The focus topic of the event was "The present and future of the Turkish steel market". The increase in imports despite the decrease in competition in the sector and excess capacity and how this will change in the future were discussed.

Kocaer Çelik Board Member Mehmet Çakmur moderated the event. We wanted to determine how we will shape the future by creating a discussion environment about Türkiye's investments in the iron and steel industry and where we have gone from the past to the future. We wanted to talk and discuss capacity, capacity usage, how it will be shaped. He opened the event by saying, "It will be good if we can shed light with presentations and discussion topics."

Harun Bozoklar, Founder of Bozoklar Metal Foreign Trade Company, made a presentation and evaluated Türkiye's import-export on a product basis.

''I believe that capacity increases in our country and globally will increase competitiveness in the foreign market''

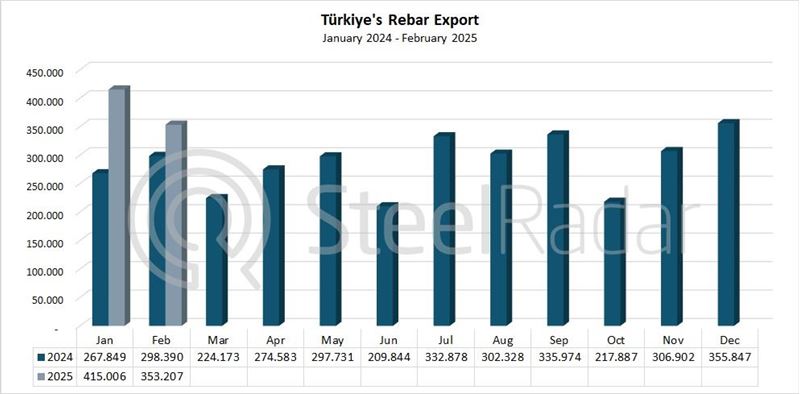

Harun Bozoklar, CEO of Bozoklar Metal “Türkiye's biggest success story was in iron and steel. There have been capacity problems for the last few years. First of all, what was the crude steel capacity, what happened? Electric arc furnaces, blast furnaces according to production method. Blast furnace capacity utilization has been more regular in the last three years. The electric arc furnace is fed mostly with scrap. There are two distinctions made in scrap: imported and domestic. There is no change in domestic scrap (regularly below 10 million tons). Türkiye's crude steel capacity usage was compared with the world, we used less than the world, but as time went by, this gap widened. We have become a country that uses more than 10% less than the rest of the world. We have started to show problems in capacity usage. We used to use all the slab we produced, and after 2021, there has been a decrease in our slab production. We looked at how much of the consumption we import and how much of the production we export. There is a sharp decline in exports. We will talk on a market basis, starting with section 232, US quotas and anti-dumping have dealt a serious blow to our exports.

The crude steel capacity utilization rate in Türkiye was compared to the world. We have always shown capacity utilization below the world level, but the gap has begun to widen. Our capacity is below 10% compared to the world. As of 2019, serious problems began to arise in our capacity utilization in billet and slab. We import between 17% and 20% of long products. This includes the log. There is a very sharp decline in exports. While it was a country that exported 60% of our production, it has now decreased. We fell to 25% in exports. There are many reasons for this. It dealt a serious blow to our exports.

MetKim Metal General Manager Osman Türeyyen said, “It is obvious that the domestic market is insufficient. Looking at last year's figures, around 34 million tons of liquid steel was produced in manufacturing, 24 million tons of which was in furnace facilities and the rest in blast furnaces. 24-25 million tons of scrap were used. We imported 18-19 million tons of scrap, and 6-7 million tons of scrap could be generated. The biggest problem is that it needs to be better organized due to the scrap shortage. We collect scrap in the domestic market as well as the exports of countries such as Germany and France. In 2023, the figure is around 54%, the theoretical capacity is almost 55-60 million tons (only electric arc furnaces). Importation of billet and slab. Production costs of iron and steel factories (electricity and scrap). Scrap cannot be controlled very much, when you don't buy it, others buy it. It tries to cover it by importing billets and slabs. This is the biggest thing in the import-export table, we lost competitiveness.

“The scrap market is shifting from west to east”

Bilecik Demirçelik General Manager Muammer Bilgiç; Spent steel must be used for 30-40 years to be converted into scrap, so Türkiye cannot be counted as time. Not producing scrap will be an issue in the new era. There is an issue of reducing total consumption. I think that the current scrap collection in the domestic market is at a good level. Yes, we used to be at a good level in terms of electricity costs, but we experienced increases and decreases in terms of energy. I will say something that is not widely discussed, we went through a process that lasted 16 months, the crisis that started with the invasion of Ukraine, and electricity and natural gas prices increased in our country. I think it was increased for other reasons and its impact on 100 thousand tons of production is 10 million dollars. It has exceeded the 450 kilos we consumed last year. While India etc is rising, the West is falling. One of them is about scrap, showing 40 years ago and 40 years later. The scrap market (consumption) is shifting from West to East. However, it will remain based on local-domestic needs. The scrap export market will not expand or even shrink. Secondly, weight does not fully reflect reality, the distribution varies from country to country. We are right in the middle, we will stay in the middle, but for example, construction steel will not be produced as much as Germany, but our need for change and transformation will not change.

We need to replan capacity and product distribution. The data must be accurate. The new Turkish steel industry will work with a different raw material and composition. Low copper and chromium scrap will be needed. New products will cost more. There were many companies that went for vertical integration. I appreciate these very much. This happened organically. It's time for some things. Why not integrate with other members of the value chain? The new product requires new production techniques and management. It's too hard. There is already a difference between us and the world, we need to take this path to prevent this gap from widening further. Nervürlü has shouldered this path and brought it to this day. “This now needs to be translated into different products.”

ÇOLAKOĞLU Metallurgy Sales Manager Kürşad Aynas said, “Our hot sales to the European Union will not be possible. Because European manufacturers interpret the reason for this as politics. Why is there an import tax on slabs and billets? It is a tax that was imposed at the time. It is not bad to have investments, but most company owners get into this business without doing a feasibility study. Borçelik has a new investment and will focus on automotive. It is necessary to completely reduce imports and give more competitive prices.” The domestic market is 28 million tons in total, the majority of which comes from rebar producers.

“We see that we are losing competitiveness as hot rolled sheet consumers”

Cold Rolling, Galvanized and Painted Sheet Manufacturers Association (SOGAD) President Güvenç Temizel said, “The places where we create the most added value are the automotive, white goods pipe profile and machinery industries. “Our capacity utilization is a little low but we are not bad, our flat rate is 10 million tons. We have a 30% localization rate in liquid steel production. We exist as a rolling mill. As Sogad, our first priority is to keep them exportable. These are the products that actually enable Turkey to grow and export. Energy prices have increased significantly, a sector that already operates with large margins. Naturally, as hot rolled sheet consumers, we see that we have lost competitiveness. Hot rolled sheet imports fell in the 2021-23 period, while slab imports are also increasing. Since we have fallen behind in competition in recent years, there is not enough scrap. The most critical issue is energy-scrap. As for the situation in our industry, galvanized sheet capacity has increased 2.5 times since 2016. On the export side, we have reached 2.4 million tons, the restrictions in the USA and Europe, starting with saction 232, are also tiring our industry. We are in the same boat. The increase in some of our product exports is also challenging us. There were profitable years for a couple of years, it was done with the intention that if certain qualities were made, imports would be blocked. For example, Borçelik has such an investment plan, but for example, we know that one of our members wants to produce thinner galvanized sheets.

As the domestic market grew, there was no need for imports. 200 to 300 mt additional capacities are coming. There are serious figures in imports because we have lost our competitiveness. We say that the difference between China TR (hot rolled sheet) in 2023 will be 200-250 dollars. When there is a difference in the hot sheet market around 100 dollars, it is appropriate to buy from there. In terms of capacity usage, we dropped considerably at the end of 2023 in the association, but we have increased as of this year. At the end of 2023, we were at 60% in capacity utilization. As far as we know, there are also differences among members. On the import (hot rolled sheet) side, we also had difficulty in supplying it to the domestic market at high prices. We experienced hot-galvanized sheet flow from Korea. Korea tripled its total exports to Turkey.

CBAM will come into effect after 2026. Our electric afterfurnace base includes high flat and long products. We also have high investments in renewable resources in terms of electricity. The issue of electricity is advantageous for us. I think we will be in a much better situation than countries like Vietnam and Taiwan. Our investments in renewable energy resources are high. All we need to do is to produce that system that is compatible with Europe. It would be much better if liquid iron could be returned to steel producers. It would be better if we focus on issues where we can unite.

“We anticipate that scrap production capacity will increase”

Turkish Steel Producers Association (TÇÜD) Secretary General Veysel yayan; “There is a pessimistic view on our scrap production, but our scrap production is over 10 million tons. Last year it was around 10 million 800 thousand tons. This constitutes a limited part of our consumption, but it also has the potential to increase. Last year, our steel consumption was 37 million tons. Our domestic production does not follow this trend in parallel with steel consumption. There were 17 million tons of imports. I think this can transform gradually and we can get out of this situation. It is not possible to say that this 10 million 800 thousand tons will be sufficient. In parallel with Turkey's consumption, it may add to the instant scrap generated during consumption. There was a consumption of 28 million tons in 2012. We predict that scrap production capacity will increase in the coming period. There is a 20-year potential in terms of consumption. We are approaching a point where we can easily produce 15 million tons. The amount may increase slightly if consumption is directed domestically and consumed there. This is partly related to prices. There is active scrap production, but if prices are better, collecting scrap may become more profitable. In this regard, it would be a realistic perspective to expect scrap prices to increase in parallel with the increase in consumption in the coming years and to expect this to be reflected in production. Our capacity and need have increased. In this case, it is expected to increase in capacity utilization rate. This did not happen in 2023. Because China sold at prices almost close to scrap prices. We see that this will start to change slightly in 2024 and the capacity utilization rate will start to increase in the first 4 months of 2024. In parallel with this, we can say that our flat steel producing organizations have also achieved a significant increase in exports by taking advantage of the opportunities provided by economies of scale. We can observe these issues if some measures are taken by the Ministry of Commerce in 2024.

“I think rail import is not right”

Yayan argued that it is not right to import rails from British Steel to connect Mersin port to the cities of Adana, Osmaniye and Gaziantep and said, "I argue that the import for the train line is not right. It should create a basis for using domestic steel. "While this is happening in other countries, we should also have this," he said.

Comments

No comment yet.