Rebar prices in the UAE markets moved within a narrow range, averaging around 2,745 dirhams (747 $) per ton. This represents an 8% increase compared to the same period in 2023 when the average price was 2,538 dirhams (691 $)per ton. As the market adapts to these changes, the current exchange rate remains steady, with 1 US dollar equating to 3.67 UAE dirhams.

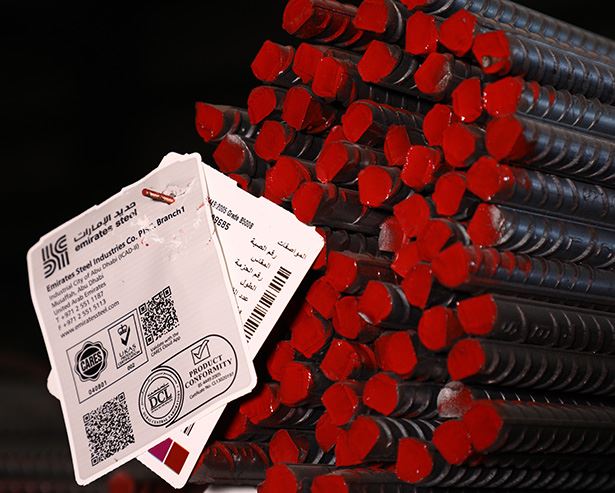

In January 2024, prices reached 2,680 dirhams per ton, followed by a range around 2,734 dirhams (744 $)per ton in February, and finally settling at 2,745 dirhams (747 $) per ton in March. Just last month, the prices for Emirates Arkan Rebar (10-40 mm) stood at 2,744 dirhams ($747) per ton CPT Abu Dhabi, and 2,752 dirhams ($749) per ton CPT Dubai, Sharjah, and the Northern Emirates. Notably, these prices did not include the 5% VAT. Market insiders have revealed that Emirates Arkan Steel has adjusted its rebar prices to 2,370 dirhams ($645) per ton CFR. This adjustment follows Emirates Steel Company's shift from a unified market price model to individualized pricing based on specific customer agreements. These fluctuations were influenced by various factors.

The high cost of shipping and logistical challenges impacted overall pricing. Opportunities for the availability of basic raw materials used in the construction and building materials industry played a role. These materials became more critical due to global geopolitical conditions, including the crisis in Ukraine.

Under the new pricing policy, regular customers benefit from additional discounts if their orders exceed a certain percentage of the monthly volume specified in their Memorandum of Understanding (MoU) with Emirates Arkan Steel. This strategy aims to foster stronger customer relationships and ensure consistent demand.

The UAE continues to invest heavily in infrastructure projects, real estate developments, and mega-events like Expo 2020. As construction activity intensifies, suppliers struggle to keep up with rising demand, leading to upward pressure on prices.

Fluctuations in global steel prices, trade policies, and supply chain disruptions also contributed to price hikes. Economic recovery in major markets, such as China and the United States, increased competition for steel resources on the international market.

Comments

No comment yet.