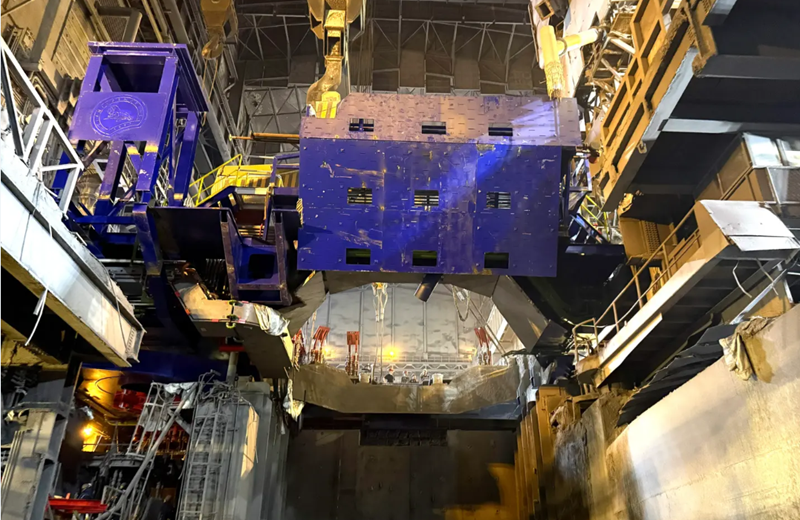

ArcelorMittal, the world's second-largest steelmaker, is considering a potential offer for U.S. Steel Corp. This could reverse ArcelorMittal's retreat from the United States as a production base after selling most of its operations to Cleveland-Cliffs Inc in 2020 for $1.4 billion to focus on growing markets such as India and Brazil. ArcelorMittal is discussing a possible offer with its investment bankers, but there is no certainty that it will press ahead with it. If it does launch a bid, it could mark the escalation of a bidding war already underway for U.S. Steel, following rival offers from Cleveland-Cliffs and Esmark Inc for more than $7 billion.

U.S. Steel workers are members of the United Steel Workers (USW) union, which has come out in support of a deal with Cleveland-Cliffs even though U.S. Steel has rebuffed that offer as unreasonable. The union's endorsement is important because its collective bargaining agreement with U.S. Steel makes it a party in the negotiations and affords it the right to counter with its demands. USW International President Tom Conway said it would not make sense for ArcelorMittal to move forward with an offer and that the union would not support any buyer other than Cleveland-Cliffs.

ArcelorMittal's deliberations come after U.S. Steel launched a process to explore interest from potential acquirers. U.S. Steel became an acquisition target following several quarters of falling revenue and declining profits, as it struggled with high raw material and energy costs.

Comments

No comment yet.