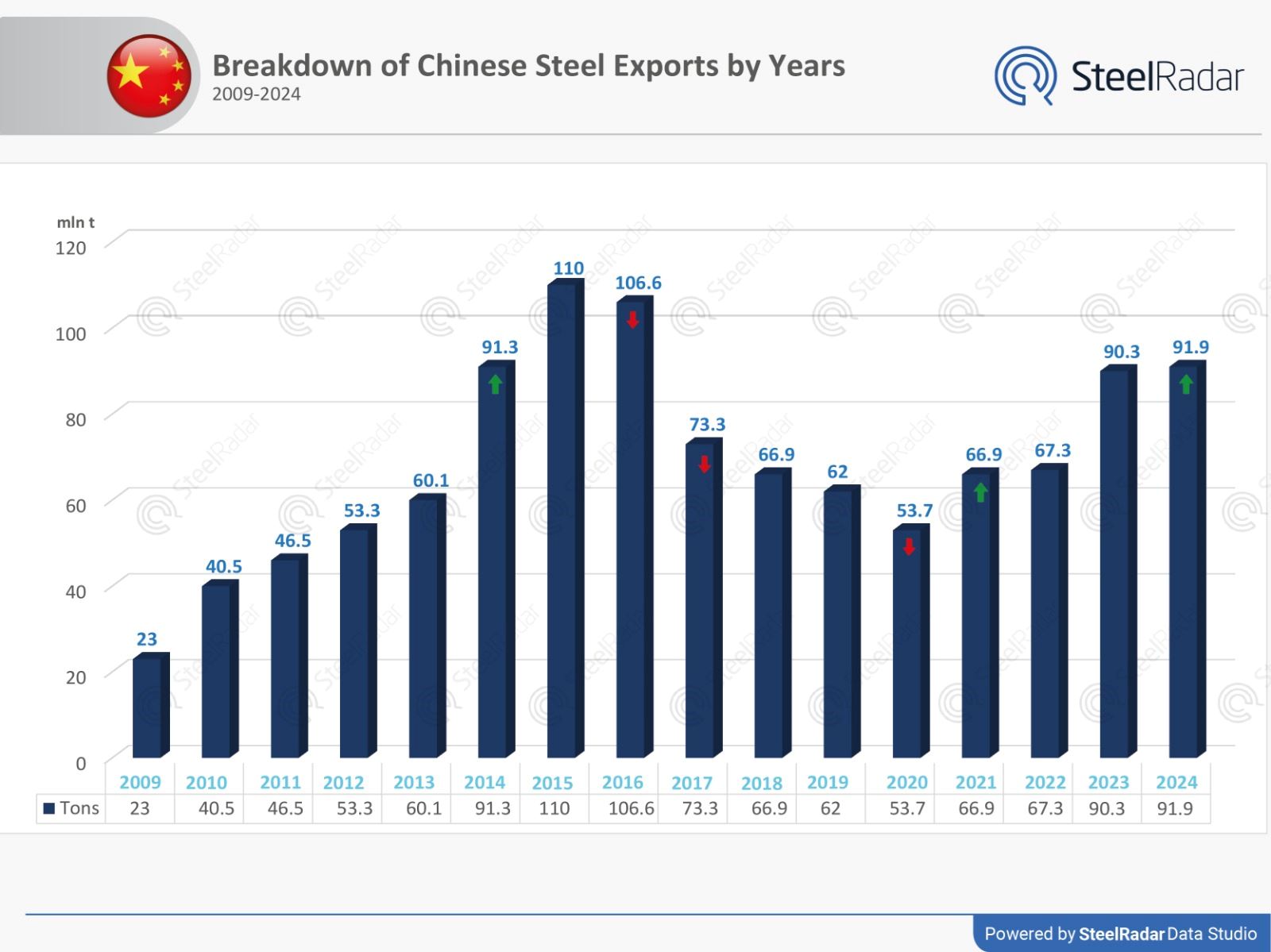

China's steel exports reached 11.18 million tons in October, the highest level in the last 9 years. This figure was 40.8% higher than October of the previous year and 10.2% higher than September. As of January-October 2024, total steel exports reached 91.89 million tons, up 23.3% compared to the same period last year. This increase raised expectations that 110 million tons could be reached by the end of 2023. On the other hand, steel imports decreased by 19.8% in October with 536 thousand tons and steel imports in the first 10 months of the year decreased by 10.1% with 5.72 million tons.

Iron ore prices increase

Iron ore prices increased in October on the back of new stimulus in China's economy. Iron ore from Australia with 62% Fe content reached US$105.6/ton, a new record high since October 15. Iron ore prices have increased by 7.4% since October 23. Moreover, the recovery in China's real estate sector was another factor supporting iron ore and steel prices. However, with the arrival of the winter season, cold weather in northern China and potential environmental production constraints could cause some decrease in steel demand.

Chinese economy and government incentives

China's growth rate was recorded at 4.6% in the third quarter of 2024, the lowest quarterly growth since March last year. This slowdown cast doubt on Beijing's ability to meet its 5% growth target. However, the Chinese government announced interest rate cuts and stimulus packages for the real estate sector to support economic growth, boosting market optimism.

The stimulus packages announced at the end of September aim to provide lower down payment requirements and better terms on loans for the construction sector. These steps have boosted construction activity, increasing demand for steel and iron ore. However, investors remain cautious due to the Chinese economy's high debt levels and other structural challenges.

China's plan to restructure local government debt

The Chinese government has initiated a $1.4 trillion program to restructure the debt of local governments. This plan will allow local governments to issue more bonds by increasing their debt limits. The aim is to reduce China's financial risks and stimulate economic growth. However, this step was deemed insufficient by some investors, causing fluctuations in the Chinese stock market.

US-China trade tensions and export opportunities

The trade measures taken during the previous presidential administration of US President Donald Trump led to new tariffs on Chinese steel exports. While this makes it more difficult for China to export steel to the US, it has the potential to increase China's exports to other countries. Chinese analysts say this could create new export opportunities for China.

In conclusion, the record highs in China's steel exports and the announced incentives for the economy have increased market sentiment, while emphasizing the need for structural reforms to maintain China's growth potential.

Comments

No comment yet.