Weakened Outlook for Metallurgical Coal Demand

The Australian Department of Industry, Science and Resources (DISR) expects the country’s metallurgical coal exports to peak in the 2027–2028 fiscal year. However, this peak is projected to fall short of earlier forecasts. Still, exports are expected to be 13 million tons higher in 2029–2030 compared to 2024–2025.

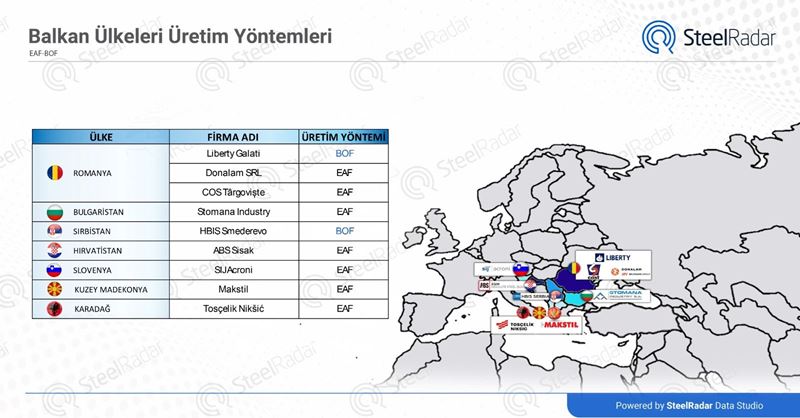

According to IEEFA, the growing adoption of electric arc furnace (EAF) technology in steelmaking is reducing the dependence on coal-based blast furnaces. The increasing use of feedstocks like scrap metal and the broader adoption of low-emission production technologies are expected to further weaken demand for metallurgical coal.

Growing Competition and Changing Markets

IEEFA notes that changing steel production strategies in Japan and India, Australia’s two largest metallurgical coal export markets, are negatively affecting the export outlook. India is shifting towards green hydrogen-based steelmaking, while Japan is expanding its scrap metal resources and accelerating its transition to EAF systems.

This situation threatens Australia’s market share, while the potential for countries like Russia, Canada, and the United States to redirect exports to traditional Australian markets such as Japan, South Korea, and India is increasing competitive pressure.

Thermal Coal Exports May Have Peaked

According to the Resources and Energy Quarterly (REQ), Australia’s thermal coal exports may have already peaked in 2024 or 2025. Export volumes are projected to fall by 14 million tons by the 2029–2030 fiscal year.

IEEFA analysts say that while the number of coal-fired power projects is declining globally, falling Chinese imports are unlikely to be fully offset by increasing demand from India and Southeast Asia. In fact, the amount of new coal power capacity added worldwide in 2024 was the lowest in the past two decades.

Demand for High-Quality Coal Also Declining

IEEFA states that assumptions about the resilience of Australia’s high-calorific value (high CV) coal are inconsistent with market analyses. Countries such as Japan and South Korea are turning to more cost-effective alternatives. If new markets do not emerge, the decline in exports may lead to some coal mines being closed earlier than planned.

Experts emphasize that falling prices and declining demand are also raising doubts about the future of new coal mine developments.

Yorumlar

Henüz yorum yapılmadı