According to producers' assessments to SteelRadar and comments by SteelRadar analyst;

Türkiye's steel industry is going through difficult times. In addition to the global lack of demand, high costs in our country are challenging producers.

The low prices of countries producing with cheap energy in the global market slowed down the competitiveness in the market. The tightening of credit in domestic markets, inflation and the increase in production costs caused the steel produced to increase in stocks without being consumed.

Use of long products stagnated

The long period of calm in the rebar market has caused rebar to circulate among traders. The stagnation in the construction sector halted the use of rebar.

The increase in inventory costs caused factories to restrict production. Semi-finished and finished product manufacturers started to produce limited production with maintenance work. Energy costs and non-competitive imported products are the main problems of the sector.

Import prices for flat products remained below domestic market prices

In flat products, imports from the Far East and non-legal trade with the Middle East indicated that sales in the domestic market could not maintain their strength in prices.

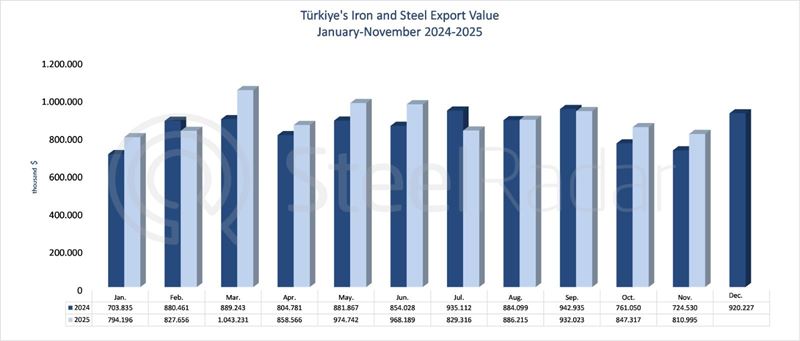

As for exports, deliveries mainly to the European region showed that Türkiye was relegated to the second option as prices with Italy approached.

Expectations from the ministry on the issue were listed as follows;

- Supporting producers in energy costs

- Additional taxes on imports that cause unfair competition

- Credit support to the market in the fight against inflation

- Strict monitoring of product origins in illegal trade

If improvements are made to the main problems gathered under four main headings, Türkiye's high-quality and strong giant sector has the experience and know-how to make a better start in 2024 and quickly recover its lost markets.

Comments

No comment yet.