Egypt’s iron and steel sector faced a significant shift last year as imports experienced a sharp decline. According to data, Egypt’s steel imports plummeted by 17.8%, reaching a total value of approximately $4.2 billion in 2023. This notable decrease contrasts with the $5.1 billion recorded in 2022, reflecting the challenges within the global steel market.

Egypt’s reliance on imported iron and steel waned during 2023, with a substantial drop in overall imports. The decline underscores the country’s efforts to enhance domestic production and self-sufficiency.

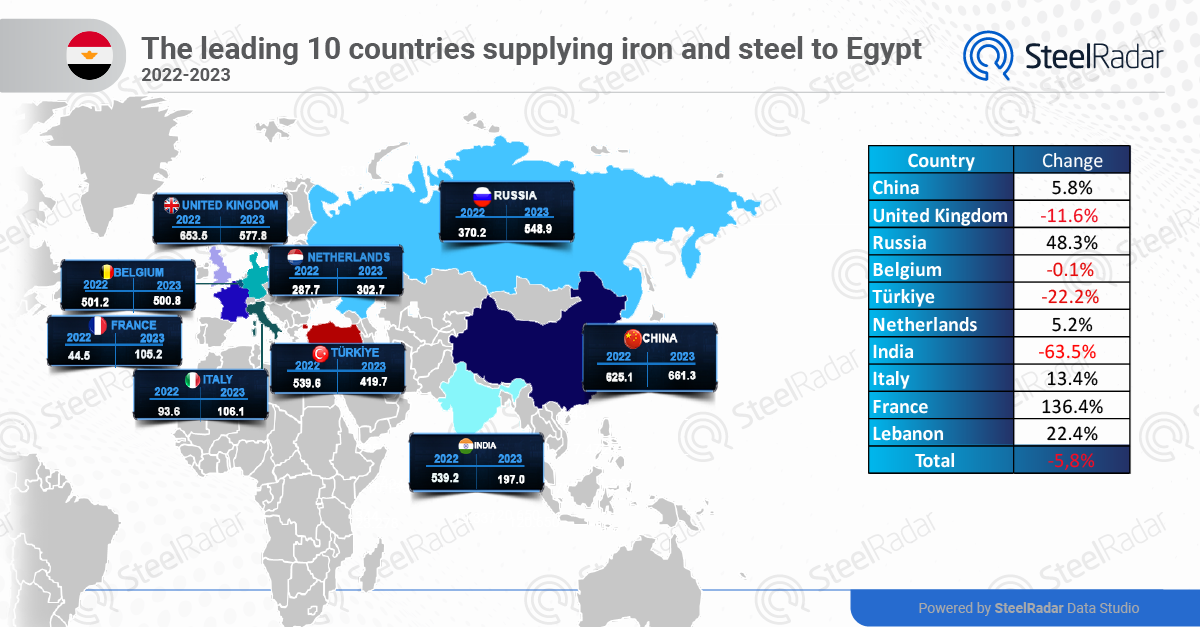

Ten countries accounted for 83.5% of Egypt’s total iron and steel imports. Among them, China remained a dominant player, with imports increasing from $625.1 million in 2022 to $661.3 million in 2023. Meanwhile, the United Kingdom, Belgium, Türkiye, and India witnessed declines in their export volumes.

Despite global market fluctuations, China’s steel exports to Egypt continued to grow, reinforcing their strong trade ties.

Imports from the UK decreased from $653.5 million in 2022 to $577.8 million in 2023.

Belgian steel exports remained relatively stable, hovering around $500 million.

Türkiye experienced a significant decline, with exports dropping from $539.6 million to $419.7 million.

India’s steel exports to Egypt saw a drastic reduction, plummeting from $539.2 million to a mere $197.0 million.

While some countries faced setbacks, others seized opportunities. Notably, Russia, the Netherlands, Italy, France, and Lebanon increased their steel exports to Egypt.

Exports surged from $370.2 million to $548.9 million.

Dutch exports rose from $287.7 million to $302.7 million.

Italian steel found its way into Egypt, growing from $93.6 million to $106.1 million.

French steel exports experienced remarkable growth, jumping from $44.5 million to $105.2 million.

Lebanese steel also made strides, increasing from $82.9 million to $101.5 million.

The decline in steel imports reflects Egypt’s commitment to fostering a robust domestic steel industry. As the nation navigates economic challenges, this shift may pave the way for further investments in local production and technological advancements.

Comments

No comment yet.