Semi finished Steel Products

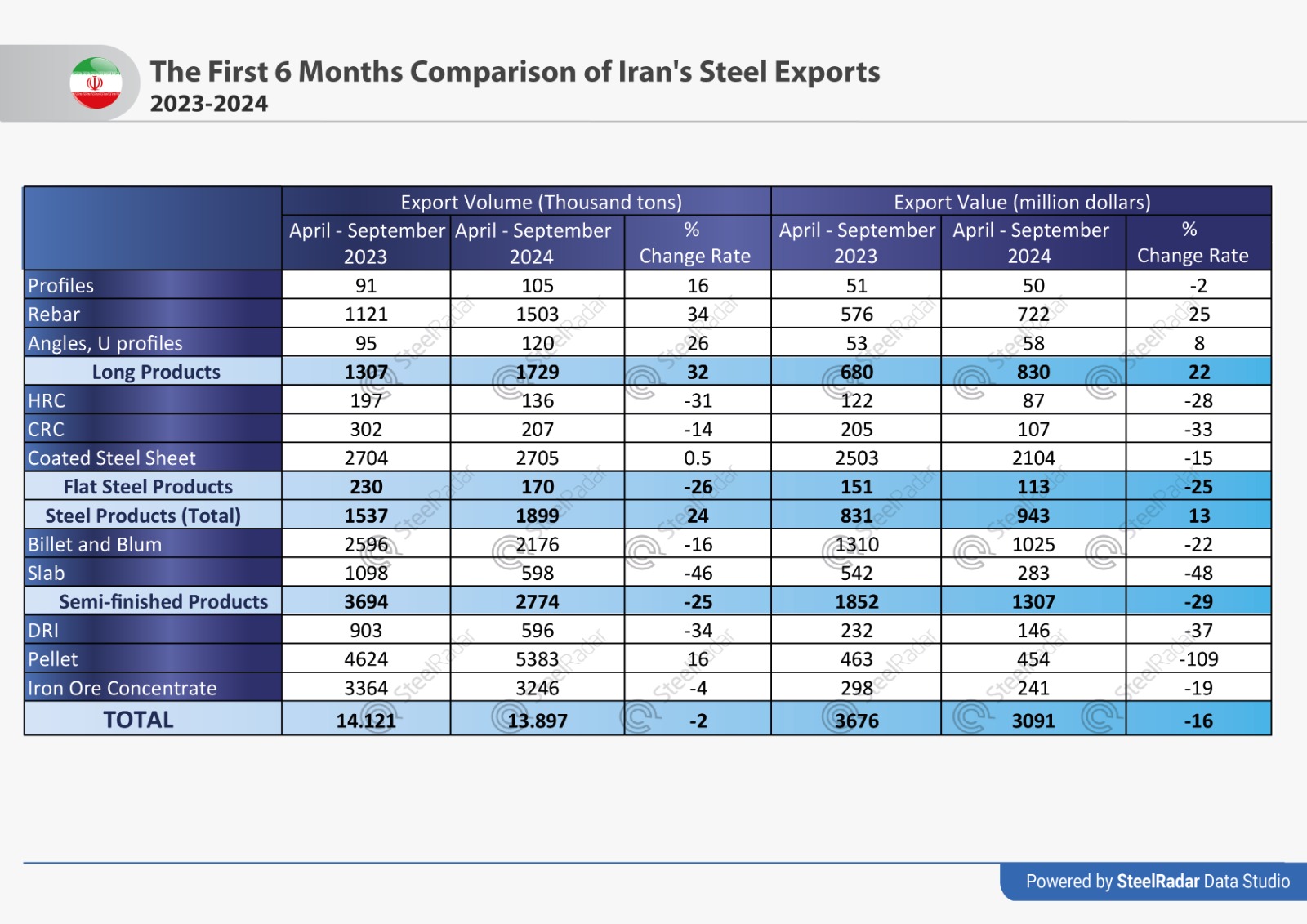

The steel export sector in Iran has faced significant challenges in the first half of 1403 (Persian calendar year, April-September), according to recent data released by the Iranian Steel Producers Association. While some categories of steel products showed growth, others experienced sharp declines, reflecting a complex interplay of market conditions, domestic policies, and international factors.

One of the most striking figures is the 25% drop in the export volume of intermediate steel products, such as billet and slab. These products are critical in the global steel supply chain, often used as raw materials by steel manufacturers worldwide. This decline suggests a slowdown in demand for these essential inputs, which could be linked to global market fluctuations, including reduced demand from key importing countries or increased competition from lower-cost producers in other regions.

Sponge Iron Exports Hit Hard Despite Increased Production

In another troubling development, the volume of sponge iron exports has plummeted by 34%, despite an 11% rise in its domestic production. This unusual scenario points to a disconnect between domestic production capabilities and export demand. Analysts suggest that the dip in sponge iron exports may be attributed to trade restrictions or price competitiveness issues. Moreover, the rise in production without a corresponding increase in exports could indicate either a saturation of key markets or logistical challenges in meeting foreign demand.

Iron Ore Pellets Exhibit Varied Performance

Iron ore pellets, a key input for steel production, have seen a 16% increase in export volume. However, the export value has declined by nearly 2%. This paradox could be explained by the drop in global iron ore prices or shifts in buyer preferences toward cheaper alternatives. The discrepancy between volume growth and value decline indicates that while more pellets are being sold abroad, the sales are occurring at lower prices, impacting revenue generation.

Long Steel Products: An Unexpected Surge Amidst Challenges

A noteworthy 32% surge in the export volume of long steel products, such as rebar and wire rods, has been recorded. However, the reality behind this growth is more complex. A significant portion of these exports has been converted into rial-denominated sales due to the government's policy requiring exporters to return foreign currency at the NIMA exchange rate. This regulation has led many Iranian steel mills to sell their products domestically in local currency rather than in hard foreign currencies, thus reducing the profitability of these transactions. Additionally, much of this export activity is now being conducted through traders and leased business cards, potentially circumventing official channels and revealing an underlying issue with the transparency and efficiency of the sector.

Slab Exports

Perhaps the most concerning data point is the state of slab exports, which have halved in the first six months of 1403. Slabs are an important semi-finished steel product used in a wide range of industries, from automotive to construction. The dramatic fall in slab exports signals a deeper crisis within the sector, likely caused by reduced global demand, competition from other steel-producing nations, and domestic policy hurdles. This downturn in slab exports, a crucial component of Iran's steel exports, could have far-reaching implications for the country's overall steel industry.

A Volatile Outlook for Iran’s Steel Exports

The mixed performance across various categories of steel exports paints a picture of an industry grappling with both internal and external pressures. While some products, like long steel products, have seen growth, the overall picture is one of decline in key sectors, particularly in intermediate products and slabs. The disparity between production increases and export performance indicates underlying inefficiencies in the sector, as well as the impact of external challenges, such as fluctuating global prices and shifting demand patterns.

Domestic policies, particularly those related to foreign exchange requirements, have also added to the complexity, with exporters finding themselves navigating a difficult landscape of regulations and market dynamics. For the Iranian steel industry to thrive in the coming months, a more balanced approach is needed — one that considers not just production capabilities but also how to better align with global market demands and streamline export procedures.

If these trends continue, Iran's position in the global steel market could be further threatened, requiring swift adjustments to both domestic policy and international market strategies.

Comments

No comment yet.