drop from May 2024, attributed primarily to electricity restrictions impacting industrial operations.

Despite the monthly setback, Iran's cumulative steel production for the first half of 2024 demonstrated resilience, reaching 16,6 million tonnes. This figure represents a 5,9% increase compared to the corresponding period in 2023, positioning Iran as the ninth largest global steel producer for the first half of the year. The fluctuating production trends underscore Iran's ongoing challenges in maintaining consistent industrial output.

Overall, the June 2024 data underscores the complexities faced by African and Middle Eastern steel industries amidst broader economic conditions, emphasizing the need for strategic adjustments and resilience in navigating global market dynamics.

In the first half of 2024, the global steel industry has experienced varied production trends among the top 10 steel-producing countries. According to recent data, China remains the leader with a production of 530,6 million tonnes, marking an 11% increase from the previous year. India follows with 123 million tonnes, showing a significant 7,4% rise.

Japan, however, faced a decline, producing 70 million tonnes, a 2,6% drop from the previous year. The United States also saw a decrease, with production falling by 15% to 67 million tonnes. Russia’s production slightly dipped by 3% to 26,8 million tonnes.

South Korea and Germany reported modest increases, with South Korea producing 31.5 million tonnes (up by 4,3%) and Germany at 19,4 million tonnes (up by 1,8%). Türkiye’s production rose to 18.4 million tonnes, reflecting a 5,9% increase.

Brazil and Iran rounded out the list, with Brazil producing 11,8 million tonnes, a 1,8% increase, and Iran at 16,6 million tonnes, up by 5,9%.

These figures highlight the dynamic nature of the steel industry, with some countries ramping up production while others face challenges. The overall global steel production landscape continues to evolve, influenced by economic conditions, technological advancements, and geopolitical factors.

Comments

No comment yet.