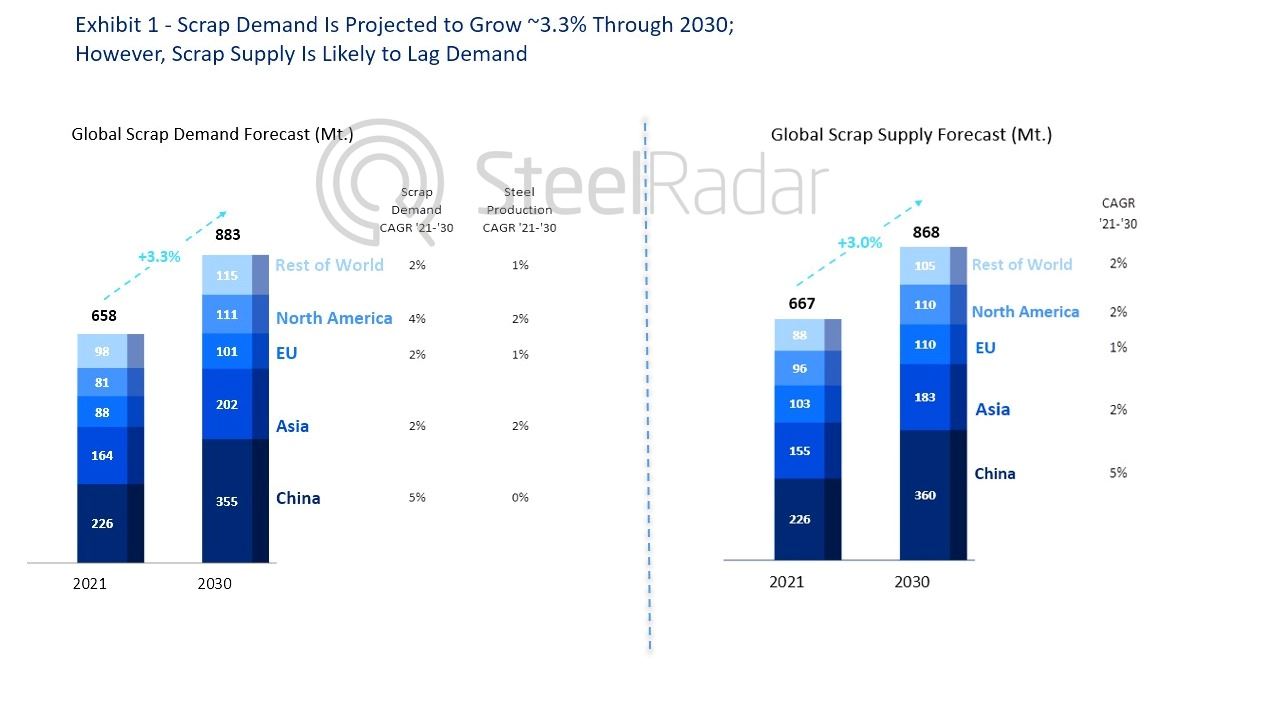

Global carbon steel scrap supply is struggling to keep up with demand growth. This crisis has been ongoing for many years and if the current trend continues, the problem will deepen. According to BCG analysis, global scrap demand will grow at a compound annual growth rate (CAGR) of around 3.3% over the next eight years, while supply will only increase at around 3% CAGR.

This increase in demand will be the result of scrap becoming increasingly favored for steelmaking, particularly as industries seek to reduce carbon emissions from their raw materials.

By volume, scrap will account for 50% of the global iron content in steel by 2030, up from 35% today. Once this point is reached, annual scrap consumption in both China and the US is likely to be 40% to 50% higher, much of which will be used to produce more steel. This increase is expected to lead to an increase in domestic scrap demand in major steel producing countries, reducing global scrap trade by 15%.

And these increases in domestic scrap demand in major steel producing countries are expected to reduce global scrap trade by around 15%.

By 2030, the current surplus of 9 million metric tons of steel scrap is projected to turn into a deficit of 15 million metric tons, underscoring the seriousness of the problem.

Such a major change in the dynamics of the steel industry is expected to have a major impact on steel producers and scrap metal suppliers.

Causes of the supply-demand gap

Rising scrap demand, driven by trends that have gained momentum over the past few years, will be triggered by the increased use of recycled steel scrap, with the transition to electric arc furnace-based (EAF) steelmaking a key factor. This transition involves a shift away from the traditional blast furnace-basic oxygen furnace (BOF) steelmaking route.

Moreover, some BOF steelmakers are also increasing the amount of steel scrap, commonly known as charge, in the final stages of their production process. Overall, existing and future EAF plants will represent an increasing share of the global steel appetite over the next decade, particularly for large, durable products such as automobiles and household appliances, and for new construction.

Although EAF mini plants have been around since the 1980s, they are becoming more attractive as they increase the production of advanced high-strength steel using less carbon-intensive raw materials. In addition to being more environmentally friendly, EAF steelmaking provides flexibility in planning and making changes to production volumes and production capacity. Globally, EAF operations, which currently account for around 29% of steelmaking capacity, are expected to exceed 41% by 2030 as new EAF plants open, particularly in Europe and China.

The availability of scrap in the short term will depend on how much metal can be recycled from end-of-life car bodies, industrial equipment, refrigerators, washing machines and other large commodities. In the medium term, the situation worsens. As global economies slowed down during the financial meltdown of the late 2000s and again during and after the COVID-19 pandemic, fewer items were produced and sold, reducing the amount of heavy scrap currently on the production line. And because it can take many years before new items are ready to be recycled, products produced today or in the near future will not be useful for EAF steelmaking for 15 to 50 years.

The availability of prime scrap will be highly affected by the imbalance of scrap supply and demand. A deficit of around 30 million metric tons is expected by 2030. The increased demand will be driven by many manufacturing and construction projects, as well as increased demand for cleaner scrap to produce high-quality, flat-rolled steel sheets.

There is also the emerging issue of recycling infrastructure in developing countries such as India and China. In these regions, scrap accumulation logistics are underdeveloped, circular supply chains are in their infancy and sorting equipment is at a high level, making scrap accumulation difficult on a large scale. In addition, the cost of transporting scrap from recycling sites to steel mills is often exorbitant, making the operation unprofitable.

The US faces a shortage of prime scrap

Approximately 17% (around 110 million metric tons) of the annual scrap supply is traded worldwide. Türkiye depends on the EU, the US, the UK and Russia for 25 million metric tons of low-grade scrap imports each year. The US is such a big supplier to Türkiye that some Turkish steelmakers have set up sourcing units in North America to secure supplies for the country. But the US is facing a shortage of premium scrap and is turning to Canada to compensate. Meanwhile, it exports to Japan, Korea, Southeast Asia and China.

Comments

No comment yet.