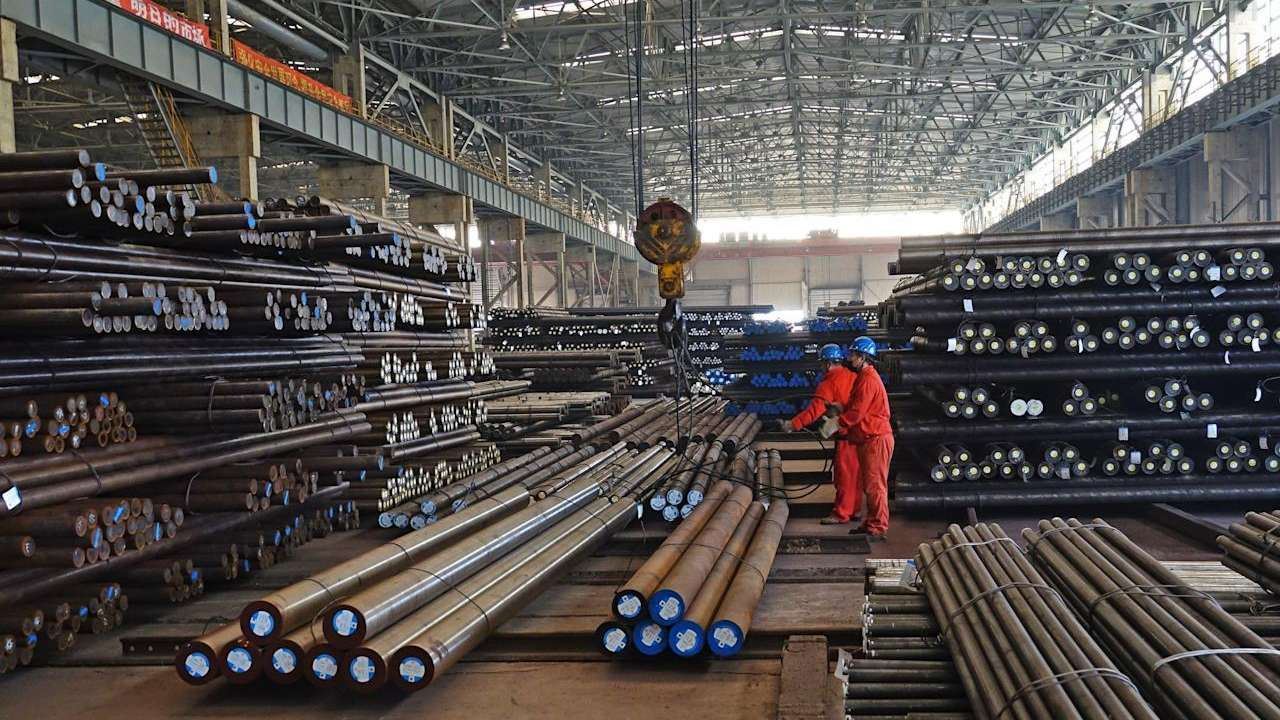

Tata Steel, India’s largest steel producer, continues its expansion strategy with a USD 3.2 billion project at its Kalinganagar facility in Odisha. The new investment will increase the plant’s annual production capacity from 3 million tons to 8 million tons, solidifying Odisha as Tata Steel's primary investment hub. This latest phase includes advanced technologies in its pellet plant, coke plant, and cold rolling mill, alongside features like the world’s largest Top Gas Recovery Turbine, designed to optimize energy and water efficiency.

The expansion strengthens Tata Steel’s foothold in high-value steel segments such as automotive, construction, energy, shipbuilding, and defense, aligning with India’s broader vision for self-reliance and sustainable industrial growth. India, the world’s second-largest steel producer, is ramping up production to support its rapidly expanding economy, projected to grow by 7.2% in FY2024-2025.

Tata Steel’s efforts are part of a nationwide surge in steel production. India’s crude steel output rose from 127 million tons in FY2022-2023 to 145 million tons in FY2023-2024, according to the Ministry of Steel. The National Steel Policy, introduced in 2017, aims to boost production to 300 million tons annually by 2030, reflecting the growing demand for steel across key industries.

Other major players are also making significant moves. JSW Steel, one of India’s leading producers, announced in February a USD 7.8 billion investment in a new crude steel complex in Odisha. This project is expected to increase JSW's crude capacity from 30 million tons to 39 million tons and will include a cement grinding plant and a facility for electric vehicles and battery production, requiring an additional USD 4.8 billion investment.

Meanwhile, Nippon Steel and ArcelorMittal are expanding their joint venture in Gujarat, acquired in 2019. The AM/NS India plant is undergoing a USD 4.9 billion expansion to add two new blast furnaces, which will increase capacity by 50%, reaching 15 million tons annually by 2026.

Comments

No comment yet.