As a tool designed to realise Europe's climate goals, the CBAM could restrict foreign producers from entering the European market. If trading partners are reluctant to adapt to stricter climate standards, this could have a negative impact on Europe's foreign trade. Experts say that these developments could lead to an increased competitive advantage for companies in third countries.

According to a study, CBAM, which will work in integration with the EU's Carbon Trading System (EU ETS), could usher in a new era in the pricing of carbon certificates. By 2034, existing free quotas for some sectors are expected to disappear, which will increase the cost of products subject to carbon tax.

According to data from the Asian Development Bank, if carbon prices reach EUR 100/tonne, emissions intensity in developing countries in Asia could be equivalent to a value added tax of between 3% and 12% of exports to Europe. For example, this is estimated at 11.4 % for China's exports, 10.5 % for India and 4.9 % for South Korea.

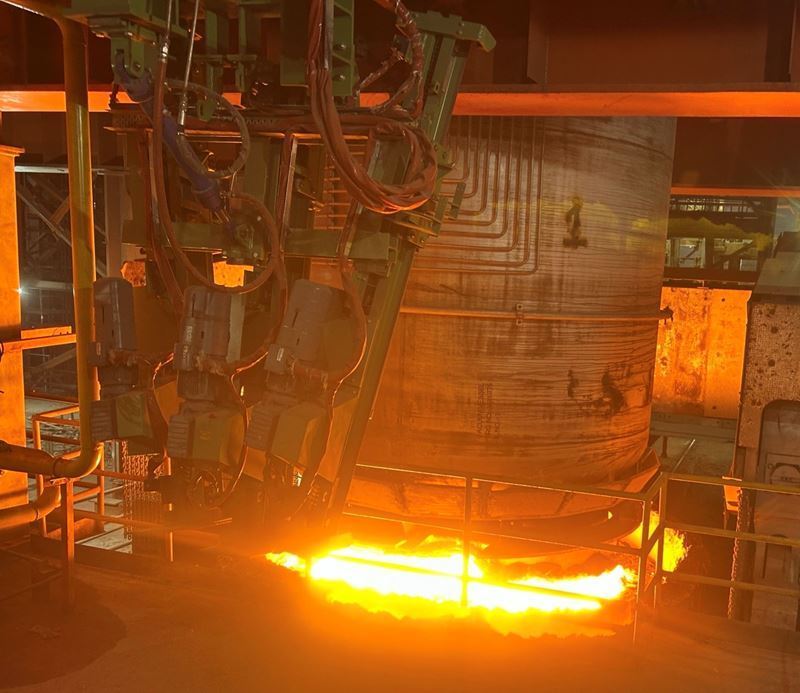

Some sectors, such as ferrous metals in India, may face a burden much higher than current economic averages. For example, the CBAM impact in this sector is said to be as high as 786.9 %.

While CBAM may provide a domestic market advantage for European producers, it may force exporters under high tax burden to seek alternative markets. It is estimated that this may affect Europe's competitiveness in global trade and indirectly lead to price increases that will be passed on to consumers.

Low-income countries may be adversely affected by CBAM, which may reduce their capacity to modernise their production facilities. The absence of developed financial markets may further complicate the ability of these countries to finance their decarbonisation projects.

Comments

No comment yet.