Last year, Indian exports surged by 170%, primarily to China, raising concerns among some segments of the industry about protecting their margins.

Anil Nachrani, president of the Chhattisgarh Sponge Iron Manufacturers Association, emphasized the need for government intervention to prevent the closure of domestic steel mills. He highlighted that smaller mills across five major manufacturing states are facing losses, paying significantly higher prices compared to larger operations. These smaller producers, constituting about 40% of the national output, are calling for restrictions on iron ore exports.

This push could potentially stabilize iron ore prices, which have been weak this year. The Indian government has previously intervened to support local producers, such as imposing a 50% export tax on all grades of iron ore in May 2022, though this measure was later lifted.

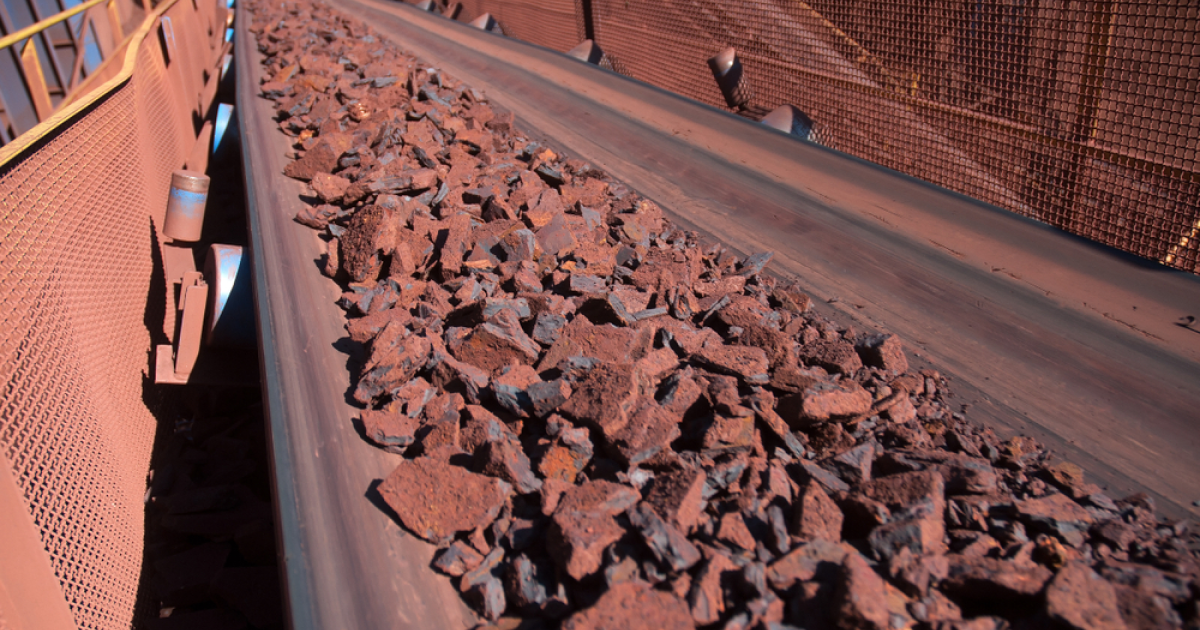

The capacity expansion of major Indian steelmakers has heightened competition for iron ore, particularly in auctions and the open market. However, soft demand for steel from end-users is further squeezing margins for smaller players who lack captive mines for key raw materials like coal and iron ore.

Deependra Kashiva, director general at the Sponge Iron Manufacturers Association, underscored the challenges smaller players face in competing with larger producers and highlighted the need for policy measures to address these disparities.

Yorumlar

Henüz yorum yapılmadı