In June and July, European steel industry associations voiced their concerns over the high electricity prices impacting the sector's competitiveness.

Reasons cited for the price surge included increased demand due to higher average temperatures in the second half of the month, a decrease in wind energy production, unstable solar energy generation throughout the month, volatile gas prices, and rising CO2 emissions.

In response, countries such as Italy, through Federacciai and Assofond, called for urgent measures to reduce energy costs and align them with other European countries. The Federacciai President stated that a plan to support energy-intensive industries had been postponed.

Spain, represented by UNESID, highlighted that energy costs for steel production in Spain were almost double the EU average and recommended that the government use emission trading revenues to offset these costs.

British UK Steel also urged the new UK government to intervene, stating that energy costs in the UK were significantly higher compared to France and Spain. The organization expects electricity consumption to increase with the transition to EAF.

Ukraine proposed reducing the share of electricity imports to 50% to ensure a stable energy supply in the steel sector in response to rising electricity prices.

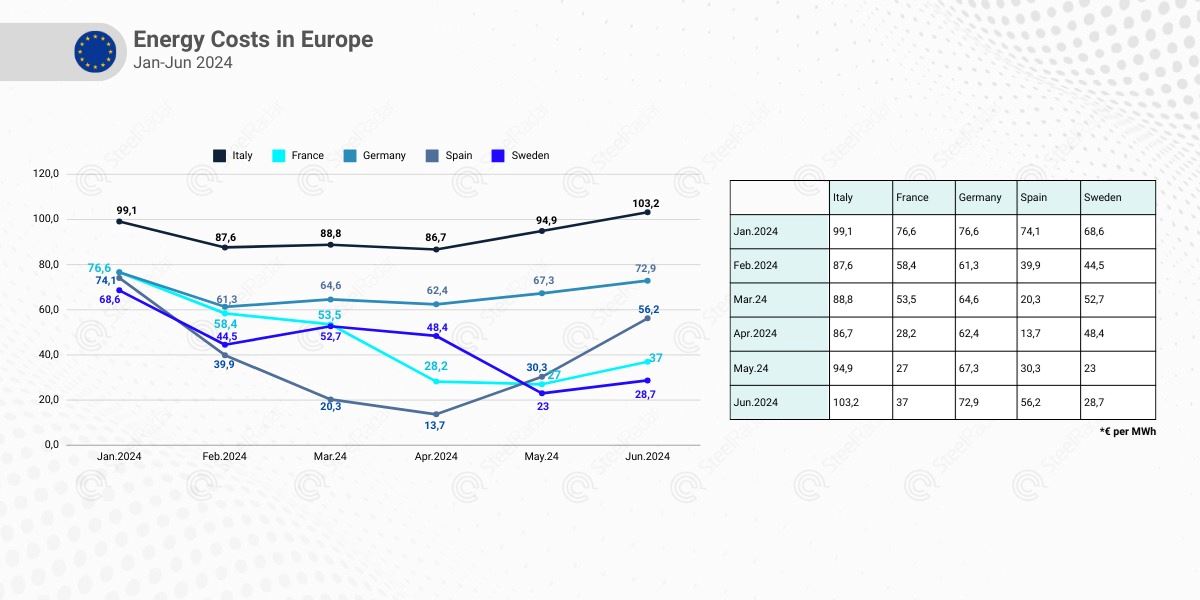

In the European Union, average monthly wholesale pre-day prices for June 2024 increased significantly compared to May.

According to Ember's data, these increases were as follows:

- Italy: €103.2/MWh (monthly +8.7%);

- France: €37.8/MWh (monthly +39.4%);

- Germany: €72.9/MWh (monthly +8.3%);

- Spain: €56.2/MWh (monthly +85.5%);

- Sweden: €28.7/MWh (monthly +24.7%).

Yorumlar

Henüz yorum yapılmadı