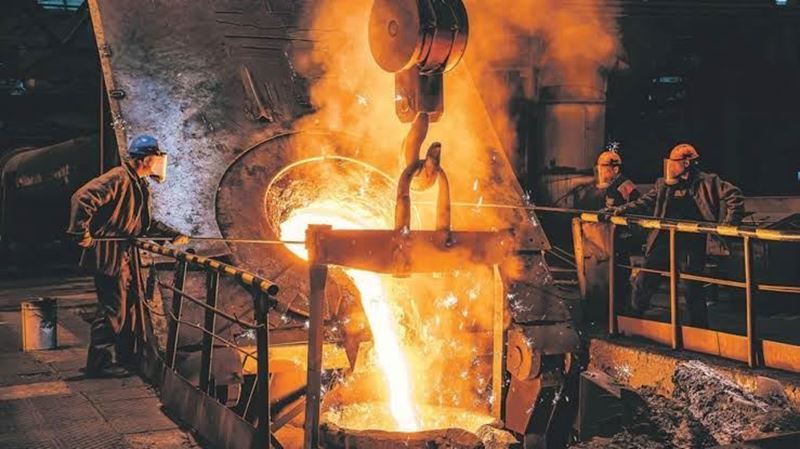

The United States and the European Union are working on a deal that would impose new tariffs targeting excess steel production from China and other countries and leave the Trump-era trade dispute behind.

According to Bloomberg, the taxes will focus primarily on imports from China that benefit from non-market practices. The scope of the measures and the level of taxes, including other countries that may be targeted, are still being discussed. It is also expected that these talks will provide a framework for other nations to join the agreement in the future.

The agreement will be part of the Global Arrangement (GSA) on Sustainable Steel and Aluminium, which the EU and the Biden administration have been negotiating since 2021. The talks aim to resolve the dispute that started when President Donald Trump imposed customs duties on metal imports from Europe, citing national security.

A mutual 25 percent tax has been applied since 2018

The US has imposed a 25% tariff on steel imports from the EU since 2018, and the EU imposes approximately the same level of duty on a range of steel imports under its own safeguards.

The two sides agreed to stop punitive measures against each other's property in 2021 and find a permanent solution to the dispute by October 31.

The agreement under discussion is likely to be an interim agreement, according to one of the sources, because it will not cover all the key issues in the overall arrangement, including taxation of carbon-intensive imports.

While the Office of the US Trade Representative declined to comment on the deal, a European Commission spokesman said both sides were committed to finding a solution before the deadline. The spokesman added that any agreement must comply with the two parties' international obligations, including World Trade Organization rules.

European Commission Vice-President for Trade Valdis Dombrovskis said in a statement on Wednesday that the commission "engages intensively with the United States, both at political and expert level, and is working on the conclusion of this global sustainable agreement." He added that a deal was "still achievable" by the deadline.

A binding agreement is unlikely to be reached this year

Negotiations on other aspects of the GSA have revealed that the two sides' positions are far apart, meaning a comprehensive, legally binding agreement is unlikely to be finalized this year.

Sources said the goal of the memorandums is to reach a forward-looking agreement between US President Joe Biden and European Commission President Ursula von der Leyen in time for the US-EU summit planned for late October.

On the other hand, despite Brussels' request to lift the restrictions, it was stated that the existing quota agreements targeting Europe's metal imports will remain in force while negotiations on broader regulation continue.

As part of the steel and aluminum agreements, the United States has proposed joint tariffs to hit steel produced with high carbon emissions and global steel overcapacity, while allowing preferential access to participants who meet the regulation's standards.

According to data from the Organization for Economic Co-operation and Development, China is by far the world's largest steel producer and accounts for more than half of global crude steel production.

Taxation of dirty steel

Sources underline that since a technical agreement on taxing dirty steel is unlikely in the near future, one option is for the two sides to reach a political agreement on the basic principles to be implemented at a later date.

One of the challenges is that the US does not yet have a methodology to price carbon emissions and a system to apply to its own companies domestically, one source said. The EU is concerned that any joint action could be deemed arbitrary and contravene international trade rules, a red line for Brussels.

The EU already has such tools in place through an internal trading system and carbon border regulation mechanism, which imposes an equivalent price on carbon-intensive goods produced outside the bloc.

The US is currently conducting a study into emissions intensity in the steel and aluminum industries, while the EU is trying to determine which third country systems could be considered equivalent to its own systems.

The two processes could lead to greater alignment between the two partners' measures under GSA in the long term, but neither implementation will be completed until the fall.

Sources said the two sides were trying to finalize a critical mining deal in time for the EU-US summit, but these talks were stalled after a series of US demands, including the legal basis of the agreements. The mines deal is needed to allow European companies to access some of the benefits provided by the subsidies under Biden's Inflation Reduction Act.

Comments

No comment yet.